![]()

CHAPTER 1

Some Basic Math

In this chapter we review three math topics—logarithms, combinatorics, and geometric series—and one financial topic, discount factors. Emphasis is given to the specific aspects of these topics that are most relevant to risk management.

LOGARITHMS

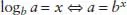

In mathematics, logarithms, or logs, are related to exponents, as follows:

We say, “The log of a, base b, equals x, which implies that a equals b to the x and vice versa.” If we take the log of the right-hand side of Equation 1.1 and use the identity from the left-hand side of the equation, we can show that:

(1.2) logb(bx) = logb a = x

logb(bx) = x

Taking the log of bx effectively cancels out the exponentiation, leaving us with x.

An important property of logarithms is that the logarithm of the product of two variables is equal to the sum of the logarithms of those two variables. For two variables, X and Y:

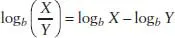

Similarly, the logarithm of the ratio of two variables is equal to the difference of their logarithms:

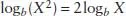

If we replace Y with X in Equation 1.3, we get:

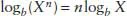

We can generalize this result to get the following power rule:

In general, the base of the logarithm, b, can have any value. Base 10 and base 2 are popular bases in certain fields, but in many fields, and especially in finance, e, Euler's number, is by far the most popular. Base e is so popular that mathematicians have given it its own name and notation. When the base of a logarithm is e, we refer to it as a natural logarithm. In formulas, we write:

From this point on, unless noted otherwise, assume that any mention of logarithms refers to natural logarithms.

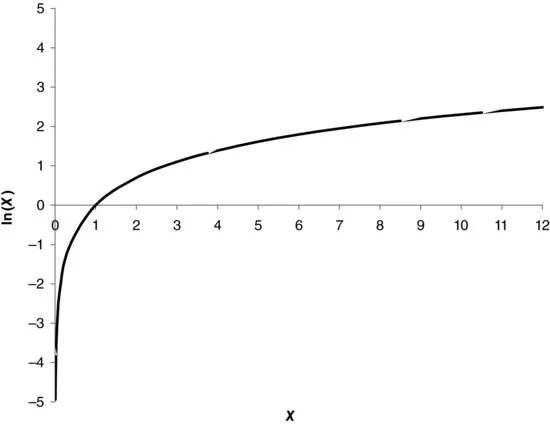

Logarithms are defined for all real numbers greater than or equal to zero. Exhibit 1.1 shows a plot of the logarithm function. The logarithm of zero is negative infinity, and the logarithm of one is zero. The function grows without bound; that is, as X approaches infinity, the ln(X) approaches infinity as well.

LOG RETURNS

One of the most common applications of logarithms in finance is computing log returns. Log returns are defined as follows:

(1.8) rt ≡ ln(1 +

Rt) where

Here rt is the log return at time t, Rt is the standard or simple return, and Pt is the price of the security at time t. We use this convention of capital R for simple returns and lowercase r for log returns throughout the rest of the book. This convention is popular, but by no means universal. Also, be careful: Despite the name, the log return is not the log of Rt, but the log of (1 + Rt).

For small values, log returns and simple returns will be very close in size. A simple return of 0% translates exactly to a log return of 0%. A simple return of 10% translates to a log return of 9.53%. That the values are so close is convenient for checking data and preventing operational errors. Exhibit 1.2 shows some additional simple returns along with their corresponding log returns.

To get a more precise estimate of the relationship between standard returns and log returns, we can use the following approximation:1

As long as R is small, the second term on the right-hand side of Equation 1.9 will be negligible, and the log return and the simple return will have very similar values.

COMPOUNDING

Log returns might seem more complex than simple returns, but they have a number of advantages over simple returns in financial applications. One of the most useful features of log returns has ...