Airline Management Finance

The Essentials

Victor Hughes

- 132 páginas

- English

- ePUB (apto para móviles)

- Disponible en iOS y Android

Airline Management Finance

The Essentials

Victor Hughes

Información del libro

Airline Management Finance: The Essentials is of significant benefit to airline industry practitioners seeking a focused, neatly contained and accessible resource that provides explicit financial information pertinent to their current or future role.

The book explains and demystifies an airline's financing and the financial reporting of its operations to airline staff and others. It seeks to explain the role of finance and the Finance Department in a non-technical way, so staff can appreciate the value of the department and its information resources, and see finance as an active contributor to the airline's operation. It concentrates on practical matters, explaining frequently used financial and accounting terms, how financial strategy works, the uses of various types of financial reporting, as well as what financial risk is and how it can be managed through the co-operation of finance and operating staff. Staff who understand the airline's finances and financial system are more likely to make decisions which align with the airline's strategy and objectives. They will also know how to use the financial information which is available. The book establishes a good foundation of financial knowledge for all staff.

This book is recommended reading for new employees in airline finance and related areas, as well as those starting to move up the supervisory ladder in an airline.

Preguntas frecuentes

Información

1 The Finance Department

The role of the Finance Department

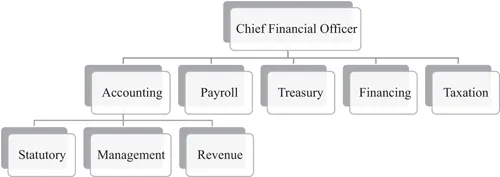

Organisation and responsibilities of a Finance Department

- Statutory Accounting: production of the financial reports required by law; these are discussed in Chapter 8. Included under this heading is the keeping of a record of all the airline’s tangible and intangible assets, the original cost, the cost of any additions or modifications, an estimate of the assets’ useful life in the airline and its overall useful life, together with a periodic assessment of the current value and some means of identification. The estimates and assessments should be reviewed regularly.

- Management Accounting: producing reports for the airline’s management, budgets, forecasts and actual results; this is the area where most operating staff have contact with the department and are most likely to use the information provided.

- Revenue Accounting: recording the airline’s actual revenue; this work can be quite simple or very complex depending on the airline’s business model. The simplest records are for an airline that only operates within one country:

- with all its tickets sold on its own website

- passengers paying in advance

- does not make refunds if tickets are not used

- its tickets are only to be used on its own flights.

In this case, the records only need to identify the passenger, the flight and the amount paid. The amount received in advance will be recorded in an account named something like ‘Unearned Transportation Revenue’. When the passenger travels, the amount received from the passenger will be transferred from the ‘Unearned Transportation Revenue’ account to the airline’s ‘Profit and Loss’ account as revenue.

Generally, the more options and services an airline offers, the more complicated the revenue records become; if, for example, in addition to the services offered in the example above, the airline:- sells its tickets through its own offices, travel agencies in different countries, as well as through its own website

- issues tickets which may include flights on other airlines

- accepts another airline’s tickets on its flights

- permits refunds of unused tickets

- offers packages which include a flight and hotel stay, with or without tours.

- Payroll: calculating and arranging payment of staff salaries; frequently this section is located in a separate area due to privacy concerns.

- Treasury: managing and forecasting the ‘cash-flow’, which is the money received and paid out. This is an important area because the company is required to be ‘solvent’; that is, able to pay its debts when they become due. Managing an airline’s cash-flow is an important topic involving many operations, including such matters as investing surplus funds overnight and, in the longer term, also handling the airline’s foreign currency position. This is discussed in Chapter 6.

- Financing: managing the airline’s financial position; that is, its borrowings and financial risks. These are discussed in detail in Chapter 4.

- Taxation, preparing all ‘tax returns’, i.e., the calculation of any taxes due to be paid or refunded; an airline’s tax position can be complicated if taxes are payable in many countries. The airline’s foreign tax position in a foreign country may be simplified if a Treaty for the Avoidance of Double Taxation, often referred to as ‘Double Tax Treaty/Agreement’ or ‘DTA’ exists between the two countries, but all foreign taxes need to be monitored.

Location of the finance staff

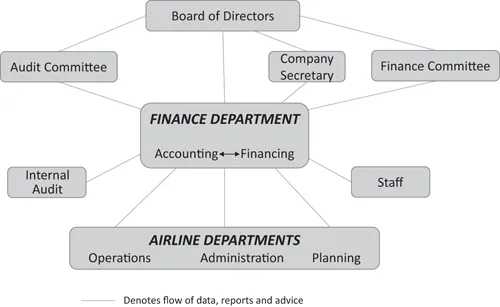

Operating structure

Audit Committee

- Establish that the company’s accounting policies are appropriate; these will be discussed in Chapter 8.

- Ensure the company’s financial reporting is complete and complies with current ‘Reporting Standards’; these are national (or international) accounting and reporting standards applicable to all companies.

- Monitor the airline’s ‘internal controls’, which are the systems designed to prevent fraud.

- Ensure compliance with the airline’s financial policies (e.g., regarding the treatment of Debtors and Creditors).

- Identify and monitor the ways the airline’s risks are managed.

- Choose and monitor the performance of the ‘External Auditors’, who are independent accountants employed to review and confirm the accuracy of the airline’s ‘Statutory Reports’ (i.e., the reports required by law; these are further discussed in Chapter 8).

- Monitor the performance, work plan and reports of the airline’s ‘Internal Audit Department’; this is a separate department responsible for checking the accuracy and efficiency of the company’s systems.