The Operational Risk Handbook for Financial Companies

A guide to the new world of performance-oriented operational risk

Brian Barnier

- 276 Seiten

- English

- ePUB (handyfreundlich)

- Über iOS und Android verfügbar

The Operational Risk Handbook for Financial Companies

A guide to the new world of performance-oriented operational risk

Brian Barnier

Über dieses Buch

The Operational Risk Handbook for Financial Companies is a groundbreaking new book. It seeks to apply for the first time a range of proven operational risk techniques from other industries and disciplines to the troubled territory of financial services.Operational risk expert Brian Barnier introduces a range of sophisticated, dependable and - crucially - approachable tools for risk evaluation, risk response and risk governance. He provides a more robust way of gaining a better picture of risks, shows how to build risk-return awareness into decision making, and how to fix (and not just report) risks.The practical importance of fully understanding and acting on risk to the business begins in the foreword on plan-B thinking, penned by Marshall Carter, chairman of the NYSE and deputy chairman of NYSE Euronext.The book is unique because:- It is not just about modeling and a few basic tools derived from regulatory requirements. Instead, it looks at management of risk to operations across industries, professional disciplines and history to help ops risk leaders become aware of the entire landscape of proven experience, not just their own conference room.- It is not just about compliance. Instead, it looks to operations as part of performance - managing risk to return for shareholders and other interests (e.g. guarantee funds).- It is not content to look at risk in stand-alone segments or silos; instead it takes a systems approach.- It is not just about ops risk leaders sharing war stories at a conference. Instead, it introduces a panel of six financial institution board members who get risk management and provide their perspectives throughout the book to encourage/demand more from ops risk to meet the needs of the institution in the world.- It is not a semi-random collection of tips and tricks. Instead, it is grounded in a risk-management process flow tailored to financial companies from a range of proven experience, providing tools to help at each step.Suitable for companies of all sizes, this book is of direct relevance and use to all business managers, practitioners, boards and senior executives. Key insights from and for each are built into every chapter, including unique contributions from board members of a range of companies.The Operational Risk Handbook for Financial Companies is an essential book for making better decisions at every level of a financial company; ones that measurably improve outcomes for boards, managers, employees and shareholders alike.

Häufig gestellte Fragen

Information

Part 1. Evaluating Risk

1.1. Lighting up ‘Dark Corners’

- what to do: process model steps

- management practices

- input–output tables

- what to measure: goals and metrics tables

- who does it: Responsible, Accountable, Consulted, Informed (RACI) tables

- how to measure and progress: maturity models or agreed upon procedures

- glossary.

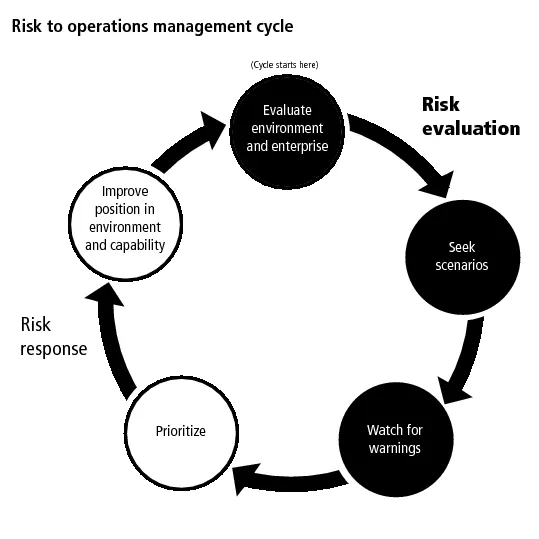

Figure 1

- Evaluate the environment and enterprise is about the environment (economic, competitive, market, political, regulatory, social, technology, natural) in which an enterprise, product or process operates. The enterprise capabilities are those in product, process, IT and other areas of the institution that work together to achieve objectives.

- Seek scenarios illuminates how situations unfold in the environment and enterprise that can impact objectives.

- Watch for warnings looks for signs that the potential scenarios are unfolding.

- Prioritize uses the warning information to help select projects from the range of options that optimize risk–return performance and balance cost and benefit.

- Improve position in environment and capability designs and implements solutions to strengthen capabilities to earn return from taking risk; reposition away from danger; reshape the environment; or some combination of these. Improving capability includes oversight, management, controls and core business process. As the cycle continues, the new state of environment exposure and enterprise capability is evaluated and the cycle continues.

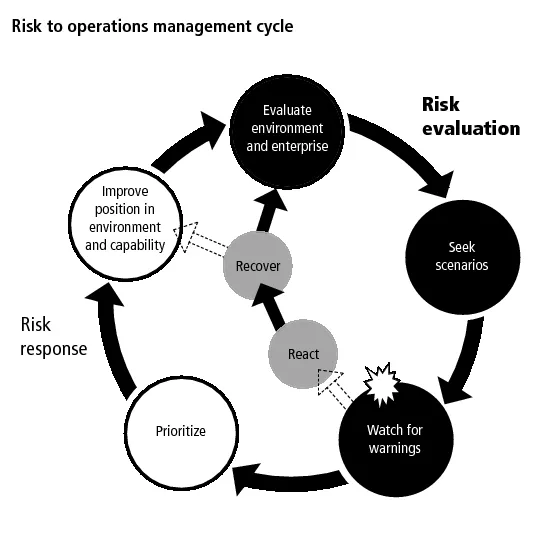

Figure 2

- React immediately implements pre-planned and other actions to contain, reduce or stop an unfolding chain of events.

- Recover begins when the cascading chain of events has been sufficiently stopped and the damaged capability can begin its journey back to ‘normal’ or ‘steady state’. Depending on the extent of the damage, this may be relatively quick and with current resources (reversing a trade or resetting failed equipment) or more extensive (fire, earthquake, flood, fraud investigations, diagnoses and fixes) requiring new resources to be prioritized. In either case, the full risk evaluation and response cycle is resumed as the enterprise seeks to continually improve performance within its environment.

- Speed is again prominent, based on the real-world speed of the unfolding situation, reaction and recovery.