eBook - ePub

Trend Following with Managed Futures

The Search for Crisis Alpha

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

Anall-inclusive guide to trend following

As more and more savvy investors move into the space, trend following has become one of the most popular investment strategies. Written for investors and investment managers, Trend Following with Managed Futures offers an insightful overview of both the basics and theoretical foundations for trend following. The book also includes in-depth coverage of more advanced technical aspects of systematic trend following. The book examines relevant topics such as:

- Trend following as an alternative asset class

- Benchmarking and factor decomposition

- Applications for trend following in an investment portfolio

- And many more

By focusing on the investor perspective, Trend Following with Managed Futures is a groundbreaking and invaluable resource for anyone interested in modern systematic trend following.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Trend Following with Managed Futures by Alex Greyserman,Kathryn Kaminski in PDF and/or ePUB format, as well as other popular books in Business & Investments & Securities. We have over one million books available in our catalogue for you to explore.

Information

PART I

HISTORICAL PERSPECTIVES

CHAPTER 1

A Multicentennial View of Trend Following

Cut short your losses, and let your profits run on.

—David Ricardo, legendary political economist

Source: The Great Metropolis, 1838

Trend following is one of the classic investment styles. This chapter tells the tale of trend following throughout the centuries. Before delving into the highly detailed analysis in subsequent chapters, it is interesting to discuss the paradigm of trend following from a qualitative historical perspective. Although data-intensive, this approach is by no means a bulletproof rigorous academic exercise. As with any long-term historical study, this analysis is fraught with assumptions, questions of data reliability, and other biases. Despite all of these concerns, history shapes our perspectives; history is arguably highly subjective, yet it provides contextual relevance.

This chapter examines a simple characterization of trend following using roughly 800 years of financial data. Despite this rather naive characterization and albeit crude set of financial data throughout the centuries, the performance of “cutting your losses, and letting your profits run on” is robust enough to garner our attention. The goal of this chapter is not to quote t-statistics and make resolute assumptions based on historical data. The goal is to ask the question of whether the legendary David Ricardo, the famous turtle traders, and many successful trend followers throughout history are simply a matter of overembellished folklore or whether they may have had a point.

In recent times, trend following has garnered substantial attention for deftly performing during a period of extreme market distress. Trend following managers boasted returns of 15 to 80 percent during the abysmal period following the credit crisis and infamous Lehmann debacle. Many have wondered if this performance is simply a fluke or if the strategy would have performed so well in other difficult periods in markets. For example, how would a trend follower have performed during past crises like those experienced in the Great Depression, the 1600s, or even the 1200s?

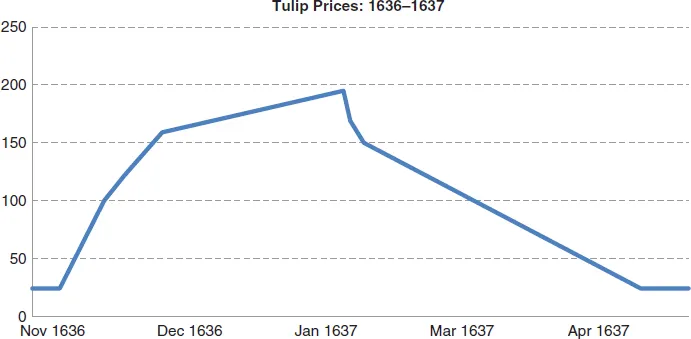

Given that this chapter engages in a historical discussion of trend following, it seems only fitting to begin with a rather controversial and relatively spectacular historical event, the Dutch Tulip Bubble of the early 1600s. Historical prices for tulips are plotted in Figure 1.1. One common type of trend following strategy is a channel breakout strategy. A channel breakout signal takes a long (short) position when a signal breaks out of a certain upper (lower) boundary for a range of values. Using a simple channel breakout signal,1 a trend following investor might have entered a long position before November 25th, 1636 and would have exited the trade (by selling tulip bulbs and eventually short selling if that was even possible) around February 9th, 1637. A trend following investor simply “follows the trend” and cuts losses when the trend seems to disappear. In the case of tulips, a trend following investor might have ridden the bubble upward and sold when prices started to fall. This approach would have led to a sizeable return rather than a handful of flower bulbs and economic ruin. Although it is one rather esoteric example, the tulip bulb example demonstrates that there may be something robust or fundamental about the performance of a dynamic strategy like trend following over the long run. It is important to note that in this example, as in most financial markets, the exit decision seems to be more important than the entry. The importance of cutting your losses and taking profits seems to drive performance. This is a concept that is revisited often throughout the course of this book.

exit decision the decision of when to exit a position.

FIGURE 1.1 A standard price index for tulip bulb prices.

Source: Thompson (2007).

Trend following strategies adapt with financial markets. They find opportunities when market prices create trends due to many fundamental, technical, and behavioral reasons. As a group, trend followers profit from market divergence, riding trends in market prices, and cutting their losses across markets. Examples of drivers that may create trends in markets include risk transfer (or economic rents being transferred from hedgers to speculators), the process of information dissemination, and behavioral biases (euphoria, panic, etc.). Despite the wide range of explanations, the underlying reasons behind market divergence are of little consequence to a trend follower. They seek simply to be there when opportunity arises. Throughout history, opportunities do arise. The robust performance of trend following over the past 800 years helps to historically motivate this point.2

■ The Tale of Trend Following: A Historical Study

Although almost two centuries have passed since the advice of legendary political economist David Ricardo, the same core principles of trend following have garnered significant attention in modern times. Using a unique dataset dating back roughly 800 years, the performance of trend following can be examined across a wide array of economic environments documenting low correlation with traditional asset classes, positive skewness, and robust performance during crisis periods.3

The performance of trend following has been discussed extensively in the applied and academic literature (see Moskowitz, Ooi, and Pedersen 2012).4 Despite this, most of the data series that are examined are typically limited to actual track records over several decades or futures/cash data from the past century. In this chapter, an 800-year dataset is examined to extend and confirm previous studies.5 To examine trend following over the long haul, monthly returns of 84 markets in equity, fixed i...

Table of contents

- Cover

- Title Page

- Copyright

- Foreword

- Preface

- Introduction

- Part I: Historical Perspectives

- Part II: Trend Following Basics

- Part III: Theoretical Foundations

- Part IV: Trend Following as an Alternative Asset Class

- Part V: Benchmarking and Style Analysis

- Part VI: Trend Following in an Investment Portfolio

- Glossary

- About the Authors

- Index

- Wiley End User License Agreement