CHAPTER 1

Leveraging Intellectual Capital to Create Growth Opportunities and Profitable New Income Streams

Intellectual capital consists of human capital, intellectual property (IP), and relationship capital, and these are the key assets for driving growth and maximizing shareholder value in all types of economic conditions.

The biggest challenge that many companies face is how to keep growing in a slowing economy. The primary but not exclusive focus of this book is on two key strategies, franchising and licensing, as methods for leveraging the intellectual capital of a company into new revenue streams, market opportunities, and profit centers. For many years, companies of all sizes and in many different industries did not understand how to harvest their intangible assets; traditionally, they viewed these assets relatively passively as a way to defend market share instead of proactively as a source of new opportunity.

The strategic views toward the use of intellectual capital has evolved in the boardroom over the past three decades, as described in Figure 1-1.

CEOs and business leaders of companies of all sizes are often guilty of committing a very serious strategic sin: the failure to properly protect, mine, and harvest the company’s intellectual property. This is especially true at many technology-driven and consumer-driven companies. From 1997 to 2001, billions of dollars went into the venture capital and private equity markets, and the primary use of these proceeds by entrepreneurs was the creation of intellectual property and other intangible assets. Eight years later, however, emerging growth and middle market companies, in many cases, have failed to leverage this intellectual capital into new revenue streams, profit centers, and market opportunities because of a singular focus on the company’s core business or a lack of strategic vision or expertise to uncover or identify other applications or distribution channels.

Entrepreneurs and growing company leaders may also lack the proper tools to understand and analyze the value of the company’s intellectual assets. In a recent study by Professor Baruch Lev at NYU, only 15 percent of the “true value” of the S&P 500 was found to be captured in their financial statements. Given the resources of an S&P 500 company, it is likely that smaller companies have their intangible assets even more deeply embedded and that the number for privately held companies may be as low as 5 percent. Imagine the consequences and opportunity cost if you were preparing to eventually sell your business (or even structure an investment with a venture capitalist or strategic investor) and 95 percent of your inherent value gets left on the table! This gap in capturing and reflecting this hidden value points out the critical need for a legal and strategic analysis of an emerging company’s intellectual property portfolio.

Figure 1-1. Strategic views on intellectual capital: past, present, future.

Traditional View Reactive and passive approach: IP assets enhance the company’s competitive advantage and strengthen its ability to defend its competitive position in the marketplace (IP as a barrier to entry and as a shield to protect market share)

Current View Proactive/systemic approach: IP assets should not be used merely for defensive purposes but should also be viewed as an important asset and profit center that is capable of being monetized and generating value through licensing fees and other channels and strategies, provided that time and resources are devoted to uncovering these opportunities, especially dormant IP assets, which do not currently serve at the heart of the company’s current core competencies or focus.

Future View Core focus/strategic approach: IP assets are the premiere drivers of business strategy within the company and encompass human capital, structural/organizational capital, and customer/relationship capital. Intellectual asset management systems need to be built and continuously improved to ensure that IP assets are used to protect and defend the company’s strategic position in domestic and global markets and to create new markets, distribution channels, and revenue streams in a capital-efficient manner to maximize shareholder value.

Intellectual asset management (IAM) is a system intended to create, organize, prioritize, and extract value from a set of intellectual property assets. The intellectual capital and technical know-how of a growing company are among its most valuable assets, provide its greatest competitive advantages, and are the principal drivers of shareholder value. Yet rarely do companies have adequate personnel, resources, and systems in place to properly manage and leverage these assets. IAM helps growing companies ensure that strategic growth opportunities are recognized, captured, and harvested into new revenue streams and markets.

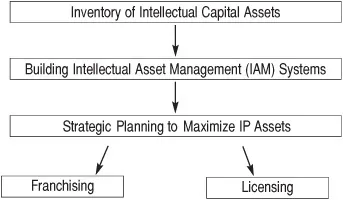

As demonstrated in Figure 1-2, the harvesting of intellectual capital is a strategic process that must begin with an inventory taken by the company’s management team and by qualified outside advisors in order to get a comprehensive handle on the scope, breadth, and depth of the company’s intangible assets. In these times of shareholder distrust of and disappointment in the management teams and boards of publicly held companies, corporate leaders owe it to shareholders to uncover hidden value and to make the most of the assets that have been developed with corporate resources. The leadership of the company will never know whether it has a “Picasso in the basement” unless it both (1) makes the time to take inventory of what’s hiding in the basement and (2) has a qualified intellectual capital inventory team that is capable of distinguishing between a Picasso and a child’s art project. Once these assets are properly identified, an intellectual asset management system should be developed to ensure open communication and strategic management of these assets. At that point, the company is ready to engage in the strategic planning process to determine how to convert these assets into profitable revenue streams and new opportunities, thereby enhancing and protecting shareholder value.

Figure 1-2. Harvesting IP.

A review of your current IAM practices includes an analysis of the following:

What

IAM systems, procedures, and teams are in place now?

How and when were these systems developed?

Who is responsible/accountable for managing these systems within the company?

To what degree are adequate systems for internal and external communication and collaboration currently in place?

What idea/technology harvesting filters are in place, as well as procedures for innovation decisional analysis (as to whether to move forward, prepare a budget, allocate resources, create a timetable, etc.)?

Are the strategy and process for harv...