![]()

Chapter 1

What is the Role of the International Accounting Standards Board (IASB)?

What exactly does the IASB do and what are its objectives?

Answer

The IASB was previously known as the International Accounting Standards Committee (IASC) until April 2001, when it became the IASB.

The IASC was originally set up in 1973 and was the sole body to have both responsibility and authority to issue international accounting standards. In 2001, when the IASB took over responsibility for international financial reporting, it took on all of the IASC's standards (which were all prefixed with ‘IAS’ – e.g. IAS 2 Inventories, IAS 10 Events After the Reporting Period). The IASB amended many of the standards, but then began to issue its own standards, which were known as International Financial Reporting Standards (IFRS). This is why you see standards prefixed with IAS (IASC standards) and IFRS (IASB standards). The term ‘IFRS’ has become a somewhat generic term that refers to all the standards (both IAS and IFRS).

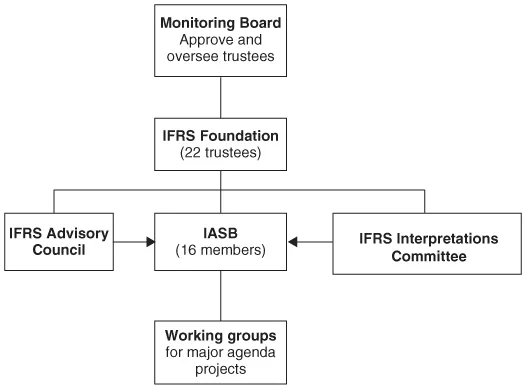

The setup of the IASB is as follows:

Monitoring Board

The Monitoring Board has been subject to criticism over the years because of its lack of accountability and lack of responsiveness to the concerns of its constituent members. However, the responsibilities of the monitoring board are to oversee the IFRS Foundation trustees, participate in the trustee nomination process and approve appointments of new trustees.

It also has responsibility to review and provide advice to the trustees on the fulfilment of their responsibilities: there is an obligation for the trustees to report, on an annual basis, to the Monitoring Board. The Monitoring Board also has the authority to request meetings with the trustees, or separately with the chairs of the trustees and the IASB, to discuss any area of the trustees' or IASB's work.

IFRS Foundation

The 22 trustees within the IFRS Foundation act under the terms of the IFRS Foundation Constitution. It is a requirement of this constitution that in order to ensure a broad international basis, the Foundation must comprise of:

- six trustees that are appointed from Asia/Oceania regions;

- six trustees that are appointed from Europe;

- six trustees that are appointed from North America;

- one trustee that is appointed from Africa;

- one trustee that is appointed from South America; and

- two trustees that are appointed from any area, but this is subject to the Foundation maintaining an overall geographical balance.

The IFRS Foundation oversees the IASB, and in addition the trustees appoint members of the:

- IASB;

- IFRS Advisory Council; and

- Interpretations Committee.

Other responsibilities include monitoring the IASB's effectiveness, securing funding and approving the IASB's budgets.

IASB

The IASB comprises 16 members (of whom only three may be part-time) that are appointed for a term of three to five years. The IASB has overall responsibility for all technical matters, which include:

- preparing and issuing IFRSs;

- preparation, and issuance, of exposure drafts;

- setting up procedures for reviewing comments received on documents that have been published for comment; and

- issuing bases for conclusions.

It is expected that by July 2012, the IASB will comprise of the following:

- four members from Asia/Oceania;

- four members from Europe;

- four members from North America;

- one member from Africa;

- one member from South America; and

- two members appointed from any area (subject to the IASB retaining overall geographical balance).

Each member of the IASB has one vote and the approval of ten members is required for exposure drafts to be issued as discussion or as the final standard. If there are fewer than 16 members of the IASB, approval by at least nine members is required.

IFRS Advisory Council

There are approximately 40 members appointed to Council by the trustees for a renewable term of three years. Each member has a diverse geographic and functional background.

Council provides a forum for participation by organizations and those individuals that have an interest in international financial reporting. It meets at least three times a year and its primary responsibilities include:

- advising the board on agenda decisions and priorities;

- giving advice to the trustees and the board; and

- passing on the views of the council members on the major standard-setting projects.

Ultimately, IFRSs are the basis of international financial reporting and must be complied with in their entirety; in other words, financial statements can never be prepared using a mix of IFRSs and national accounting standards. There are several steps involved in the creation of an IFRS, which include:

1. Setting the agenda.

2. Planning the project.

3. Developing and publishing a discussion paper.

4. Developing and publishing an exposure draft.

5. Developing and publishing an IFRS.

6. Procedures after the IFRS is published.

Clearly, once a standard has been published, that is not necessarily the end of the line. There is often a need to amend a standard for a variety of reasons, and any necessary (but not urgent) changes are incorporated within the IASB's Annual Improvements Project. There are generally two types of amendments required to an IFRS/IAS:

- To clarify a standard due to ambiguous wording or because of unintentional gaps within the standard itself.

- To correct a minor (and unintended) consequence, conflict resolution, and to deal with any oversights. It is important to emphasize that the correction does not introduce, or change, the existing principles contained within the standard.

However, in situations when the amendment is considered priority, the IFRS interpretations committee will deal with such issues. IFRS interpretations committee does not issue standalone standards, but it is important to point out that IFRICs are authoritative. There are seven steps that IFRS interpretations committee must follow to achieve transparency and consistency:

1. Identify the issue(s).

2. Set an agenda.

3. Hold the IFRIC meeting and vote.

4. Draft an interpretation.

5. IASB release the draft interpretation.

6. Allow the comment period and deliberation process to take place.

7. IASB release the interpretation.

![]()

Chapter 2

Frequently Asked Questions

1. What is the Conceptual Framework?

Consistency and comparability are at the heart of preparing general purpose financial statements, and over the years many authorities have attempted to officially define the purpose of accounting. The provision of a ‘coherent and consistent foundation for the development of accounting standards’ was a study carried out in 1940 by Paton and Littleton, and the intention was to provide an accounting framework that would do just that.

Answer

The truth of the matter is that financial reporting has evolved considerably—not necessarily from the position it was at, say, 100 years ago, but even in modern times. It is true to say that the information conveyed in financial statements is indeed more detailed than it was possibly even ten years ago, which is a legacy of today's globalization of business and the increased access to the global capital markets.

The definition of a Conceptual Framework is essentially a framework that contains a set of generally accepted theoretical principles that form the basis of new reporting practices (such as the introduction of a new IFRS) or evaluation of existing practices (such as when an IFRS is amended). The theoretical basis ...