![]()

The Current Tax System and Its Problems

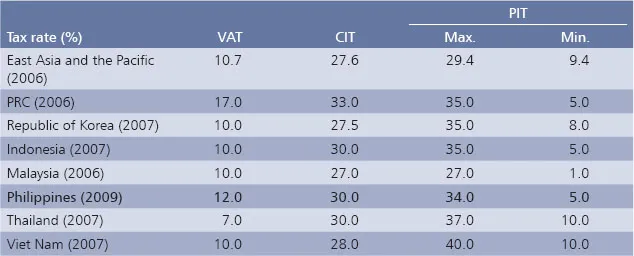

In the Philippines, VAT, CIT, and personal income tax (PIT), make up over two thirds of total tax revenues. Although the statutory tax rates applied in the country are higher than those of its neighboring countries, the revenues generated as a share of GDP are not proportionally higher compared to those of its neighboring countries. Although the share of indirect taxes (VAT, excise taxes, customs duties, etc.) has been decreasing, indirect taxes still account for 58% of total tax revenues in 2009. This suggests that the country’s overall tax system is relatively regressive compared to that in the other countries in the Asia and Pacific region. In theory, fairness of a tax system must be checked in the context of the progressivity of public spending. Even if revenues are raised in a regressive manner, the overall impacts of the tax system can be progressive if the authorities spend its resources more for the poor. However, given the limited spending on education and health and weak targeting of poverty programs4 in the Philippines, the country’s tax system cannot be progressive even after taking into account the expenditure pattern. The fiscal system has not helped distribute income more equitably.5

Several business surveys show that a high tax rate is one of the barriers to doing business in the country. However, the current CIT rate of 30%, having dropped from the previous 35% in 2009, is comparable with the rate of the neighboring countries (Table 1).6 PIT rates, both the maximum (34%) and the minimum (5%), are also comparable with those of the other countries. In the Philippines, the VAT was introduced in 1998 with a single rate (10%) and a reasonable exemption threshold. The VAT base was then broadened to cover services in 2004 and petroleum products and electricity in 2005. With the VAT reform in 2005 (RA 9337,7 known as the reformed VAT law), the VAT rate was increased to 12%, the highest in the Asia and Pacific region. With the rate increase, the VAT-to-GDP ratio rose from 1.65% in 2004 to 2.18% in 2007.

Table 1 Tax Rates in Selected Countries

CIT = corporate income tax, PIT = personal income tax, PRC = People’s Republic of China, VAT = value-added tax.

Source: World Bank, World Development Indicators.

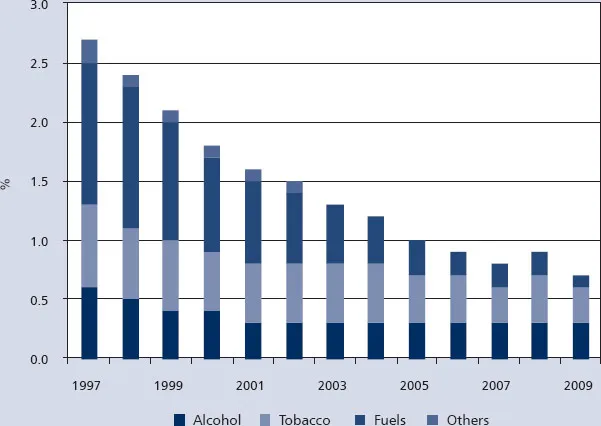

Excise taxes are levied on tobacco, alcoholic products, and petroleum products. Currently, a grave concern is the dramatic decline of the excise taxes. From 1997 to 2009, excise taxes as a share of GDP decreased by 1.8 percentage points (Figure 5). In 1996, the authorities shifted the excise tax from an ad-valorem to a complicated multitiered unit tax rate, and did not allow for inflation adjustment. The authorities, with the RA 9334 approved in 2004, planned discrete increases in the tax rate on tobacco and alcoholic products beginning 2005 and every other year until 2011.8 The reformed VAT law in 2005 incorporated a number of mitigating measures, including reducing the selected petroleum excises (Table 2) and import tariff of petroleum products from 5% to 3%.

Table 2 Philippines: Excise Taxes on Petroleum Products (Peso/liter)

| Item | Before the 2005 reform | After the 2005 reform |

| Gasoline (regular) | 4.80 | 4.35 |

| Kerosene | 0.60 | 0.00 |

| Diesel | 1.63 | 0.00 |

| Bunker fuel | 0.30 | 0.00 |

Source: The Philipp...