Retail Disruptors

The Spectacular Rise and Impact of the Hard Discounters

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Retail Disruptors

The Spectacular Rise and Impact of the Hard Discounters

About this book

The rise of hard discounters like Aldi and Lidl has been monumental. Explore the very real threat they pose to traditional retailers and brand manufacturers and what you can learn from their growth.

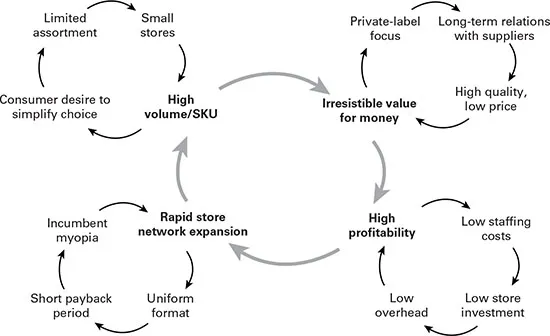

Hard discounters are stores that sell a limited selection of consumer-packaged goods and perishables - typically fewer than 2,000 Stock Keeping Units - for prices that are usually 50-60% lower than national brands. The best-known hard discounters are Aldi and Lidl, but global brands include Trader Joe's, EuroSpin, Biedronka, Netto and Leader Price. Their rise has been monumental; they have irrevocably changed the face of retail in Europe and Australia and are making steady inroads into the US.

Retail Disruptors is the first book that explores this upheaval, providing expert insight into the business models of the leading hard discounters, and what mainstream retailers and brand manufacturers can do to remain competitive in the face of disruption. Meticulously researched by two of the leading authorities in retail strategy, private labels, branding, and hard discounting, Retail Disruptors is essential reading for all brand manufacturers and retailers who want to retain the competitive edge.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

PART ONE

Hard discounter strategies

02

Understanding the hard discounter business model

High volume per SKU

| Aldi | Albert Heijn | |

Total revenues | €2.5 bn | €13 bn |

Market share | 7.0% | 35.2% |

Number of stores | 500 | 950 |

Number of SKUs | 1,250 | 27,500 |

Revenues per store | €5.0 mn | €13.7 mn |

Revenues per SKU | €2.0 mn | €0.5 mn |

Revenues per SKU per store | €4,000 | €500 |

Consumer desire for choice simplicity

Table of contents

- Cover

- Title Page

- Copyright

- Contents

- List of figures

- List of tables

- List of abbreviations

- About the authors

- Preface

- Acknowledgements

- 01 How hard discounters are disrupting the traditional retail model

- PART ONE Hard discounter strategies

- PART TWO Competitive counterstrategies for conventional retailers

- PART THREE Brand manufacturer strategies versus hard discounters

- Index

- Backcover