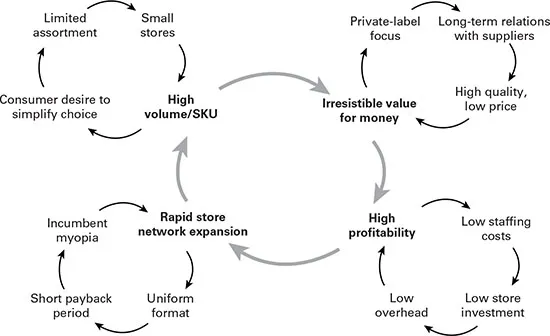

How are hard discounters able to grow so fast? How are they able to make money at such low price points? Why has it proven so difficult for conventional retailers to copy elements of their model to fight them off? To answer these questions, we must take a close look at the business model that powers the hard discounter format. While different hard discounters, of course, do not follow the exact same model, there are many similarities that are brought together in Figure 2.1. The core of the business model is the virtuous cycle, in which a high volume per stock keeping unit (SKU) leads to irresistible value for money for consumers. This contributes to high profitability that funds expansion of the store network, which further increases the volume per SKU, and so on. We take up each of these in turn.

We need to point out, though, that each of these four key success factors can only be in place because of specific and crucial enabling processes, which are also outlined in Figure 2.1. In our discussion of the key success factors, we will take a look at these enabling processes as well.

High volume per SKU

High volume per SKU is not feasible in a mainstream supermarket which carries 25,000–40,000 items. There is simply not enough consumer demand to achieve high sales volume for so many SKUs. The hard discounter solves this problem by limiting the number of SKUs offered to around 1,000–2,500 items. In each category, it carefully selects only the most popular flavours, package sizes, or other types of variety. This strategy leads to high volumes per item. We illustrate this for the Netherlands, where we compare Aldi with market leader Albert Heijn (Table 2.1).1 Aldi carries about 1,250 different items versus 27,500 items offered by Albert Heijn. Aldi generates revenues of €2.5 billion per year with 500 stores, while Albert Heijn generates €13 billion per year with 950 stores.

Table 2.1 Comparison of sales per SKU between Aldi and Albert Heijn in the Netherlands in 2016

| | Aldi | Albert Heijn |

Total revenues | €2.5 bn | €13 bn |

Market share | 7.0% | 35.2% |

Number of stores | 500 | 950 |

Number of SKUs | 1,250 | 27,500 |

Revenues per store | €5.0 mn | €13.7 mn |

Revenues per SKU | €2.0 mn | €0.5 mn |

Revenues per SKU per store | €4,000 | €500 |

SOURCE Based on 2017 research from EFMI Business School

At first sight, Albert Heijn outperforms Aldi almost by a factor of three when sales per store are compared: €13.7 million versus €5.0 million. But when we compare the sales per item, a totally different picture arises: Aldi sells €2 million per SKU per year versus €0.5 million for Albert Heijn. So, even with only one-fifth of the market share, Aldi’s revenue per SKU is four times that of Albert Heijn. And Albert Heijn is the market leader! The situation for other chains is even bleaker. If we further take into account that many Aldi items are sold in other countries, the factor of four can easily become a factor of 10 or more. That is one of the amazing effects of item rationalization.

But why would consumers patronize a store that limits their freedom of choice by more than 95 per cent? Because more choice is not always preferred by shoppers.

Consumer desire for choice simplicity

It is a common supposition in Western society that choice is good, and the more choice, the better. Economic theory dictates that the greater the number of options in a product category, the higher the likelihood that consumers can find a close match to their needs. This attracts a broader, more diverse set of people to the store, as they can be more confident that they can find a suitable item in that store, facilitating one-stop shopping. Economic theory further postulates that consumers derive utility from freedom of choice and enjoyment of exploration in the store. As it turns out, this is not necessarily the case.

In one famous study conducted in an upscale grocery store in Menlo Park, California, researchers showed that consumers were more likely to make a purchase when presented with an assortment comprising of six flavours of jam than with an assortment comprising of 24 flavours (all flavours were of the same brand).2 The difference was substantial: only 2 per cent of the consumers in the extensive-choice context made a purchase versus 12 per cent of the consumers in the limited-choice condition. This study is not an isolated instance. A stream of subsequent work has documented that consumers regularly experience choice overload, leading to less satisfaction, more post...