Hands-On Artificial Intelligence for Banking

A practical guide to building intelligent financial applications using machine learning techniques

Jeffrey Ng, Subhash Shah

- 240 Seiten

- English

- ePUB (handyfreundlich)

- Über iOS und Android verfügbar

Hands-On Artificial Intelligence for Banking

A practical guide to building intelligent financial applications using machine learning techniques

Jeffrey Ng, Subhash Shah

Über dieses Buch

Delve into the world of real-world financial applications using deep learning, artificial intelligence, and production-grade data feeds and technology with Python

Key Features

- Understand how to obtain financial data via Quandl or internal systems

- Automate commercial banking using artificial intelligence and Python programs

- Implement various artificial intelligence models to make personal banking easy

Book Description

Remodeling your outlook on banking begins with keeping up to date with the latest and most effective approaches, such as artificial intelligence (AI). Hands-On Artificial Intelligence for Banking is a practical guide that will help you advance in your career in the banking domain. The book will demonstrate AI implementation to make your banking services smoother, more cost-efficient, and accessible to clients, focusing on both the client- and server-side uses of AI.

You'll begin by understanding the importance of artificial intelligence, while also gaining insights into the recent AI revolution in the banking industry. Next, you'll get hands-on machine learning experience, exploring how to use time series analysis and reinforcement learning to automate client procurements and banking and finance decisions. After this, you'll progress to learning about mechanizing capital market decisions, using automated portfolio management systems and predicting the future of investment banking. In addition to this, you'll explore concepts such as building personal wealth advisors and mass customization of client lifetime wealth. Finally, you'll get to grips with some real-world AI considerations in the field of banking.

By the end of this book, you'll be equipped with the skills you need to navigate the finance domain by leveraging the power of AI.

What you will learn

- Automate commercial bank pricing with reinforcement learning

- Perform technical analysis using convolutional layers in Keras

- Use natural language processing (NLP) for predicting market responses and visualizing them using graph databases

- Deploy a robot advisor to manage your personal finances via Open Bank API

- Sense market needs using sentiment analysis for algorithmic marketing

- Explore AI adoption in banking using practical examples

- Understand how to obtain financial data from commercial, open, and internal sources

Who this book is for

This is one of the most useful artificial intelligence books for machine learning engineers, data engineers, and data scientists working in the finance industry who are looking to implement AI in their business applications. The book will also help entrepreneurs, venture capitalists, investment bankers, and wealth managers who want to understand the importance of AI in finance and banking and how it can help them solve different problems related to these domains. Prior experience in the financial markets or banking domain, and working knowledge of the Python programming language are a must.

Häufig gestellte Fragen

Information

- Chapter 1, The Importance of AI in Finance

- What is AI?

- Understanding the banking sector

- Importance of accessible banking

- Application of AI in banking

What is AI?

- Reasoning: The ability to solve puzzles and make logic-based deductions

- Knowledge representation: The ability to process knowledge collected by researchers and experts

- Planning: The ability to set goals and define ways to successfully achieve them

- Learning: The ability to improve algorithms by experience

- Natural Language Processing (NLP): The ability to understand human language

- Perception: The ability to use sensors and devices, such as cameras, microphones, and more, in order to acquire enough input to understand and interpret different features of the environment

- Motion: The ability to move around

How does a machine learn?

- Supervised learning is based on the concept of mining labeled training data. The training data is represented as a pair consisting of the supplied input (also known as a feature vector—this is a vector of numbers that can represent the inputted data numerically as features) and the expected output data (also known as labels). Each pair is taggedwith a label. Thefollowing diagram illustrates the supervised learning method:

- Unsupervised learning is based on a situation where the training data is provided without any underlying information about the data, which means the training data is not labeled. The unsupervised learning algorithm will try to find the hidden meaning for this training data. The following diagram illustrates the unsupervised learning method:

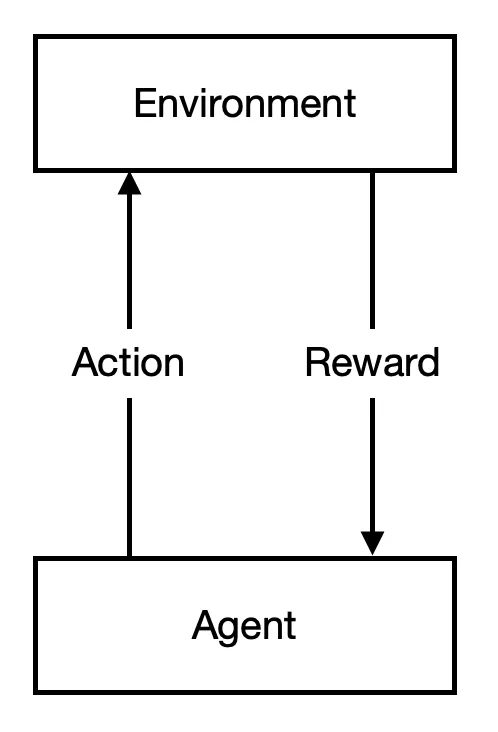

- Reinforcement learning is a machine learning technique that does not have training data. This method is based on two things—an agent and a reward for that agent. The agent is expected to draw on its experience in order to get a reward. The following diagram depicts the reinforcement learning method: