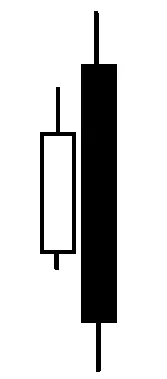

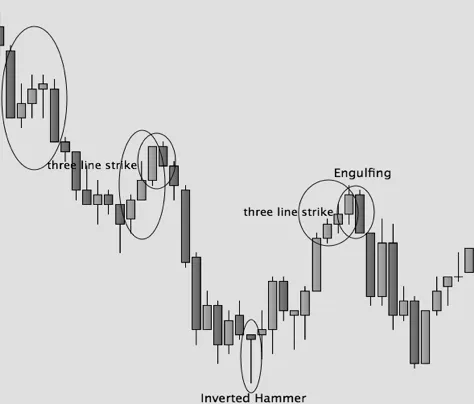

In order to offer you a better idea of the Japanese candles potentialities you can find in the Forex, we suggest that you follow some price patterns examples. The purpose is to inform you on the importance of this subject, which can be crucial during the trading. Therefore let us see the following picture:

In the circles, we can observe some different and typical inversions or permanent patterns of the candlestick charts. Here we can easily recognize some of them.

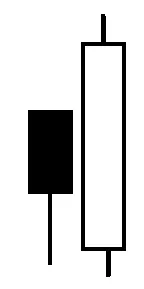

Now we are going to analyze the chart. At the start of this currency cross (for instance, EUR/USD) there appears a bear trend. The first circled picture is the pattern of a bear trend. Then we can see a price inversion attempt, which is stopped by sellers’ strength.

The cross swap continues by an acceleration of the sales (the three long black candles make this trend evident), and it is followed by a steady moment characterized by indecision.

After that, we have different candles with a small body, and short swinging battles, which can be won by sellers as well as by buyers.

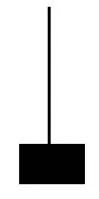

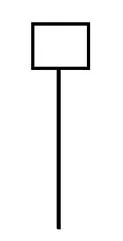

The minimum in the market is finally reached by a candle with a long bear shade. It is the most evident sign that the sellers’ strength is over.

As a matter of fact, this picture is an example of an Inverted Hammer candle. From now on, the market will start going upward again.

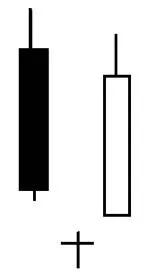

The following candles are characterized by buyers’ victory, as well as a new minimum bull trend, which will be shortly tested, and higher than the previous ones.

This simple analysis can help you to understand the great importance of the Japanese candlesticks' analysis in order to plan a winning trading strategy. By studying the charts, a successful Forex trader does not only learn how the possible combinations and schemes these candles can form, but he can also understand at first glance what type of configuration is going to form as far as the trend is concerned.

After having developed a correct point of view, it will be fundamental to analyze the price patterns and anticipate the changes in the market directions.