M&A Information Technology Best Practices

Janice M. Roehl-Anderson

- English

- ePUB (adapté aux mobiles)

- Disponible sur iOS et Android

M&A Information Technology Best Practices

Janice M. Roehl-Anderson

À propos de ce livre

Add value to your organization via the mergers & acquisitions IT function

As part of Deloitte Consulting, one of the largest mergers and acquisitions (M&A) consulting practice in the world, author Janice Roehl-Anderson reveals in M&A Information Technology Best Practices how companies can effectively and efficiently address the IT aspects of mergers, acquisitions, and divestitures. Filled with best practices for implementing and maintaining systems, this book helps financial and technology executives in every field to add value to their mergers, acquisitions, and/or divestitures via the IT function.

- Features a companion website containing checklists and templates

- Includes chapters written by Deloitte Consulting senior personnel

- Outlines best practices with pragmatic insights and proactive strategies

Many M&As fail to meet their expectations. Be prepared to succeed with the thorough and proven guidance found in M&A Information Technology Best Practices. This one-stop resource allows participants in these deals to better understand the implications of what they need to do and how

Foire aux questions

Informations

PART I

Introduction

Chapter 1

Introduction to the IT Aspects of Mergers, Acquisitions, and Divestitures

Role of IT in M&A

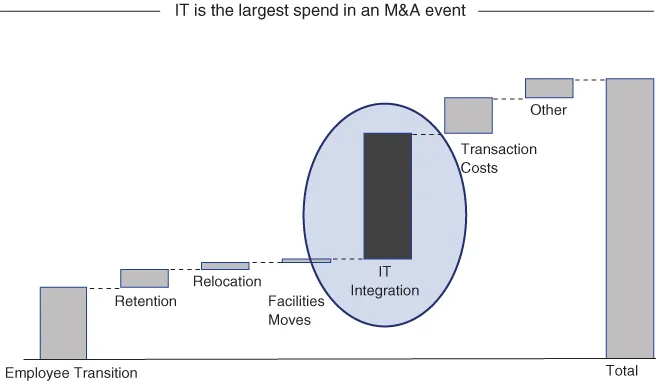

- Unexpected integration/divestiture costs. IT-related activities are generally the largest cost items in a merger or divestiture. However, because IT is a secondary focus in most deals, the magnitude, complexity, and cost of these activities are often significantly underestimated.

- Long delays in capturing benefits. Many M&A deals expect significant synergies from economies of scale, cross-selling, consolidation of business back-office operations, and legacy system retirement. All of these synergies have one thing in common—they require major IT changes. Yet many companies put off developing an IT integration strategy and detailed IT plans until the deal is essentially closed. This delayed IT involvement can put IT in a reactive mode and make it virtually impossible for companies to achieve their aggressive goals.

- Temporary IT solutions that are expensive, risky, and wasteful. Because of the long lead times associated with IT, many companies are forced to develop and implement transition services agreements (TSAs) in order to close deals on schedule. While in some circumstances TSAs will be unavoidable, these short-term solutions for IT systems and business processes can be difficult and expensive to set up and can also increase security risks. To the extent IT has visibility early in the cycle, appropriate alternatives can be planned and developed so that TSAs are less comprehensive and complex in nature.

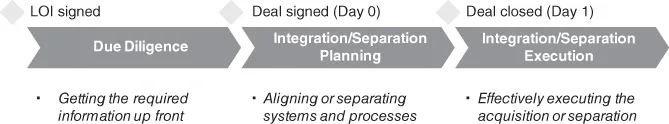

- LOI (letter of intent) signed. Period of exclusivity; due diligence initiated.

- Deal signed/announced (Day 0). Period to obtain regulatory and shareholder approvals; integration/separation planning initiated.

- Deal closed (Day 1). Financial close of the transaction; integration/separation execution.

Due Diligence

Key Considerations for IT Due Diligence

| People, Process, and Spending | Applications | Infrastructure |

|

|

|

- Assign senior IT executives to help with IT due diligence. Make the seniormost member (CIO or designee) the key member in the IT due diligence team and involve the IT function in all phases of the M&A lifecycle, from preliminary due diligence to Day 1 and beyond until all key synergies have been captured.

- Team IT with business. For smooth functioning of M&A deals and to operate the program effectively, staff people from IT and from business areas to jointly drive planning and execution. This encourages collaboration and teamwork between IT and the business/functional areas, which is an effective strategy to foster a strong working relationship and sense of ownership.

- Identify IT requirements before you sign the deal. Insist the team identify IT investments that will be needed to achieve the expected short- and long-term benefits. Technology-related synergies often occur over multiple years. Also, it is essential to develop order-of-magnitude estimates for these critical IT projects to validate the magnitude and timing of the expected benefits.

- Make IT costs and timing part of deal valuation. Make IT investments a mandatory part of your valuation model, and include estimated costs for IT projects that are required for capturing the expected short- and long-term business synergies, as well as costs for software licensing and TSAs.

- Get a head start on IT projects.“Clean teams” are groups of specialists who are given special access to restricted information before the deal is complete. They can provide an early start on time-critical IT activities. For example, clean teams can be used to compare business and data models, assess the impact of the deal on the company's future IT landscape, and conduct detailed scoping and planning.

- Get your priorities straight. Every deal has an impact on IT, and it is essential to immediately inventory and assess IT projects (even those not directly related to the deal) to verify that they are still required and align with the company's future direction. Priority should be given to IT projects that (1) link to critical Day 1 requirements, (2) enable or accelerate large synergy opportunities, or (3) are essential to implementing the company's future strategic initiatives.

- Keep the pressure on. An effective Day 1 is o...