eBook - ePub

International Trade and Economic Growth (Collected Works of Harry Johnson)

Studies in Pure Theory

Harry G. Johnson

This is a test

Partager le livre

- 208 pages

- English

- ePUB (adapté aux mobiles)

- Disponible sur iOS et Android

eBook - ePub

International Trade and Economic Growth (Collected Works of Harry Johnson)

Studies in Pure Theory

Harry G. Johnson

Détails du livre

Aperçu du livre

Table des matières

Citations

À propos de ce livre

The studies collected in this volume embody the results of research conducted in the mid 1950s into various theoretical problems in international economics. They fall into three groups – comparative cost theory, trade and growth and balance of payments theory. This volume consolidates the work of previous theorists and applies mathematically-based logical analysis to theoretical problems of economic policy.

Foire aux questions

Comment puis-je résilier mon abonnement ?

Il vous suffit de vous rendre dans la section compte dans paramètres et de cliquer sur « Résilier l’abonnement ». C’est aussi simple que cela ! Une fois que vous aurez résilié votre abonnement, il restera actif pour le reste de la période pour laquelle vous avez payé. Découvrez-en plus ici.

Puis-je / comment puis-je télécharger des livres ?

Pour le moment, tous nos livres en format ePub adaptés aux mobiles peuvent être téléchargés via l’application. La plupart de nos PDF sont également disponibles en téléchargement et les autres seront téléchargeables très prochainement. Découvrez-en plus ici.

Quelle est la différence entre les formules tarifaires ?

Les deux abonnements vous donnent un accès complet à la bibliothèque et à toutes les fonctionnalités de Perlego. Les seules différences sont les tarifs ainsi que la période d’abonnement : avec l’abonnement annuel, vous économiserez environ 30 % par rapport à 12 mois d’abonnement mensuel.

Qu’est-ce que Perlego ?

Nous sommes un service d’abonnement à des ouvrages universitaires en ligne, où vous pouvez accéder à toute une bibliothèque pour un prix inférieur à celui d’un seul livre par mois. Avec plus d’un million de livres sur plus de 1 000 sujets, nous avons ce qu’il vous faut ! Découvrez-en plus ici.

Prenez-vous en charge la synthèse vocale ?

Recherchez le symbole Écouter sur votre prochain livre pour voir si vous pouvez l’écouter. L’outil Écouter lit le texte à haute voix pour vous, en surlignant le passage qui est en cours de lecture. Vous pouvez le mettre sur pause, l’accélérer ou le ralentir. Découvrez-en plus ici.

Est-ce que International Trade and Economic Growth (Collected Works of Harry Johnson) est un PDF/ePUB en ligne ?

Oui, vous pouvez accéder à International Trade and Economic Growth (Collected Works of Harry Johnson) par Harry G. Johnson en format PDF et/ou ePUB ainsi qu’à d’autres livres populaires dans Volkswirtschaftslehre et Wirtschaftstheorie. Nous disposons de plus d’un million d’ouvrages à découvrir dans notre catalogue.

Informations

PART ONE

COMPARATIVE COST THEORY

CHAPTER I

Factor Endowments, International Trade and Factor Prices*

IN the past few years, there has been a revival of interest in the Heckscher-Ohlin model of international trade, and a closer scrutiny of two propositions associated with its analysis of the principle of comparative costs.1 The first is that the cause of international trade is to be found largely in differences between the factor-endowments of different countries; the second that the effect of international trade is to tend to equalize factor prices as between countries, thus serving to some extent as a substitute for mobility of factors. The result, very briefly, has been to show that neither proposition is generally true, the validity of both depending on certain factual assumptions about either the nature of technology or the range of variation of factor endowments which are additional to, and much more restrictive than, the assumptions of the Heckscher-Ohlin model itself.

My purpose here is to survey the related problems of the relation between factor-endowment and international trade and the effect of trade on relative factor prices, with the aim of clarifying the nature and simplifying the explanation of some of the results of recent theoretical research. The main instrument employed to this end is a diagrammatic representation of the technological side of the economy, developed from one originated by Mr R. F. Harrod.2

In common with other models of international trade, it is assumed, on the consumption side, that tastes and the distribution of the means of satisfying wants (property ownership, or claims on the social dividend) are given; and that, on the production side, technology and the supply of factors of production in each country are given (the latter implying that factors are immobile between countries). Production functions and factors are assumed to be identical in all countries; the outputs of goods are assumed to depend only on inputs of factors into the production processes for those goods, and factors are assumed to be indifferent between uses. Further, production is assumed to be subject to constant returns to scale, so that the marginal productivities of factors depend only on the ratios in which they are used. Finally, perfect competition and the absence of trade barriers (tariffs and transport costs) are assumed. The argument is simplified still further by assuming, initially, the existence of only two countries, I and II, two goods, X and Y, and two factors of production, labour and capital,3 the available quantities of the factors being given independently of their prices.

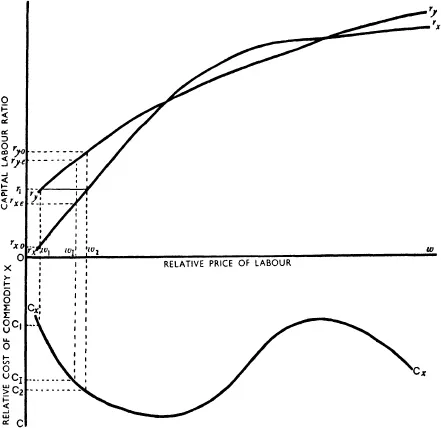

The given technical possibilities of production, summarized in the production functions, imply a definite relationship between the optimum capital: labour ratios in the two industries, relative factor prices, and relative costs of production of commodities. This relationship is represented in Fig. 1. For any given relative price of labour in terms of capital (such as wI) there will be an optimum ratio of capital to labour in the production of each good (rx.e in X and ry.e in Y) which equates marginal productivities to factor prices, and a relative cost of X in terms of Y (cI) which embodies the ratio of their costs of production at the given factor prices with the associated capital: labour ratios.

An increase in the relative price of labour above the given level will make it profitable to substitute capital for labour in both industries, thus raising the optimum capital: labour ratio in both;4 it will also increase the relative cost of the labour-intensive good (X in the neighbourhood of wI), since its costs will be raised more than those of the capital-intensive good by the increase in the relative price of labour.5 Further increases in the relative price of labour will continue to raise the optimum capital: labour ratio in both industries; but either one of two possibilities may be the effect on the relative cost ratio, depending on the relative ease of substituting capital for labour in the two lines of production. The first, and simpler, occurs when one commodity remains labour-intensive and the other capital-intensive, whatever the relative factor price. In this case, one commodity can be definitely identified as labour-intensive and the other as capital-intensive; and the relative cost of the labour-intensive good will continue to rise as the relative price of labour rises, so that the latter can be deduced from the former. The second occurs when, owing to greater facility in substituting capital for labour in the initially labour-intensive good, the difference in capital-intensity between the two goods narrows and eventually reverses itself, so that the labour-intensive good becomes capital-intensive and vice versa; such a reversal of factor-intensities may occur more than once (as illustrated in Fig. 1), as variation in relative factor prices induces variation in the capital-intensity of production of both goods. In this case, a commodity can only be identified as labour-intensive or capital-intensive with reference to a range of relative factor-prices or (what is the same thing) a range of capital-intensities; and the relative cost of a commodity will alternately rise and fall as the relative price of labour rises, as that commodity varies from being labour-intensive to being capital-intensive. Consequently more than one factor price ratio may correspond to a given commodity cost ratio, and the factor price ratio cannot be deduced from the commodity cost ratio alone. The distinction between the two cases, which turns on the facts of technology, is fundamental to what follows.

FIG. 1

The analysis so far has been concerned with the relationships implicit in the given technological possibilities of production. But only a limited range of the techniques available can actually be used efficiently by a particular economy with a given factor endowment; and the possible range of relative factor prices and relative commodity costs is correspondingly limited. The factor endowment of the economy sets an overall capital: labour ratio, to which the capital: labour ratios in the two industries, weighted by the proportions of the total labour force employed, must average out. At the extremes, the economy’s resources may be used entirely in the capital-intensive industry or entirely in the labour-intensive industry; and the relative prices of factors, and the relative costs of commodities, must lie within the limits set by these two extremes.6

The restrictions imposed by the factor endowment on the techniques the economy can employ and on the possible variation of factor prices and relative costs of production are illustrated in Fig. 1, where rI represents the economy’s overall capital: labour ratio. If all resources are used in the production of Y, the relative price of labour will be w1, if all are used in the production of X the relative labour price will be w2; the corresponding relative costs of commodity X are c1 and c2. As w rises from w1 to w2, the capital: labour ratio in Y rises from rI to ry.o and the ratio in X from rx.o to rI; the increases in these ratios are reconciled with the constancy of the overall capital: labour ratio by a shifting of resources from production of Y to production of X, which frees the capital required for the increases in the ratios. It can easily be shown that, for any relative factor price, the proportions of the total labour supply employed in one of the industries is equal to the ratio of th...