A Practical Guide to Financial Services

Knowledge, Opportunities and Inclusion

Lien Luu, Jonquil Lowe, Patrick Ring, Amandeep Sahota, Lien Luu, Jonquil Lowe, Patrick Ring, Amandeep Sahota

- 308 páginas

- English

- ePUB (apto para móviles)

- Disponible en iOS y Android

A Practical Guide to Financial Services

Knowledge, Opportunities and Inclusion

Lien Luu, Jonquil Lowe, Patrick Ring, Amandeep Sahota, Lien Luu, Jonquil Lowe, Patrick Ring, Amandeep Sahota

Información del libro

Financial services are an ever increasing part of the infrastructure of everyday life. From banking to credit, insurance to investment and mortgages to advice, we all consume financial services, and many millions globally work in the sector. Moreover, the way we consume them is changing with the growing dominance of fintech and Big Data. Yet, the part of financial services that we engage with as consumers is just the tip of a vast network of markets, institutions and regulators – and fraudsters too.

Many books about financial services are designed to serve corporate finance education, focusing on capital structures, maximising shareholder value, regulatory compliance and other business-oriented topics. A Practical Guide to Financial Services: Knowledge, Opportunities and Inclusion is different: it swings the perspective towards the end-user, the customer, the essential but often overlooked participant without whom retail financial services markets would not exist. While still introducing all the key areas of financial services, it explores how the sector serves or sometimes fails to serve consumers, why consumers need protection in some areas and what form that protection takes, and how consumers can best navigate the risks and uncertainties that are inherent in financial products and services.

For consumers, a greater understanding of how the financial system works is a prerequisite of ensuring that the system works for their benefit. For students of financial services – those aspiring to or those already working in the sector – understanding the consumer perspective is an essential part of becoming an effective, holistically informed and ethical member of the financial services community. A Practical Guide to Financial Services: Knowledge, Opportunities and Inclusion will equip you for both these roles.

The editors and authors of A Practical Guide to Financial Services: Knowledge, Opportunities and Inclusion combine a wealth of financial services, educational and consumer-oriented practitioner experience.

Preguntas frecuentes

Información

1 Overview of financial services

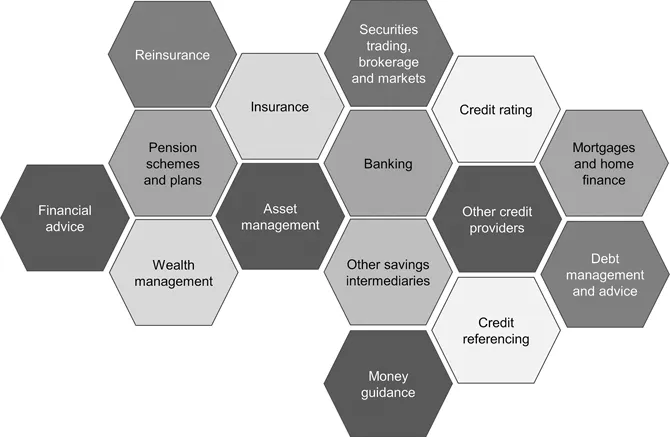

- ‘Financial services’ is an umbrella term for a wide range of different products and services, including day-to-day money management, saving and borrowing, insurance and investing for the future.

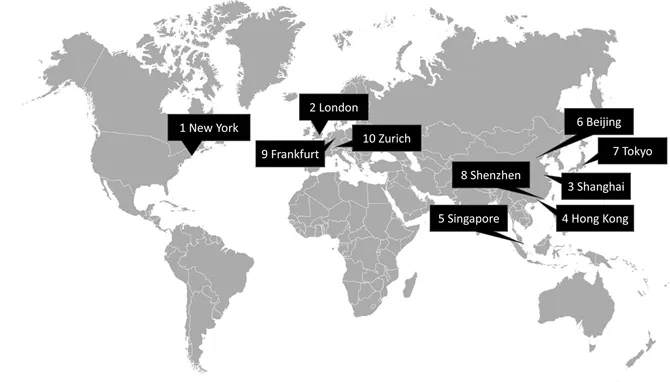

- Globally financial services have been growing and are concentrated in geographical centres, including, for example, New York, London and several Asian cities.

- This development of financial services markets may contribute to economic growth and shapes the way that individuals and households manage their financial affairs.

- The nature and level of household engagement with financial services is also shaped by major contextual factors, such as income growth and distribution, migration, ageing populations and climate change.

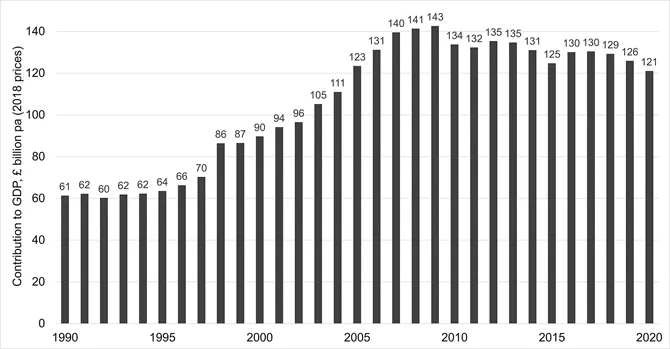

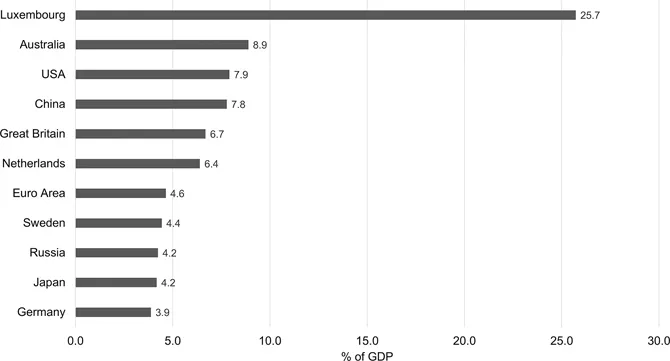

- Appreciate the scale of financial services both globally and in the UK.

- Understand key events that have shaped the current financial services system.

- Begin to see the implications of the financial system for the well-being of individuals and households and how they manage their financial affairs.

1.1 The financial services sector

1.1.1 The size of the financial sector

1.1.2 Why financial services matter to consumers

1.2 Growth and deregulation