![]()

PART ONE

An Introduction to Air Transportation

![]()

1

The Airline Industry: Trends, Challenges and Strategies

Introduction

Stages of Development Impacting the Airline Industry

Past, Present and Future Trends

Regional Analysis

The Industry: Challenges and Strategies

The New Breed of Airlines

Failing and Achieving Success

Chapter Checklist • You Should Be Able To:

Define the four stages of development impacting the airline industry

Discuss the main trends impacting the global airline industry including regional challenges

Describe and discuss the main critical financial issues and challenges associated with air transportation

Understand the main strategies for global aviation in order to achieve success

Discuss the different types of air carriers evolving and the main factors behind success and failure

Describe how evolving new technology may impact the future of aviation

INTRODUCTION

In previous editions of this book, Chapter 1 provided an overview of the air transportation and aerospace industries. Given the volume of change constantly occurring in the aviation industry, it is important for the reader to have a full understanding of the global airline industry before proceeding with the other chapters in the book. Having knowledge at the macro level will assist the reader in better understanding the other chapters presented. This chapter provides a background on the current global industry including a regional analysis, discusses current and future evolvement of the industry in terms of trends, discusses challenges and strategies impacting the industry, discusses the new breed of airlines, and discusses why airlines fail and what can be done to achieve success. Chapter 1 presents an overall framework to supplement the other chapters in the book. As a result, some information presented in this chapter will be repeated in other chapters and discussed in greater detail.

STAGES OF DEVELOPMENT IMPACTING THE AIRLINE INDUSTRY

Historically, the United States aviation industry has been the center of focus for discussions related to history, change, challenges and strategies. One of the main reasons for this is because the U.S. has traditionally been at the forefront of evolvement in the aviation industry and that is the one major reason why the bulk of reference material on the market is heavily concentrated on the U.S. airline industry. However, as the rest of the world experiences increased change in political environments, different regions of the globe are becoming more important in terms of change, resulting in decreased emphasis on the U.S. industry. Although some experts disagree, there are four stages of development impacting the airline industry in terms of maturity. Some regions of the world have skipped a step or two resulting in both positive and negative results for the industry. With that said, the logical stages of development include: regulation, liberalization, deregulation and in some cases, re-regulation. The first three stages of development are discussed in greater detail throughout the book.

Stage I: Regulation

At one point in time, the bulk of the global airline industry was heavily regulated meaning governments had strict control of the industry in terms of air fares, routes and market entry of new airlines. The main factors resulting from a regulated environment include, but are not limited to, the following: strict ownership control of airlines, limited to no competition on selected routes, limited markets served, limited city-pair frequency, high air fares for passengers, government bail-outs for air carriers in distress, and incentive to achieve airline profitability.

Stage II: Liberalization

In a liberalized environment, there is less government control of the industry compared to a regulated environment. Although liberalization generally brings positive results to the industry, one large barrier to implementation is that the global airline industry cannot implement seamlessly or simultaneously. However, the industry does recognize the need to implement where appropriate and as of mid-2011, the industry appears to be moving forward in a positive direction with increased bilateral negotiations between countries. As per the International Air Transport Association (IATA) liberalization allows for expansion into new markets, diversification into new products, specialization in niche products, and market exit for air carriers not able to succeed in specific competitive markets.

Stage III: Deregulation

In a fully deregulated environment, government controls like entry and price restrictions for air carriers are removed allowing airlines to serve any given route and freely compete with other carriers. In many ways, deregulation is the opposite of regulation. Generally speaking, air fares are substantially decreased, safety is improved, and service quality increases (i.e., route frequency, total number of miles flown, on-time performance, frills and amenities). In the case of the United States, selected small- and medium-sized airports have not felt the true benefits of deregulation because of the limited amount of competition in each market.

Stage IV: Re-regulation

In 2007, the United States airline industry entered formal discussions regarding the possibility of re-regulating the industry as a result of merger discussions between American Airlines and Northwest Airlines and United Airlines and Continental Airlines.

In a re-regulated environment, the government would have a role in pricing and restrict airlines from selling air fare below actual cost. Re-regulation would also result in changes to the Railway Labor Act, as discussed in later chapters of the book, where unions would not be permitted to strike resulting in binding arbitration. Suggested changes also include restricting airlines to utilizing larger aircraft on certain city-pairs resulting in decreased frequency. Also, the air traffic control system would be updated to increase efficiency of the national air transport system and decrease delays at hub airport facilities throughout the country. As the airline industry restructures, it appears there will be increased expansion, increased consolidation, and increased concentration.

By 2014, a number of changes impacted the U.S. airline industry as a result of merger deals between legacy airlines. The industry moved from having eight major players to essentially four. American Airlines and US Airways merged to create a new American Airlines. Delta and Northwest merged to create a new Delta. United and Continental merged to create a new United. Southwest and AirTran merged to create a new Southwest.

Some industry experts argue that the U.S. airline industry is in a re-regulation phase given the Justice Department’s decision to allow such mergers to occur. Experts argue that consolidation in the industry reduces competition, ultimately creating monopolies at select key airports across the country. Experts on the other side argue consolidation is a positive thing for the industry as it creates new opportunities for low-cost carriers and new start-ups.

Technically, as of 2014, the U.S. airline industry was deregulated but there are emerging trends incorporating forms of re-regulation. What happens in the next decade in terms of deregulation v. re-regulation will be dependent on the success of the existing air carrier structure. Unfortunately, it is not possible to forecast the future as the airline industry is unpredictable and volatile.

PAST, PRESENT AND FUTURE TRENDS

The Global Airline Industry

Since the terrorist attacks on the United States on September 11, 2001, the global airline industry has experienced four phases of evolvement: survive, adapt, recover and rethink. The rethink phase is an ongoing process forcing air carriers worldwide to constantly enhance business models to achieve profitability while maintaining a safe and efficient operation. In the new operating environment, airlines are no longer defined as airlines but as businesses where only the fittest survive. If the bottom line is not met, the air carrier disappears and is often replaced by a new competitor or an existing competitor expands its operation.

Scenarios

In the past decade, the global airline industry has faced a long list of negative scenarios resulting in high barriers for successful operations. Some of these scenarios include: 2003 outbreak of Severe Acute Respiratory Syndrome (SARS), the Iraq War, the Afghan War, the ongoing Syrian crisis, and the 2008–2012 financial crisis. In the year 2014 onwards, airlines will be forced to prepare for additional scenarios whether they occur or not. Preparation includes developing a flexible business plan allowing the airline to adapt to most any environment. Historically, well-established airlines have not done a great job adapting to fluctuating environments because of their dependency on legacy-based systems. New air carriers, particularly those known as “low-cost” carriers have been able to withstand changes in the global environment because their business models incorporate flexibility. With that said, not all such airlines have been able to survive. Moving forward, airlines must prepare for globalization, changes in the international political landscape, distribution of natural resources (oil, gas, water), internal conflicts (shifts in power), unintended consequences and unintended consequences from good intention, public and international perception, war, terrorism, and continued financial issues.

The Top Five Frustrations in Aviation

The airline industry is perhaps the most high-profile industry in the world, but it is also considered one of the most neglected in terms of investment. With that said, the airline industry faces numerous frustrations and the list is lengthy. For the purpose of discussion, the author highlights what are considered to be the top five frustrations impacting aviation today (in random order). These include: fuel and oil; pollution control; personnel cutbacks; global economic woes; and recurring safety lapses. Additional areas of debate include: costs associated with Air Navigation Service Providers (ANSP); government interference; the environment and efficient infrastructure; security and taxation. Such topics are discussed in greater detail throughout the book.

The Top Three Costs for Airlines and Typical Airline Operating Expenses

The top three costs for most airlines, in any order, are: fuel, labor and maintenance. In the United States, fuel was approximately 40 percent of airline operating costs in the year 2013 as per IATA. Actual costs associated with airline operations vary region by region, country by country, and company by company. In the U.S., the Air Transport Association (ATA) produces a Passenger Airline Cost Index on a quarterly basis. The author recommends the reader consult the ATA web site to get a better understanding of costs associated with operating an airline. The index takes into account the following costs: fuel; labor; aircraft rents and ownership; non-aircraft rents and ownership; professional services; food and beverage; landing fees; maintenance material; aircraft insurance; non-aircraft insurance; passenger commissions; communication; advertising and promotion; utilities and office supplies; transport-related; and other operating.

The Aviation and Aerospace Almanac lists typical operating expenses as: ticketing, sales, promotion; general administrative; fuel and oil; station expenses; passenger services; maintenance and overhaul; flight crew; depreciation and amortization; landing and associated airport charges; en route facility charges; and other operating costs. For specific percentage breakdowns of costs, the reader is encouraged to review ICAO Air Transport Reporting Form EF-1.

REGIONAL ANALYSIS

Airlines are important to the global economy because they link regional economies with the rest of the world. When the economy is doing well, airlines tend to profit but when the economy is not doing well, airlines tend to lose profit, often being the first and hardest hit industry in turbulent times.

In order to better understand the aviation industry, it is important to have a global understanding of how the industry functions as well as a regional understanding. Just because one region is successful, it does not mean another region is following similar patterns. However, the effects of a region do have positive and negative impacts on other regions causing what is called the domino effect or a chain reaction.

At the end of 2009, the aviation industry suffered from a global economic crisis the implications of which will never be fully known. According to IATA, airlines worldwide lost a combined US$11 billion in 2009 due to rising fuel costs and reduced earnings on fares and cargo. Despite indications of certain economies returning to positive environments, the positive impact on air carriers worldwide has been slow to grow. As a result, airlines have been shrinking capacity to accommodate reduced bookings for first and business class travel. Typically, when the economy suffers, the volume of business travel is reduced or eliminated by many corporations negatively impacting high-end fares.

By the end of 2012, business confidence had bottomed out and there was the expectancy that business activity would increase dramatically. However, by early 2014, this trend had not occurred. In 2013, GDP growth averaged 2 percent compared to 2.2 percent in 2012 with developed nations doing better than developing nations like India, Brazil, and China. In 2013, oil prices were approximately US$109 per barrel while jet fuel averaged US$126 per barrel. The 2013 fuel bill for the global airline industry was approximately US$213 billion or 31 percent of total costs. In 2013, passenger growth fell to 5 percent from 5.3 percent in 2012. IATA expected worldwide passenger numbers to reach 3.12 billion by end of 2013, early 2014 combined with record load factors of 80.2 percent. Demand for air cargo is declining and for 2013, growth was only 0.9 percent forcing airlines to focus on passenger traffic. Air cargo revenue reached a peak in 2011 declining to $59 billion in 2013 while passenger revenue increased reaching $565 billion.

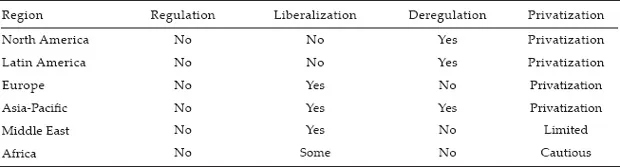

Table 1-1 highlights current regional regulatory trends. Depending on what direction regional and global economies take, such regulatory trends may change to adapt to the changing environment. It is expected the volume of airline consolidation will increase to compensate for increased operating costs and increased competition in specific markets.

TABLE 1-1 Regional Regulatory Trends

North America

In terms of regulatory trends for North America, Canada has experienced the privatization of airlines, airports, Air Traffic Control (ATC), and the rise of the low-cost airline. The United States has experienced the rise of the low-cost carrier, government control of airports, the development of secondary airports, major airline debt, bankruptcies, mergers, stagnant domestic passenger growth, and increased international gro...