![]()

APPLICATIONS

The foundations discussed up to this point include the basic Mindles for managing uncertainty and risk. To fully understand them, you need to apply them. Ironically, understanding may not happen when you are concentrating on an application, but rather when your mind is wandering and you suddenly make a connection.

In this section, I will present some important areas of application that may serve as catalysts for those connections.

I will begin with Part 5 on modern finance, an area in which Nobel Prizes were won for conquering the Flaw of Averages. I will then discuss other areas in which the Flaw is still prevalent.

![]()

PART 5

THE FLAW OF AVERAGES IN FINANCE

In the early 1950s the Portfolio Theory of Harry Markowitz revolutionized the field of finance by explicitly recognizing what I refer to as the Weak Form of the Flaw of Averages. Specifically, the average return is not enough to describe an investment; you also need to know its risk. This work was extended and brought into widespread practice by William Sharpe in the 1960s. Soon modern portfolio theory was broadly acknowledged in the investment community, and Markowitz and Sharpe received the Nobel Prize in 1990.

The option pricing models of Fischer Black, Myron Scholes, and Robert Merton, introduced in the early 1970s, illuminated a special case of the Strong Form of the Flaw of Averages. Specifically, the average payoff of a stock option is not the payoff given the average value of the underlying stock. Their improved modeling of this situation led to tremendous growth in the area of financial derivatives, and option theory resulted in its own Nobel Prize in 1997.

These modern-day pioneers began to make the field of finance compliant with the Flaw of Averages. By understanding their work, we may attempt to generalize these principles to other areas of business, government, and military planning that are still average-centric.

![]()

CHAPTER 21

Your Retirement Portfolio

Nearly all of us share a problem that lies deep in Flaw of Averages territory: investing for retirement.

In Die Broke, Stephen Pollan and Mark Levine argue that wealth is of no value once you’re dead, so make sure your family is taken care of while you are still alive and aim to die with nothing beyond your personal possessions.1 This sounds about right to me, but whether or not you agree with this philosophy, it is a useful starting point for retirement planning. If, instead, you want to die with a specific sum in the bank, the following discussion requires only slight modification.

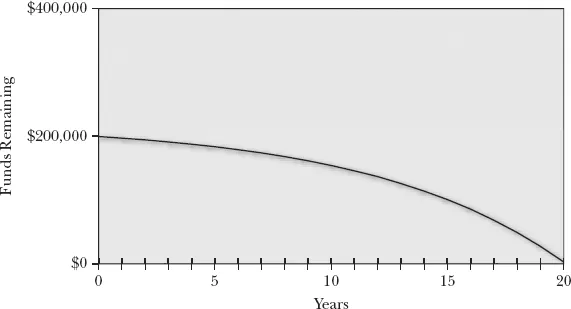

So suppose your retirement fund has $200,000 and you expect to live another 20 years. In fact, to simplify the analysis, let’s assume that through some arrangement with the devil you know that you will die in exactly 20 years. How much money can you withdraw per year to achieve that perfect penniless state upon your demise? We will assume the money is invested in a mutual fund that has decades of history and that is expected to behave in the future much as it has in the past. Recent events have shown what a bad assumption this can be, but it is still much better than using averages alone and will be useful here for exposition. The annual return has fluctuated, year by year, with an average year returning 8 percent. Traditionally, financial planners have put this sort of information into a retirement calculator that starts with your $200,000, and then subtracts annual withdrawals year by year, while growing the remainder at 8 percent. By adjusting the amount withdrawn, you can quickly arrive at the expenditure level that exhausts your funds in exactly 20 years. For this example, $21,000 per year does the trick and results in balances over time, as shown in Figure 21.1.

You may wish to visit FlawOfAverages.com to see animations for this section or, if you have Microsoft Excel, to play along with the downloadable model there.

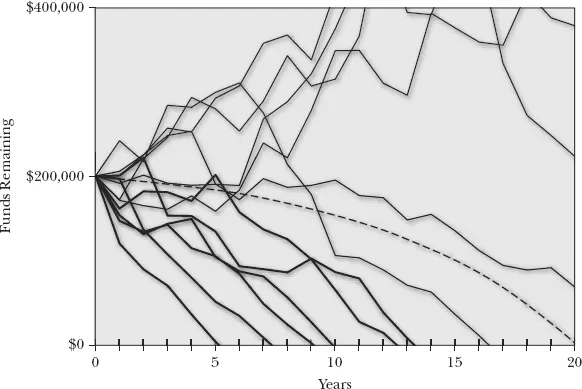

What’s wrong with this picture? Plenty. The assumption that every year will yield the average return of 8 percent is terribly misleading. To avoid the Flaw of Averages, you must also model the year-by-year fluctuations of the fund. Assuming that past fluctuations are representative of future fluctuations, your wealth could equally likely follow a myriad of other trajectories. Figure 21.2 depicts a dozen potential wealth paths simulated at random by a computer, along with the flawed average projection of Figure 21.1 (dotted line).

Now if you run out of money two or three years early, you can just move in with your kids or hitch a ride to San Francisco and hang out with the other bums in Golden Gate Park. But going belly-up five years or more ahead of schedule (depicted by the bold scenario paths in Figure 21.2) would be ruinous and has roughly a 50/50 chance of occurring.

Thus the Flaw of Averages applied to this example states that, given the average return of 8 percent every year, there is no chance of ruin. But if you average over all the things the market could do, there is a 50 percent chance of ruin. And this assumes that the future is like the past, which it probably isn’t!

Simulation for the Masses

Financial Engines, a firm founded by Nobel Laureate Bill Sharpe, pioneered the use of Monte Carlo simulation of retirement accounts in 1996.2 In 1997, Sharpe told me that at first he expected competition at the technical level, with different firms fighting it out over who had the most accurate simulation. But to his surprise, he found that most financial advisory companies at the time were still using averages; that is, their analyses were based on the approach of Figure 21.1. Sharpe wrote a humorous essay at the time, entitled “Financial Planning in Fantasyland,” that is available online.3

In a sense Financial Engines is the prototypical Probability Management company. At its core is a database of distributions on the returns of more than 25,000 investments. Initially, all they provided was access to their simulations online, mostly to large organizations, whose employees used the service to monitor their retirement accounts. But as time went on, their clients have asked them for investment management services as well.

Once Financial Engines had broken the simulation ice, many smaller firms followed suit, creating their own models with @Risk or Crystal Ball or by developing their own stand-alone simulation software.

But Michael Dubis, a Certified Financial Planner in Madison, Wisconsin, has this warning: “Many financial planners use Monte Carlo as if it were the Holy Grail of Financial Planning success,” he says. “This is dangerous if they don’t have a solid understanding of statistics or the assumptions that go into simulations.” And Dubis relates another problem regarding a lack of standards. If you add 2 and 3, you will get 5 regardless of whether you use paper and pencil, an abacus, a pocket calculator, or an Excel spreadsheet. This constancy has not been true of simulation. “The industry is crying out for standardized representations of distributions, so that any two financial planners, working with the same client, would come to the same conclusion no matter what software they use.” The problem is that even if the users of the simulations made identical assumptions, each software package has its own method for generating random numbers. The power of the DIST representation of pregenerated distribution samples is that any two simulations using the same assumptions will get exactly the same answer.

The Parisian Meter Stick

Dubis has articulated one of the main aspirations of the new field of Probability Management: to develop libraries of standardized distributions for use in various industries. Just as there was once a defining platinum meter stick in a museum in Paris, there should be publicly available online benchmarks for the distributions of returns of major asset classes. And it could come in several flavors. According to Dubis, “Many of us are anxious for the day that inputs go beyond simple log-normal distribution and include real life scenarios that ‘Fat-Tails’ and ‘Mandelbrot distributions’ would incorporate.” Michael couldn’t contain himself there and slipped in a few Red Words, but his point is that in fact asset prices can be modeled in several standard ways, and they could all be represented. If your portfolio looked safe under all of the standard distribution assumptions, you would feel safe indeed. If it looked safe under all but one set of assumptions, it would encourage you to learn more about that standard, maybe even discussing it around the water cooler. And getting people to discuss probability at the water cooler is perhaps the ultimate go...