![]()

CHAPTER 1

THE FRUGAL WOMAN

Manages Her Money

My frugal ways only began after I hit rock bottom. I woke up one morning and looked at someone who had squandered her money on everything, and knew I was in big trouble. I needed to make some serious changes.

It has taken me a couple of years to perfect my strategy. If you think I am ‘doing without,’ then you are mistaken. I have the things I need and some of the things I want; this helps me to keep an eye on my larger goals. I also want to stress that I live happily. No bill collectors calling. I love going to the bank—I get recognition there because I’m a good customer. They tell me about specials on CD rates and even ask me for advice on how to save.

The old me was beaten down. Now, money is empowering in more ways than one. Money is not evil; poverty is evil. It can drive good people to steal, cheat, lie, and even worse. Money problems can break up marriages and families. They can cause good parents to lash out at children and the people around them. Money in the bank brings peaceful thinking (not to mention compounded interest). When my thoughts are peaceful, I feel like I can achieve just about anything.

—S.T.

THE FIRST STEP IN BEING FRUGAL IS TO TAKE CONTROL of your money: Figure out where it’s going, how to spend less, and how to save more. This chapter is by no means a comprehensive guide to financial matters (for books that cover debt and money management in depth, see The Frugal Woman’s Best Financial Reads on the next page, a list of books most recommended by the Frugal Women on iVillage). But you will learn the basics of tracking your spending, creating and following a budget, and savings principles that will help get you on your way to a more secure future.

$ Debt-Proof Living by Mary Hunt (Broadman & Holman Publishers, 1999)

What Frugal Women say: “It’s the most sensible, easy-to-follow financial guide out there.”

$ How to Get Out of Debt, Stay Out of Debt, and Live Prosperously by Jerrold Mundis (Bantam Books, 1990)

What Frugal Women say: “Jerrold Mundis believes that life is for living—not just scrimping and saving every last penny. You do need to get out of debt and have savings for emergencies and retirement. But you can still enjoy life. The important thing is balance, and knowing your financial priorities.”

$ Get What You Want in Life with the Money You Already Have by Carol Keefe (Little Brown & Co., 1995)

What Frugal Women say: “Carol Keefe encourages you to remember you are not your debt; it’s only money. She also shows you how you can allocate small amounts of money to make them work for you. This is the book I pull off my shelf and go over every time I’m feeling down about my debt!”

$ 9 Steps to Financial Freedom by Suze Orman (Crown Publishers, 1997) What Frugal Women say: “Really good. The book talks about the emotional relationship with money, and money as a living, growing thing that needs to be nurtured and how to nurture it.”

The Frugal Woman Knows . . .

WHERE HER MONEY GOES

Do you constantly ask yourself Where did all my money go? at the end of every month? Before you can even begin figuring out how to spend less money, you need to figure out exactly what you’re spending it on.

One Frugal Woman advises, “The best way to save is to find your ‘leak’— in other words, where the money is going. Track your expenses—all of your expenses—including the can of soda, gas for the car, clothes, food, and so on. You should probably track for at least a month. Once your expenses are on paper, it becomes more real to everyone in the family and helps you pinpoint your leak.”

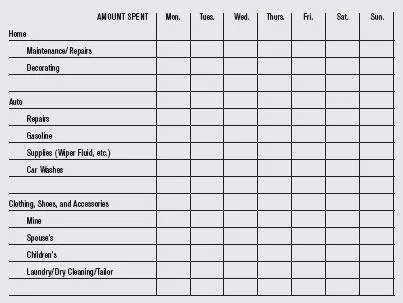

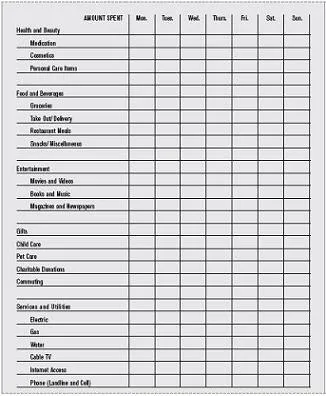

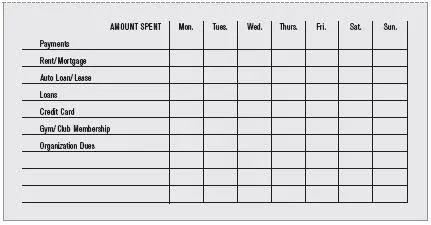

Frugal Women on iVillage use a variety of tools to track their spending—some opt for computer programs such as Quicken or Microsoft Money; others find that a plain paper version (like the Spending Chart on page 5) works just as well. However you choose to track your spending, be detailed—and honest—about your habits. There’s an old saying that we don’t trip on mountains, we stumble on pebbles. And for many, it’s the “pebbles” that trip up our budgets.

The Frugal Woman Knows . . .

DEBT IS A FOUR-LETTER WORD

The Frugal Woman despises debt, especially credit card debt. Simply put, there’s nothing less frugal than having to pay extra for what you’ve already bought—that interest that compounds and piles up on top of the expenditures you’ve already made. Frugal Women overwhelmingly embrace a debt-free life—using frugal methods to get out of debt if they are in it, and to stay out of it once it’s gone. (Realize, of course, even Frugal Women seldom try to buy a house without taking out a mortgage—although they watch mortgage rates and refinance as rates become more favorable.)

One of the simplest ways to stay free of debt, as one Frugal Woman comments, is to “live below your means. Even if you and your spouse/partner gross six figures, that doesn’t necessarily mean that you can buy that Lexus, take that cruise, go skiing every winter; you don’t really ‘deserve’ these things just because you make good salaries. Along the same lines, don’t try to keep up with the Joneses; chances are, the Joneses are up to their eyeballs in debt and can’t sleep at night.”

One of the most common—and most important—recommendations made by Frugal Women on iVillage is to pay off any credit card debt you are carrying, and not to incur any further debt. “If you can’t afford to pay for something with cash, check, or debit card,” says one Frugal Woman, “you can’t afford it.”

The Frugal Woman Knows . . .

HOW TO CONTROL HER CREDIT CARDS

Some Frugal Women choose to live without credit cards altogether (often after having gotten out of massive debt from them). But that may not be practical or desirable for you. If you are carrying large balances from month to month, many would advise you to strongly consider taking a sharp pair of scissors to your cards. If you’re not at the point of needing to cut up your plastic, try these methods to set limits for yourself.

Leave yourself reminders about their use.

“Tape a note on your credit cards with a say...