![]()

Part 2

![]()

chapter 5

: Card Networks

What are the card networks and what is their role?

At the heart of every card swipe is the Card Network, sometimes also referred to as a Card Scheme. The major Card Networks in the US are Visa, Mastercard, American Express, and Discover. China has China Unionpay, Japan has Japan Credit Bureau (JCB), and while not considered Card Networks, Alipay and PayPal are, in fact, a type of payment network. For the sake of this chapter, we will be excluding Alipay and PayPal as examples.

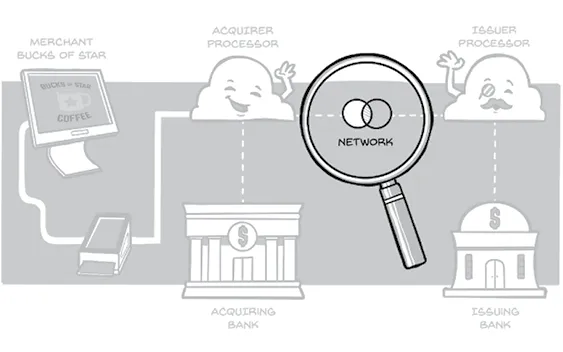

The Card Network’s job is to pass information from the Merchant Acquirer to the Issuer and vice-versa. The Card Networks set the rules for both Merchant Acquirers and Issuers. It sets the format for communicating (ISO8583 protocol) and also sets the rules for disputes so that disagreements are all handled in the same way. When these rules are adhered to, they provide a license to use their brand to Issuing Banks and Acquiring Banks.

Open Versus Closed Card Networks

Visa and Mastercard are considered open Card Networks, whereas Discover and American Express are closed Card Networks.

Visa and Mastercard: Open Card Networks

The key difference is that Visa and Mastercard will have relationships with multiple Merchant Acquirers and multiple Issuers. They typically don’t play any favorites and like to work in more of a marketplace function. This is why these Card Networks will typically invest in Issuers and Acquirers, but they won’t actually purchase these players.

American Express and Discover: Closed Card Networks

American Express and Discover typically issue their own cards, are their own bank, and typically provide their own acquiring services. This level of control affords Discover and American Express to control and own Interchange revenue, Card Network revenue, and Acquirer revenue.

How Do Visa and Mastercard Make Money?

In the case of Visa and Mastercard, because they sit in the middle, they are able to collect money from the Merchants and Issuers. Here is how Visa and Mastercard make their money:

Fees Assessed to the Merchant

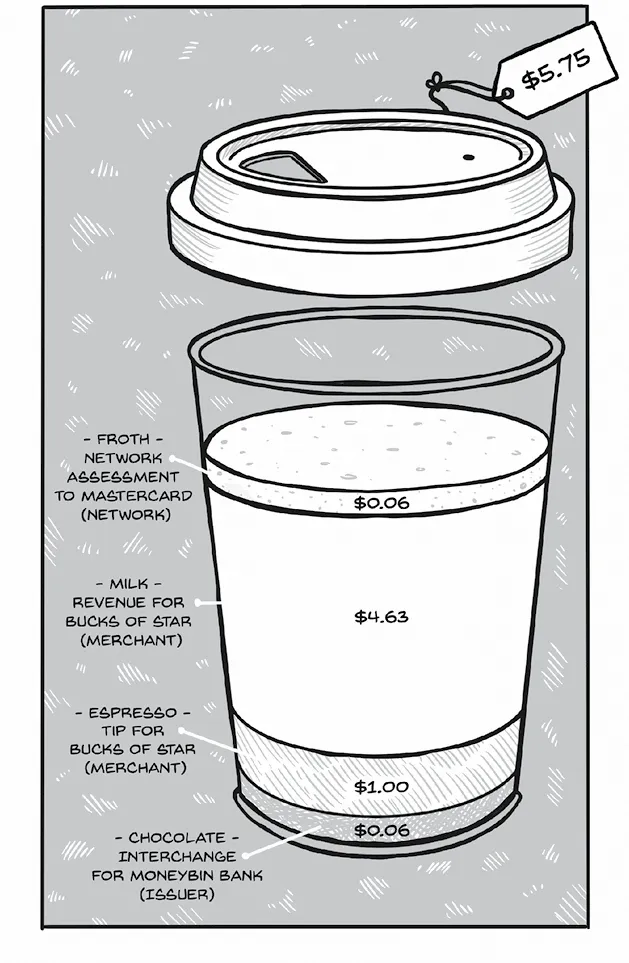

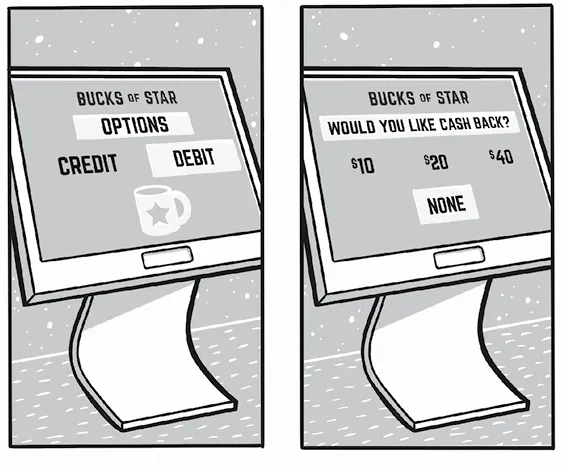

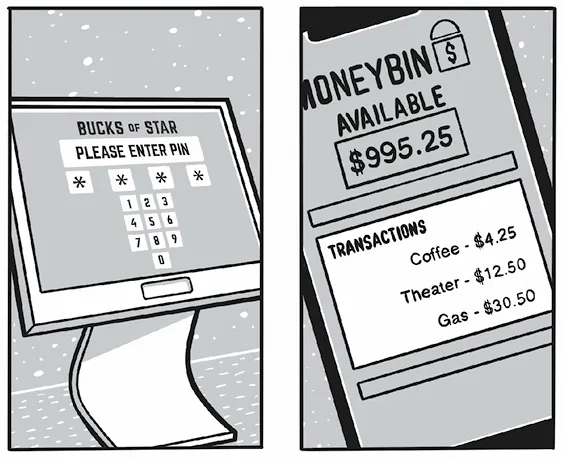

When a card that is issued by Moneybin Bank is swiped at Bucks of Star Coffee, Bucks of Star Coffee is charged the following fees:

Fees Assessed to the Issuer

The card Issuer, Moneybin Bank, is charged the following fees:

• After the transaction has cleared, a reporting settlement fee is typically charged to the Issuer from the Card Network; this is typically a flat fee per transaction.

• The Card Network will also charge the Issuer a per-transaction fee that is assessed on the authorization transaction and the clearing transaction. Another way to think about this is that the Issuer is assessed a usage fee for transmitting data through the Card Network’s “rails.”

• There are other Software-as-a-Service-type fees charged to the Issuer like fraud services and settlement services.

Acquirers and Issuers Are the Distributors of Visa and Mastercard

Visa and Mastercard’s strategy is about getting as many cards out there as possible and making sure these cards are accepted in as many places as possible. Another good way to think about it is that the Acquirers and Issuers are marketing vehicles and distributors for the Card Networks or card brands. The Issuers are responsible for getting more cards in the hands of users, and the Acquirers are responsible for getting as many card terminals and payment gateways in the hands of Merchants so they can accept card payments.

How Do American Express and Discover Make Money?

In the context of Discover and American Express, in most cases, these Card Networks are able to take the Interchange, Acquirer Fee, and Network Assessment. They are able to do this because they are also issuing their own cards and providing acquiring services. Because of this, they can adjust these fees depending on the size of the Merchant but also, their revenue per swipe is significantly higher than Visa and Mastercard.

However, their total swipe volume is significantly lower than Visa and Mastercard because they don’t have a network of Issuers and Acquirers getting their cards or card terminals into the market on their behalf. As a good frame of reference, in 2017, Visa accounted for 60 percent of all purchase volume in the US for all debit and credit cards. American Express only accounted for 13 percent, and Discover was at 2 percent.

Card Network Rails and Transaction Routing

In the background, all transactions are routed through some Card Network “rail.” Depending on how the cardholder swiped their card, the Card Network rail is determined. Three types of Card Network rails exist:

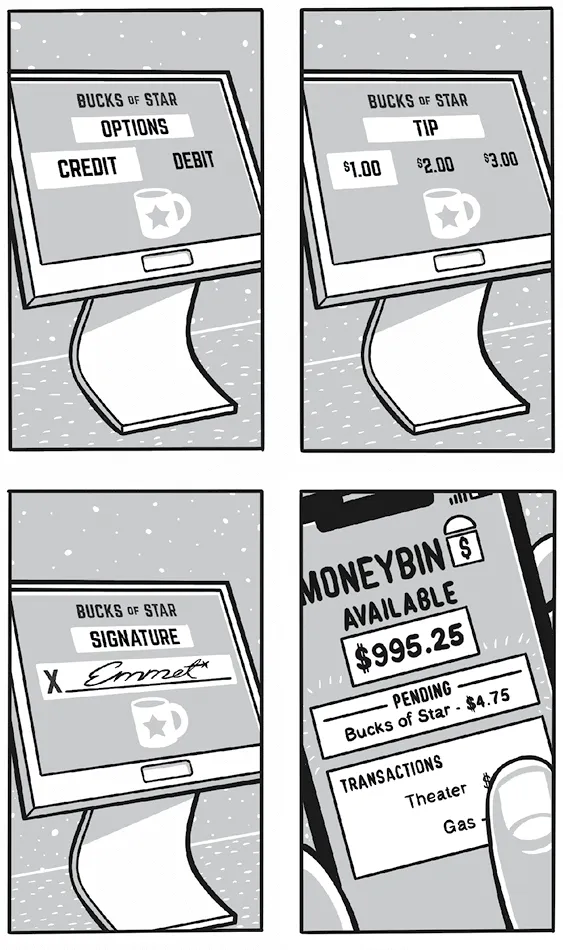

Credit Networks (Dual Message)

The typical mode of operating for these card networks is via the “Credit Network.” Sometimes, when you go to make a swipe at a card terminal, it will ask you if you want to use “Credit” or “Debit.” In most cases, you will select “Credit” if you have a credit card, and you can also select this if you have a debit card. The key difference to the cardholder is that if you select “Credit,” you may need to sign for the purchase, whereas if you select “Debit” then you will need to put in your four-digit PIN. However, under the hood, by selecting “Credit,” your card will actually charge the Merchant a higher Interchange rate. If you select “Debit,” the Merchant will be charged a lower Interchange rate. This transaction mode is also referred to as a “Signature Purchase.”

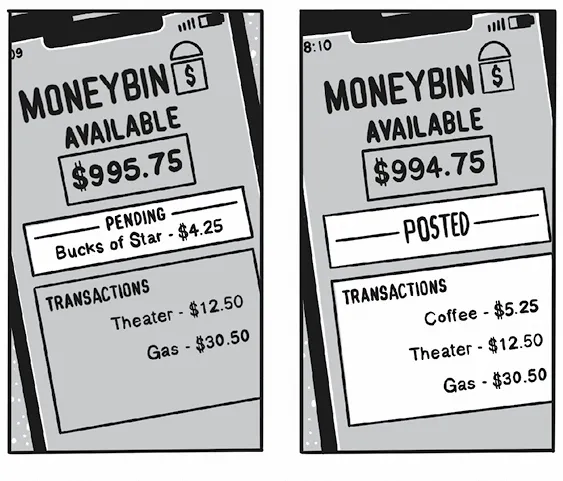

The Two Parts of the Dual-Message Swipe

The first part of the “Dual Message” is the Authorization, which effectively holds funds on the cardholder’s account until the transaction clears. The clearing transaction (typically occurs the following day) is the second part of the “Dual Message,” and this is where the money is actually removed from the cardholder’s account. If a tip is added, then it will appear in the clearing transaction.

PIN Debit Networks (Single Message)

For debit cards, each Card Network has a secondary network brand for PIN Debit or Automated Teller Machine (ATM). This mode typically yields a much lower Interchange. So, if you are using a Visa debit card from Bank of America, when it runs on the VisaNet “Credit” network, the Interchange is higher, whereas, in the “Debit” mode running on the Interlink network, the Interchange will be lower. This transaction mode is also referred to as a “PIN Debit Purchase.” When the cardholder selects this mode, they will be prompted to enter their four-digit PIN, and then the transaction will co...