Audrey N. Scarlata, Kelly L. Williams and Brandon Vagner

INTRODUCTION

The Securities and Exchange Commission (SEC) requires all public companies to report financial statements using eXtensible Business Reporting Language (XBRL). Financial statement data for large companies became available to the public in XBRL format starting in 2009 in the United States. The SEC claims that XBRL company filing data (which they refer to as “interactive data”) can improve the decision processes and decision quality of investors’ financial analysis in several ways:

- Interactive data can provide investors quicker access to the information they want in a form that’s easily used and can help companies prepare the information more quickly and more accurately.

- Using today’s disclosure documents, investors who seek specific information directly from the source must often manually search lengthy corporate annual reports or lengthy mutual fund documents. Even if these documents are online, they are often in a plain-text format with limited search capability. The need to search for and extract particular information in such documents can be time-consuming.

- Interactive data allow investors and others to pinpoint facts and figures within today’s often lengthy disclosure documents. Using interactive data, an investor can immediately pull out specific information and compare it to information from other companies, performance in past years, and industry averages […]. Meanwhile, for the financial professionals and financial publishers, analyzing companies could become cheaper and easier. Interactive data also may help filers improve their reporting processes. (SEC, 2010)

Achieving these goals is made possible by XBRL’s “instance document,” which describes each financial data element and contains references, called tags (Hannon & Gold, 2005). These tags act like information content and structure barcodes and allow for more searchable data and various presentation formats. XBRL is used in more than 60 countries (XBRL International, 2016). The increased use of XBRL-enabled financial statements and related technologies motivates this examination of the search-facilitating technologies (SFTs) that underlie XBRL and its potential impacts on end users.

Regulatory agency mandates partially motivate the increasing adoption of XBRL-based financial reports and XBRL-related technologies (Baldwin, Brown, & Trinkle, 2006). The internal adoption of XBRL was investigated by Henderson, Sheetz, and Trinkle (2012), who found that relative advantage, compatibility, and complexity positively influenced the adoption of XBRL. Thus, these factors motivate XBRL adoption by nonpublic organizations. While some evidence regarding XBRL use from an organizational standpoint has been generated, few studies test whether, or how, XBRL technology can improve decision-making, processes, and efficiency (Srivastava & Liu, 2012). We investigate these variables to increase awareness of the advantages XBRL can provide.

Accounting professionals and investors use other common methods (e.g., PDF (Portable Document Format), Microsoft Word) to view financial information if XBRL financial statements are not utilized. PDF information tags may include (but are not limited to) chapters, heading styles, blocks of text, tables, and graphics. Menus in PDF documents can be used to locate specific sections of financial statements. Though PDF documents are highly customizable, most commonly utilized PDF documents in their standard (i.e., static) form do not have the SFT that is standard with XBRL financial statements. Therefore, PDFs are hereafter referred to as “standard documents.” The focus is not on PDFs but on the XBRL alternative file formats, which are commonly downloaded as standard documents (i.e., without SFT). Furthermore, this study focuses on the effect of the different presentation formats afforded by XBRL’s SFT and alternative documents (e.g., PDF) rather than on the underlying tags or tagging processes behind these technologies.1

Research has shown that XBRL improves forecast accuracy (Liu, Wang, & Yao, 2014), financial statement transparency (Hodge, Kennedy, & Maines, 2004), and investment performance (Henderson, Huerta, & Glandon, 2015). However, little evidence has been offered on the actual effects of XBRL technology on financial statement analysis in the wake of expansive claims made for XBRL’s ability to enhance financial statement analysis (Logan & Knox, 2010). Accounting research can and should provide evidence useful for evaluating the claims of XBRL’s efficacy (Baldwin et al., 2006; Gunn, 2007; Srivastava & Liu, 2012), but only a few experimental studies have investigated the potential benefits of XBRL to financial statement users.

We propose that point-and-click filtering features with simultaneous financial statement section viewing capabilities (i.e., SFT attributes), such as those seen in XBRL-enhanced financial statements, improve the decision process (i.e., search strategy and effort), decision quality, and efficiency of novice financial statement users. We argue that novice financial statement users have the most to gain by using XBRL-enhanced financial statements due to their potential to level the playing field between novice users and more sophisticated users. Following prior XBRL behavioral research, we investigate the XBRL SFT attributes as opposed to XBRL itself. The increasing availability of XBRL financial reports motivates this investigation of proponents’ claim that XBRL technologies can be used to improve decision quality, information search, and, perhaps, even financial statement analysis (Securities and Exchange Commission [SEC], 2010; Srivastava & Liu, 2012; Vasarhelyi, Chan, & Krahel, 2012; XBRL International, 2010; XBRL US, 2008). One basis for this claim is that XBRL technologies, when integrated into well-designed financial displays, are “financial power drills” that help investors drill down into the core content of complex financial reports (Bonasia, 2007).

We use a theoretical perspective derived from cognitive cost-benefit (CCB) principles as a foundation for understanding the decision process and the resulting decision quality of financial statement users. A total of 102 student participants completed an investment task using either standard PDF-formatted financial statements or XBRL-enabled technology (i.e., SFT). This sample is larger than those used in previous behavioral studies (e.g., Dzuranin, 2006) on this issue. About one-half of participants in each technology condition received financial statement analysis training before completing the task. We implemented financial statement analysis training to half of the sample in order to study the interaction of knowledge and technology during the task. Measures of decision processes (search strategy, effort, and efficiency) and decision quality indicated that participants in the SFT (e.g., XBRL) condition used a search that was more directed, with lower effort and higher efficiency, than was that used by participants assigned to the non-SFT (e.g., PDF) condition.

The results suggest that XBRL-enabled technology may facilitate efficient data acquisition but that, without an expert investor schema (i.e., without knowing how to integrate the data acquired), investors are unlikely to reap decision benefits from this technology. These results provide insight into how using SFTs for financial statement analysis influences novice analysts’ cognitive processes. One important contribution of this study is that it clarifies for future research how and when SFT use (e.g., point-and-click search facilitating and simultaneous financial statement section viewing capabilities) may help or hinder novice decision-makers engaged in financial statement analysis. The next section describes the study’s theoretical bases and hypotheses.

THEORY AND HYPOTHESES

Cognitive Cost-Benefit and XBRL-relevant Research

The dramatic growth of academic and professional interest in XBRL reflects its expanded use and importance. Articles in peer-reviewed journals on XBRL had increased from just 18 in 2000 to over 1,700 by the end of 2017. Many published papers argue the economic and organizational benefits of XBRL (e.g., Arnold, Bedard, Phillips, & Sutton, 2012; Hodge et al., 2004). Across the literature, six interrelated claims persist. Financial statement analysis using XBRL-tagged data is said to be (1) faster, (2) cheaper, (3) easier to obtain and analyze, (4) more comparable across time points and organizations, (5) more transparent, and (6) able to generate higher-quality data. Some proponents also argue that the higher quality and superior structure of XBRL-enabled financial statements can improve financial analysis (XBRL International, 2010). We consider that a significant contributing factor to improved financial statement analysis is the combination of point-and-click filtering capabilities with simultaneous financial statement section viewing capabilities, both of which are SFT attributes of XBRL-enabled financial statements.

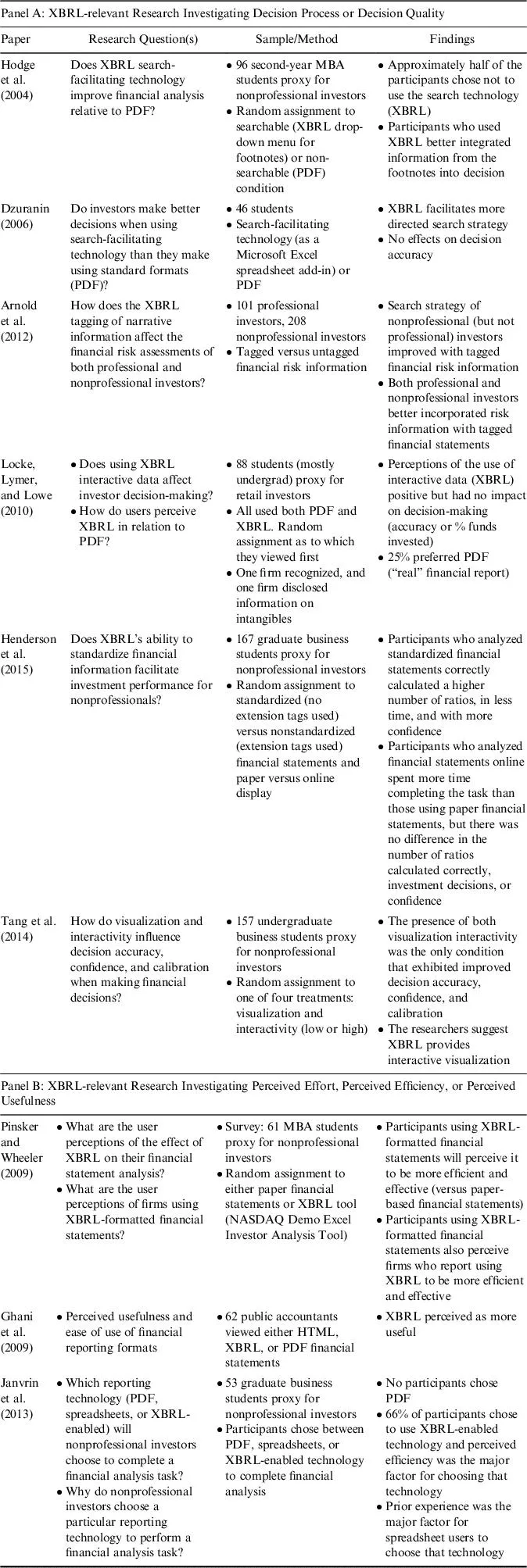

Does the combination of these two factors of XBRL-enabled financial statements improve financial statement decision quality and search strategy, and do they reduce effort and thereby improve efficiency? Table 1 summarizes the XBRL-relevant research. Panel A of Table 1 summarizes the XBRL-relevant research that investigates decision processes and decision quality. Panel B of Table 1 summarizes the XBRL-relevant research on perceptions of usefulness, effort, and efficiency. We take a closer look at these variables using a theoretical perspective derived from CCB principles, which provide a foundation for understanding decision strategies and decision-maker choices (Payne, Bettman, & Johnson, 1988, 1990, 1992, 1993).

Table 1.Summary of Previous Research.

CCB theory uses a model whereby decision-makers’ choices of strategies derive from their assessments of their relative efficacy. A two-dimensional model is proposed as follows:

(1) Dimension 1: the effort required to execute the strategy; and

(2) Dimension 2: the decision quality (i.e., accuracy) that will result from the chosen strategy.

The goal of the decision-maker’s choice of strategy is to minimize the cognitive effort required to achieve a minimally acceptable level of decision quality. The task, context, and display elements of the decision environment jointly influence the relative effort required by, and the resulting accuracy of, a strategy (Kleinmuntz & Schkade, 1993). Hence, one prediction gleaned from CCB principles is that information display elements (e.g., simultaneous financial statement viewing capabilities) directly affect decision strategies and subsequently decision quality.

The extant research provides evidence of the explanatory power and usefulness of CCB principles in predicting and explaining decision-aid use and effectiveness (Todd & Benbasat, 1991, 1992). These results suggest that “decision makers tend to adapt their strategy selection to the type of decision aids available in such a way as to reduce effort” (To...