![]()

Part I

Cross-Border Pricing Background

![]()

Chapter 1

What is Transfer Pricing and How Does It Work? An Introduction

1. How This Book Will Help You Understand and Implement Transfer Pricing Strategies

In this day and age, international expansion or simply conducting commercial dealings across borders, without too many hassles, is a taxing proposal. Without a strong understanding of the rules of the international tax regime, peace of mind is, at best, elusive.

This book focuses on the rules of transfer pricing within the international tax regime, as they have come to life between Canada and the United States.

Part I includes Chapters 1–3 and provides some meaningful contextual background on the matters of pricing cross-border transactions between related parties. Part II includes Chapters 4–9 and contains what may be considered the “Transfer Pricing Tool Kit” for the design, implementation, and documentation of the value chain for business and taxation purposes. Part III, including Chapters 10–13, focuses on the expected and unexpected relationships that will emerge from the cross-border transactions: the transfer pricing audit and the mechanisms available to remedy double taxation are discussed. Part IV, Chapter 14, provides some insight into the usefulness of an advisor with respect to the handling of cross-border transactions.

2. International Dealings 101

First and foremost, international expansion or the continuity of commercial dealings across borders is about business, not taxes. Numerous successful businesses endeavor to expand their dealings globally or to consolidate their current position. Commercial expansion is usually performed gradually through time within the limits of the financial resources available. A sudden burst of growth or a significant acceleration of growth may, in some cases, be within reach where e-commerce and web-based activities are successfully implemented on a relatively small-scale budget.

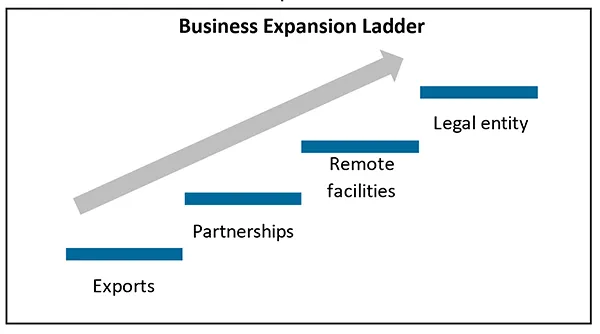

International expansion typically follows the Business Expansion Ladder as shown in Table 1. Business expansion often starts with exports, then partnerships with independent distributors or agents. This may lead to licensing or franchising deals. When market penetration is fruitful, more permanent fixtures may be considered, including storage facilities or other similar remote facilities. At some point comes formal implementation through either incorporation of a legal entity in the new country or market or even by merger and acquisition.

Table 1: Business Expansion Ladder

It is through the incorporation or acquisition of one or more legal entities that the most significant business opportunities and challenges of international expansion arise. Stakes rapidly become higher where cross-border transactions occur between what are labeled related parties. Entities of a corporate group are then expected to abide by higher standards whether for commercial, legal, or tax purposes. It becomes necessary to design and manage the value chain of the corporate group. This may be performed on an ad hoc basis or, better yet, in a proactive and timely manner.

3. The Value Chain and Transfer Pricing

The nature of the commercial relationships between the entities of a corporate group needs to be addressed to ensure efficiency. This relates to the design and the management of the value chain of the corporate group. The value chain relates to the commercial activities such as marketing, financing, customer service, manufacturing, etc. These activities may be allocated between several companies when a corporate group is present in more than one country.

It is the division among supplier firms that gives rise to the multiplication of inter-company transactions. Modern economic globalization is chiefly explained by inter-company cross-border transactions that represent an ever-increasing percentage of global trade. Rough estimations by the Organisation for Economic Co-operation and Development (OECD) suggest that inter-company trade value now exceeds 50% of aggregate international trade value.

4. The OECD’s Base Erosion and Profit Shifting Initiative

Industrialized countries have individually expressed worries for their perceived loss of corporate tax revenues. The OECD Base Erosion and Profit Shifting Initiative (“BEPS initiative”), officially launched in 2013, is the most comprehensive effort to fight back against this alleged corporate income tax gap. At its core, the BEPS initiative intends to counter the information asymmetry that permeates the international tax regime. Any successful business’s international expansion consequently must deal with the principles of the international tax regime.

Tax treaties and tax information exchange agreements provide tax authorities with an ever-increasing number of tools aimed at fighting the relative opaqueness of certain cross-border transaction arrangements. The OECD’s Master file, Local file and Country-by-Country reporting mechanisms have paved the way to a heightened level of scrutiny of cross-border transactions within a corporate group.

5. Value Chain and Complexity

As time goes by and domestic tax regimes get more complex, the taxpayer gains access to more options and opportunities. Value chain design and management opportunities are thus created for the corporate group from the complexity in its voluntary or involuntary interactions with domestic tax regimes and the international tax regime.

Moreover, opportunities in the value chain design and management may also originate from the business activities themselves. In such instances, inherent or self-conceived complexity of the business activities may provide opportunities to revamp the value chain of the business. In other words, value chain management may lead to newfound complexity. Said complexity may in turn lead to new legitimate value chain design and management opportunities.

Within the scope of the international transfer pricing rules, all these value chain design and management opportunities will ultimately lead to the determination of international transfer prices to deal with this complexity.

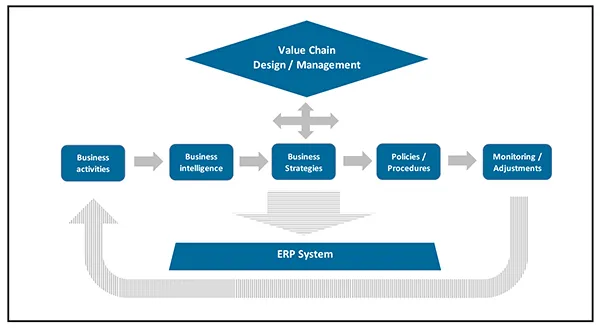

Table 2: Value Chain Design/Management

6. Enterprise Resource Planning (ERP)

Best practices in operational transfer pricing are derived from business policies and procedures that accurately intertwine day-to-day commercial activities with transfer pricing needs for tax purposes. This ultimately allows the corporate group to create business intelligence and deal with complexity. But first, some type of enterprise resource planning or ERP system is necessary to ensure day to day management of the value chain without compromising the integrity of business policies and procedures. To that effect, ERP systems come in all shapes and sizes, as well as prices.

ERP systems are information systems. As explained by Claude Doom in An Introduction to Business Information Management (ASP Editions, 2010), information feeding this system comes from business processes. In turn, these business processes create business functions that establish or maintain the coherence of the value chain of the corporate group. Wholly integrated information systems, that is, ERP systems, cover all the business functions of the value chain.

Mary Sumner points out in Enterprise Resource Planning (Pearson, 2004) that ERP systems are usually seen as devices relevant to the day-to-day management of commercial activities. This operational or transactional feature is most common in off-the-shelf ERP systems that are indeed designed and centered on the day-to-day management of commercial activities.

As explained by these authors, proficient ERP systems also comprise an “information management” feature. This array of “decision-making” or “knowledge management” tools is supported by the data gathered by the system. It typically takes the form of a “dashboard” dedicated to executive management. The information included in this dashboard generates business intelligence useful to design business strategies that may in turn smoothen the implementation of business policies and procedures across the corporate group.

7. Making Transfer Pricing Operational

Business intelligence will obviously come from the business activities of the specific corporate group. With respect to tax compliance, accurate and sensible design, structuring, analysis, implementation, management, monitoring, and adjustments to the value chain of the corporate group require the active involvement of tax specialists. This enables the successful shift from typical international transfer pricing for tax purposes to operational transfer pricing.

Operational transfer pricing may be defined as the end product or combined results of the successful juncture between the pricing of the commercial activities of the corporate group and the pricing of the cross-border transactions of the corporate group. In practice, both sets of prices often require separate processes. This creates tax uncertainty, corporate complexity, unwarranted costs, and a lasting lack of control of the specific tax outcomes of the value chain. Operational transfer pricing addresses these mishaps and puts forward the ways and means to handle these matters.

Operational transfer pricing integrates business intelligence originating from the business activities into business strategies. From these business strategies come the design, structuring, analysis, implementation, management, monitoring and adjustments to the value chain of the corporate group. This is an iterative process that occurs through time, markets, countries and/or continents, as the case may be. Operational transfer pricing starts from the commercial and legal constraints that the corporate group must tackle. It then moves toward the design and management of the value chain both for business and taxation purposes.

The following chapters of this book show how to combine value chain design, implementation, and documentation for business and taxation purposes (and hopefully, success in your transfer pricing endeavors).

![]()

Chapter 2

Fair Market Value and Transfer Pricing

1. The Arm’s Length Principle

The design of any value chain must abide by the arm’s length principle, which may be defined as follows according to paragraph 1.6 of the OECD Transfer Pricing Guidelines (Organisation for Economic Co-operation and Development 2017): “The arm’s length principle is found within the conditions of the commercial or financial relations between related entities of a corporate group that must be like those found between independent enterprises. According to the tax authorities around the world, any profits derived from a different type of arrangement may be reassigned and taxed accordingly.”

In layman’s terms, the values, prices, or profit margins between related entities must equal the expected fair market value of said values, prices, or profit margins. In practice, fair market value or arm’s length prices and margins are usually achieved by bargaining, reliance on quoted prices on free markets, comparison analysis, or any other methods recognized by valuation theory. In general, the courts must see the pricing and spreads as “reasonable” and not made to solely take advantage of tax laws. This notion is also found in Canadian and US tax law as highlighted in the following sections.

The general threshold for the application of the arm’s length principle is triggered where related entities are not dealing within the terms and conditions that are found on a free market. Related parties or “associated enterprises,” as they are labelled by the OECD in Article 9 of the Model Tax Convention, are therefore found in situations:

“Where

• an enterprise of a Contracting State participates directly or indirectly in the management, control or capital of an enterprise of the other Contracting State, or

• the same persons participate directly or indirectly in the management, control or capital of an enterprise of a Contracting State and an enterprise of the other Contracting State,

• and in ei...