People Risk Management

A Practical Approach to Managing the Human Factors That Could Harm Your Business

Keith Blacker, Patrick McConnell

- English

- ePUB (apto para móviles)

- Disponible en iOS y Android

People Risk Management

A Practical Approach to Managing the Human Factors That Could Harm Your Business

Keith Blacker, Patrick McConnell

Información del libro

People Risk Management provides unique depth to a topic that has garnered intense interest in recent years. Based on the latest thinking in corporate governance, behavioural economics, human resources and operational risk, people risk can be defined as the risk that people do not follow the organization's procedures, practices and/or rules, thus deviating from expected behaviour in a way that could damage the business's performance and reputation. From fraud to bad business decisions, illegal activity to lax corporate governance, people risk - often called conduct risk - presents a growing challenge in today's complex, dispersed business organizations. Framed by corporate events and challenges and including case studies from the LIBOR rate scandal, the BP oil spill, Lehman Brothers, Royal Bank of Scotland and Enron, People Risk Management provides best-practice guidance to managing risks associated with the behaviour of both employees and those outside a company. It offers practical tools, real-world examples, solutions and insights into how to implement an effective people risk management framework within an organization.

Preguntas frecuentes

Información

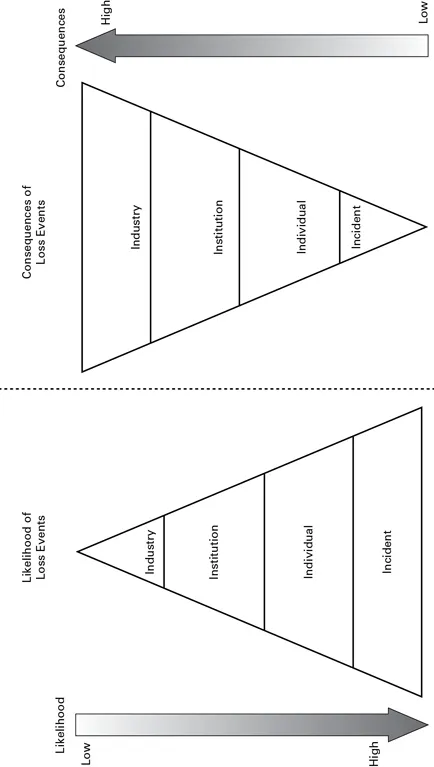

- People Risk events occur within organizations at multiple levels with varying likelihood of occurrence and unpredictable consequences when they do.

- People Risk events occur because of bad decisions arising from individual and group biases and conflicts of interest.

- People Risks are apparent at every level from a simple incident/accident to a whole industry.

- People use common rationalizations to explain their actions and mistakes.

| Case | Description | Losses | Rationalizations |

| INCIDENTS | |||

| HBOS – mistaken bank statement | Delivery of 75,000 statements | Reputation – embarrassment | Mistake – unknown operator |

| Air New Zealand – Flight 901 | Fatal air crash | 257 deaths | Miscommunication and lack of situational awareness |

| Medical fatality – Elaine Bromiley | Medical emergency | One death | Experts’ blind spots, and lack of situational awareness |

| INDIVIDUALS | |||

| Bank fraud – Ms Rajina Subramaniam | Fraud | AUD $40 million | Just Desserts – revenge for perceived abuse |

| Rogue trading – Barings, AIB, etc | Fraud | Various | Temporary Use – covering up for losses |

| Medical fatalities – Dr Harold Shipman | Patient murders | > 215 deaths | Unknown – possible addictive personality |

| Fraud – JPMorgan and Bernie Madoff | Failure to report fraud | US $2 billion fine | Distrust of Law |

| HBOS – banking fraud | Fraud | Unknown > £35 million | Economic Necessity, Just Desserts |

| Insider trading – Goldman Sachs | Fraud | £118 million | Distrust of Law and Victimless Crime |

| INSTITUTIONS | |||

| Royal Bank of Scotland | Strategic overreach | Acquired by UK Government | Ubiquity, Distrust of Law |

| Enron | Fraud – corporate | Bankruptcy | Distrust of Law, Victimless Crime |

| WorldCom | Fraud – corporate | Bankruptcy | Temporary Use, Distrust of Law |

| Washington Mutual | Bad lending | Bankruptcy | Ubiquity, Distrust of Law |

| HBOS | Bad lending | Acquired by Lloyds Bank | Ubiquity, Economic Necessity |

| Co-operative Bank | Strategic overreach | Acquired by Private Investors | Economic Necessity |

| JPMorgan – The Whale | Trading losses | US $6 billion | Economic Necessity, Distrust of Law |

| HSBC | Money laundering | US $1.9 billion fine | Ubiquity, Distrust of Law |

| Eli Lilly | Misselling drugs | US $1.4 billion fine | Distrust of Law, Victimless Crime |

| BAE Systems | Bribery | £280 million fine | Distrust of Law |

| Siemens AG | Bribery | US $1.3 billion fine | Distrust of Law |

| NHS – Mid Staffordshire | Excess deaths (unknown number) | Forced administration | Economic Necessity, Distrust of Law |

| RIM – Blackberry | Strategic overreach | Forced acquisition | Economic Necessity |

| Tesco plc | Strategic overreach | > £1 billion | Economic Necessity |

| Lehman Brothers | Strategic overreach | Bankruptcy | Economic Necessity, Ubiquity |

| BP – Gulf of Mexico oil spill | Death and pollution | US $4 billion ++ | Economic Necessity, Ubiquity, Distrust of Law |

| Fukushima nuclear plant | Nuclear accident | Unknown | Economic Necessity, Distrust of Law |

| INDUSTRY | |||

| Big Tobacco | Unsuitable products | Unknown | Ubiquity and Distrust of Law |

| New Zealand tax | Tax avoidance | NZ $2.5 billion | Ubiquity, Distrust of Law, Victimless Crime |

| PPI | Misselling products | £18 billion | Ubiquity, Distrust of Law, Victimless Crime |

| IRHP | Misselling products | £2.5 billion | Ubiquity Distrust of Law, Victimless Crime |

| Auto parts | Price fixing | US $2.5 billion fines | Ubiquity, Economic Necessity, Victimless Crime |

| LIBOR | Market manipulation | > US $4 billion fines | Ubiquity, Distrust of Law, Victimless Crime |

| Global Financial Crisis (GFC) | Misselling | US $6–14 trillion | Ubiquity, Distrust of Law, Victimless Crime |

- Incident: in every business situation there will be many incidents that, as Frank Bird and others showed, are mainly ‘near-misses’ but can sometimes produce losses, including fatalities.

- Individual: in every business there may be many individuals who may perpetrate a fraud or make a serious error, but in general, management and financial controls in an organization/system and follow-up prosecution will tend to minimize but, unfortunately, not eliminate resulting losses.

- Institution: most institutions/firms will make losses from time to time but every now and then an institution will fail with disastrous consequence for shareholders, as with Enron, and even for the global economy as in the case of Lehman Brothers.

- Industry: it is at the level of an industry that the consequences of People Risk can be greatest, such as, for example, the costs to the shareholders of banks as a result of the PPI scandal in the UK.