Tax Reforms toward Fiscal Consolidation

Policy Options for the Government of the Philippines

- 20 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Tax Reforms toward Fiscal Consolidation

Policy Options for the Government of the Philippines

About this book

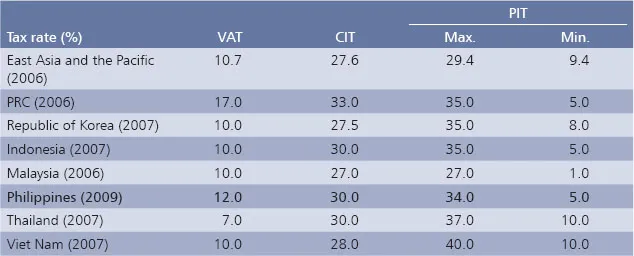

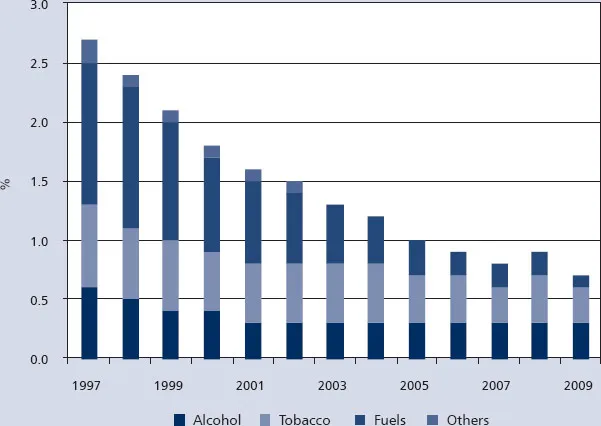

This policy note assesses tax administration measures and tax rate adjustments, two options for the Philippines' fiscal consolidation in terms of their efficiency for revenue mobilization and impacts on tax equity. Its key findings are: 1) a policy mix of a higher value-added tax and a lower corporate income tax will make the overall tax system more regressive, even if its impact on tax revenue is neutral; 2) the country's tax productivity is much lower than those of its peers in the region, which signals the presence of significant tax loopholes and weak tax administration; and, 3) there is ample room to increase excise taxes on tobacco, alcoholic products, and gasoline, without ruining the equity of the tax system. These suggest that tax administration remains a key focus of efforts for the new administration.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

The Current Tax System and Its Problems

| Item | Before the 2005 reform | After the 2005 reform |

| Gasoline (regular) | 4.80 | 4.35 |

| Kerosene | 0.60 | 0.00 |

| Diesel | 1.63 | 0.00 |

| Bunker fuel | 0.30 | 0.00 |

Table of contents

- Front Cover

- Title Page

- Copyright Page

- Contents

- List of Tables and Figures

- Abbreviations

- Summary

- Where Are We?

- Two Policy Options

- The Current Tax System and Its Problems

- Assessment of the Two Options

- Tax Administration Reforms

- Back Cover