eBook - ePub

World Economic Outlook, May 1991

International Monetary Fund. Research Dept.

This is a test

- English

- ePUB (adapté aux mobiles)

- Disponible sur iOS et Android

eBook - ePub

World Economic Outlook, May 1991

International Monetary Fund. Research Dept.

Détails du livre

Aperçu du livre

Table des matières

Citations

À propos de ce livre

NONE

Foire aux questions

Comment puis-je résilier mon abonnement ?

Il vous suffit de vous rendre dans la section compte dans paramètres et de cliquer sur « Résilier l’abonnement ». C’est aussi simple que cela ! Une fois que vous aurez résilié votre abonnement, il restera actif pour le reste de la période pour laquelle vous avez payé. Découvrez-en plus ici.

Puis-je / comment puis-je télécharger des livres ?

Pour le moment, tous nos livres en format ePub adaptés aux mobiles peuvent être téléchargés via l’application. La plupart de nos PDF sont également disponibles en téléchargement et les autres seront téléchargeables très prochainement. Découvrez-en plus ici.

Quelle est la différence entre les formules tarifaires ?

Les deux abonnements vous donnent un accès complet à la bibliothèque et à toutes les fonctionnalités de Perlego. Les seules différences sont les tarifs ainsi que la période d’abonnement : avec l’abonnement annuel, vous économiserez environ 30 % par rapport à 12 mois d’abonnement mensuel.

Qu’est-ce que Perlego ?

Nous sommes un service d’abonnement à des ouvrages universitaires en ligne, où vous pouvez accéder à toute une bibliothèque pour un prix inférieur à celui d’un seul livre par mois. Avec plus d’un million de livres sur plus de 1 000 sujets, nous avons ce qu’il vous faut ! Découvrez-en plus ici.

Prenez-vous en charge la synthèse vocale ?

Recherchez le symbole Écouter sur votre prochain livre pour voir si vous pouvez l’écouter. L’outil Écouter lit le texte à haute voix pour vous, en surlignant le passage qui est en cours de lecture. Vous pouvez le mettre sur pause, l’accélérer ou le ralentir. Découvrez-en plus ici.

Est-ce que World Economic Outlook, May 1991 est un PDF/ePUB en ligne ?

Oui, vous pouvez accéder à World Economic Outlook, May 1991 par International Monetary Fund. Research Dept. en format PDF et/ou ePUB. Nous disposons de plus d’un million d’ouvrages à découvrir dans notre catalogue.

Informations

Éditeur

INTERNATIONAL MONETARY FUNDAnnée

1991ISBN

9781451945010

Chapter I. Current Developments and Short-Term Prospects

Over the past year the world economy has been buffeted by a series of shocks: the conflict in the Middle East which brought about a sharp rise, and then an equally sharp drop in the price of oil; uncertainties about the likelihood, and later the likely duration and intensity, of military operations in that region; the difficulties associated with the early stages of restructuring in Eastern Europe and unification in Germany; and pervasive uncertainty with regard to the future course of economic policy in the U.S.S.R. On balance, the impact of these developments was to further weaken the world economy at a time when growth was already slowing in a number of large industrial economies. However, the drop in oil prices and the end of the war in the Middle East have helped to boost confidence and to enhance the prospects for stronger growth. And over the longer term German unification and reform in Eastern Europe and the U.S.S.R. could lead to a large improvement of economic conditions in those countries, with favorable repercussions for other countries.

Global Overview

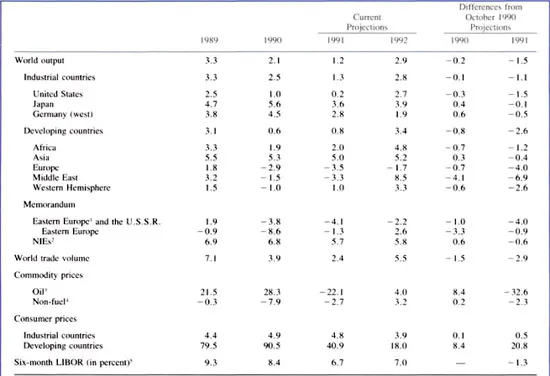

World economic growth is estimated to have slowed from 3¼ percent in 1989 to 2 percent in 1990 reflecting a slowdown in the industrial countries and a fall in economic activity in the developing country regions of Europe, the Middle East, and the Western Hemisphere (Table 1). Owing to continued recession in some industrial countries in early 1991 and to substantial declines in output in the Middle East and in Eastern Europe and the U.S.S.R., world growth is expected to slow further to 1¼ percent in 1991. With recovery in several major industrial countries expected to begin in the course of 1991, and assuming the successful implementation of stabilization policies and structural reforms in a number of developing countries, world growth would rebound to 3 percent in 1992. These developments in global activity would be reflected in the growth of world trade which is projected to fall from 7 percent in 1989 to 2½ percent in 1991, the slowest rate of expansion since 1985, before rising to 5½ percent in 1992.

Table 1. Overview of the World Economic Outlook

(Annual changes in percent, unless otherwise noted)

Note: Real effective exchange rates are assumed to remain constant at their March 1991 levels except for the bilateral rates among the ERM currencies which are assumed to remain constant in nominal terms. This implies almost no change in the U.S. dollar in 1991 relative to the assumption underlying the October 1990 World Economic Outlook. Bulgaria, the Czech and Slovak Federal Republic, and the U.S.S.R. are now included in the developing countries of Europe, whereas in previous World Economic Outlook reports these countries were in a group denoted “other countries.” The comparisons with the October 1990 projections in the final two columns are based on the new classification.

1 Eastern Europe is defined to include Bulgaria, the Czech and Slovak Federal Republic, Hungary, Poland, Romania, and Yugoslavia.

2 The Newly Industrializing Asian Economies (NIEs) include Hong Kong, Korea, Singapore, and Taiwan Province of China.

3 Simple average of the U.S. dollar spot price of U.K. Brent, Dubai, and Alaska North Slope crude oil; assumptions for 1991 and 1992.

4 In U.S. dollars based on world trade weights.

5 London Interbank Offer Rate on six-month U.S. dollar deposits; assumptions for 1991 and I992.

The near-term prospects for global economic growth have clearly deteriorated since the October 1990 World Economic Outlook. The projection for world growth in 1991 has been revised downward substantially, with weaker growth expected in both the industrial countries (especially in the United States, the United Kingdom, and Canada) and the developing countries (including particularly large downward revisions for Europe, the Middle East, and the Western Hemisphere). The outlook has deteriorated sharply in the countries directly affected by the war in the Middle East and in a number of developing countries that previously received substantial export earnings or workers’ remittances from Kuwait or Iraq.

Prospects for inflation in the industrial countries also have worsened: there were upward revisions for 1991 in all the major economies, reflecting in part the passthrough of the temporary increase in oil prices, with a particularly large revision for Japan. In the developing countries, the projection for inflation in 1991 has been revised upward, but a large decline in the average rate of inflation is still expected from 1990 to 1991.

The more pronounced cyclical divergences among the three largest industrial countries are expected to contribute to a greater narrowing of current account imbalances in the United States and Germany than was envisaged in October. Excluding the one-time effect in 1991 of the official transfers associated with the war in the Middle East, the external deficit of the United States, which was previously projected to widen by $3 billion from 1990 to 1991, is now expected to narrow by $15 billion in 1991. On the same basis, Germany’s current account surplus in 1991 is now expected to be $22 billion smaller than previously projected reflecting, in addition to the factors noted above, the surge in imports associated with unification. In Japan, the current account surplus in 1991 was projected in October to widen by about $8 billion; excluding the one-time effect of the official transfers, the current account surplus is now expected to widen by about $14 billion in 1991, reflecting mainly the lower oil prices assumed for this year.

The economic effects of the crisis in the Middle East—including the rise in oil prices and the impact of heightened uncertainty on consumer and business confidence—may have pushed the U.S. economy from a slow growth path into recession. For a number of reasons, however, the current recession in the United States is likely to have a small impact on growth in the rest of the world compared with the downturns in 1973–74 and 1981–82. First, the U.S. recession is expected to be relatively shallow and short, in part reflecting the comparatively low inflation and the absence of large inventory imbalances. Second, the U.S. share in total world output has declined, while the shares of Japan, west Germany, and the newly industrializing economies of Asia, where growth remains robust, have increased. Third, prior to the two previous recessions there had been a sharp rise in U.S. interest rates that was rapidly transmitted to other countries and was followed by a more or less synchronized slowing of growth; in contrast, U.S. interest rates have been declining for more than a year while most foreign interest rates had been rising until recently. As a result of the different relative cyclical positions, U.S. net imports fell sharply in each of the last two downturns, reducing GNP in the rest of the world by roughly 1 percent; by contrast, U.S. net imports already had been declining for the past two years and the further decline projected for 1991 is expected to have only a limited impact on growth in partner countries.

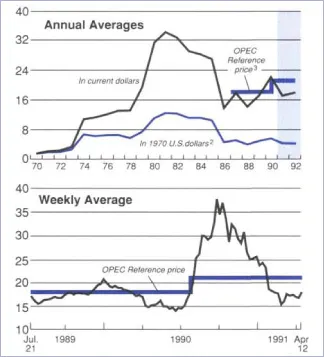

The level and volatility of oil prices increased sharply after the invasion of Kuwait by Iraq on August 2, 1990. From an average of about $16 per barrel in July, the average petroleum spot price (APSP) rose to nearly $40 per barrel for a brief period in September, declined during the remainder of the year, and then plunged by about $10 per barrel shortly after the outbreak of war in mid-January 1991 (Chart 1).1 The projections presented in this report are based in part on the pattern of futures prices in late March 1991 which implied a further decline in oil prices during the course of the year. In terms of annual averages, the price of oil is assumed to be $17.18 per barrel in 1991, about $5 per barrel less than in 1990 and 25 percent below what had been assumed in the October World Economic Outlook for 1991. In 1992, the price is assumed to be $17.87 per barrel, or 17 percent lower than assumed in October.2

Chart 1. Average Petroleum Spot Price1

(U.S. dollars per barrel)

1 The average petroleum spot price (APSP) is defined as the equally weighted average of the spot prices of U.K. Brent (light), Dubai (medium), and Alaska North Slope (heavy). The shaded area indicates staff assumptions.

2 The real price of oil is calculated as the nominal price deflated by the export price of manufactures of industrial countries.

3 The OPEC reference price of $18 a barrel was effective from February 1, 1987 to July 27, 1990 when it was raised to $21. The reference price refers to the unweighted average of the official export prices of seven crude oils.

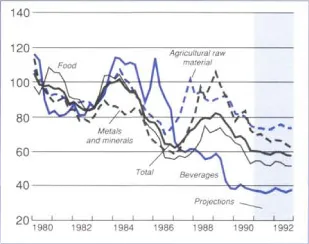

The slowdown in growth in the industrial countries has contributed to the recent declines in nominal and real non-fuel commodity prices (Chart 2). In 1991 and 1992, prices for metals and minerals are projected to decline further in real terms, while the real prices of food, beverages, and agricultural raw materials are expected to remain broadly stable. The terms of trade for the non-fuel exporting developing countries, which declined by an estimated 3 percent in 1990, are expected to rise by ¼ of 1 percent both in 1991 and in 1992.

Chart 2. Real Non-Fuel Commodity Prices1

(1980 = 100)

1 Calculated as the nominal prices deflated by the export price of manufactures of industrial countries. The total is based on world trade weights.

Recent financial market developments have reflected the diverging patterns of growth in the major industrial countries as well as the course of events in the Middle East. Since September 1990, short-term interest rates have fallen markedly in North America and the United Kingdom, and have eased somewhat in France and Japan. Short-term rates increased in Germany and Italy through the end of 1990, but have recently declined somewhat. In all the major industrial countries, long-term interest rates rose in the wake of the invasion of Kuwait by Iraq, but from late September they fell in all countries except Italy before firming when hostilities ended in late February. Equity markets declined during August and September; they generally recovered in the last two months of 1990 and rose sharply following the start of hostilities in mid-January. By mid-April, equity prices in North America and the United Kingdom had recovered to, or exceeded, their pre-invasion levels.

In foreign exchange markets, the U.S. dollar depreciated against most major currencies between August and November 1990—a continuation of the trend that began in mid-1989—in part reflecting different cyclical developments and the associated changes in interest differentials. The dollar subsequently fluctuated within a fairly narrow range, and then weakened in early February following interest rate declines in the United States before recovering sharply after the end of combat in the Middle East. By mid-April, the dollar had regained about three-fifths of its decline from mid-1989 through mid-February 1991. The projections presented in this report are based on the technical assumption that real effective exchange rates will remain unchanged from their March 1991 levels, except for the bilateral rates between the currencies participating in the exchange rate mechanism (ERM) of the European Monetary System (E...

Table des matières

Normes de citation pour World Economic Outlook, May 1991

APA 6 Citation

Dept., I. M. Fund. R. (1991). World Economic Outlook, May 1991 ([edition unavailable]). INTERNATIONAL MONETARY FUND. Retrieved from https://www.perlego.com/book/1667144/world-economic-outlook-may-1991-pdf (Original work published 1991)

Chicago Citation

Dept., International Monetary Fund. Research. (1991) 1991. World Economic Outlook, May 1991. [Edition unavailable]. INTERNATIONAL MONETARY FUND. https://www.perlego.com/book/1667144/world-economic-outlook-may-1991-pdf.

Harvard Citation

Dept., I. M. Fund. R. (1991) World Economic Outlook, May 1991. [edition unavailable]. INTERNATIONAL MONETARY FUND. Available at: https://www.perlego.com/book/1667144/world-economic-outlook-may-1991-pdf (Accessed: 14 October 2022).

MLA 7 Citation

Dept., International Monetary Fund. Research. World Economic Outlook, May 1991. [edition unavailable]. INTERNATIONAL MONETARY FUND, 1991. Web. 14 Oct. 2022.