![]()

A Nation in Debt

How Can We

Pay the Bills?

IT IS NOT UNUSUAL—and not necessarily a problem—for a government to have at least some debt. But how much is too much? Many Americans think the US national debt is too large and want to try to get it under control.

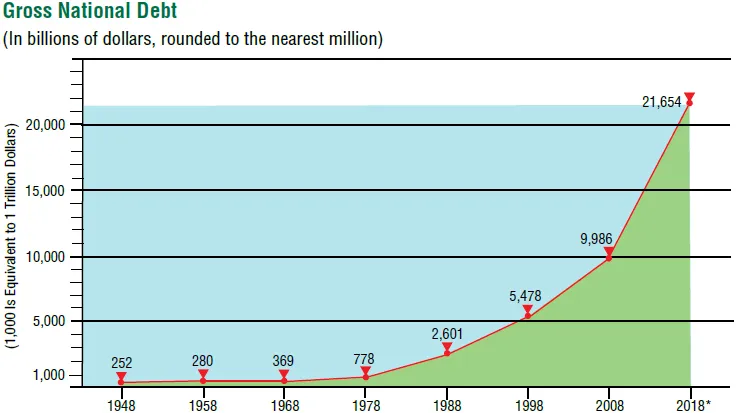

How large is the national debt?

By the end of fiscal year 2018, the US government owed around $21.7 trillion in gross federal debt ($15.8 trillion in public debt and $5.9 trillion in intragovernmental debt—money that is owed by one part of the government to another part). It was $10 trillion just ten years ago and is projected to rise to $34 trillion in another decade.

What’s the difference between the national debt and the national deficit?

National deficit and national debt are not the same. When our government spends more than it earns in taxes during a year, the shortfall is referred to as the deficit. Most years, the US government runs a deficit. In 2015, the deficit was $438 billion; in 2016, it had risen to $585 billion, and in 2018, the deficit reached $779 billion.

When there is a deficit, the country must borrow money to make up the difference, adding to the national debt.

How does the US government borrow money?

The US cannot just take out a bank loan when it needs to borrow money. Instead, it issues Treasury bonds—basically IOUs that are purchased by individuals, organizations, and other governments. When these bonds mature, the government pays back the money plus interest. US bonds are considered extremely safe investments and will continue to be—as long as investors believe there is no way the US government would default and fail to pay them back.

Just about anyone who wants to can buy Treasury bonds, so US debt is held by people and companies around the world. Currently, 43 percent of the US public debt is held by foreign investors, including about $2.2 trillion held by China and Japan. This means that nearly half of the interest payments on Treasury bonds is leaving the country.

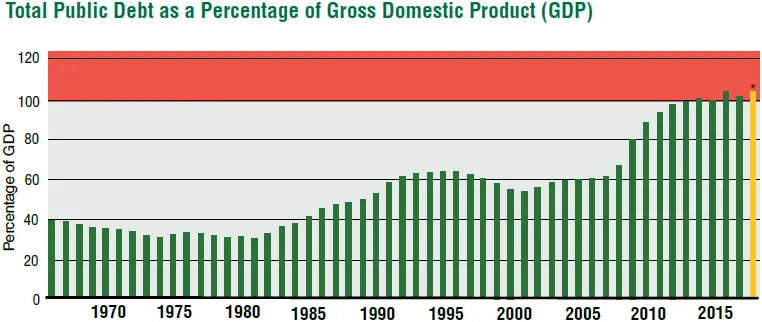

How much debt is too much?

A common way of measuring the size of a country’s indebtedness is to compare the amount of its public debt to the size of its entire economy, or Gross Domestic Product (GDP). As of late 2017, US debt held by the public was 76 percent of GDP. According to the US Government Accounting Office (GAO), the country’s debt-to-GDP ratio may exceed its historical high of 106 percent in as few as 14 years—a path the GAO calls “unsustainable.”

When individuals or families get into too much debt, their credit rating suffers and creditors may charge them higher interest rates or refuse to lend them any more money at all. In 2011, something similar happened to the United States when the Standard and Poor’s bond-rating agency downgraded the US credit rating for the first time in history. While this downgrade was serious, it did not trigger any interest-rate spikes, and demand for federal bonds remained high.

Various solutions to the debt problem have been suggested, but most don’t consider the sheer size of the debt we are talking about. Even if we eliminate the federal departments of education, agriculture, energy, transportation, health and human services, and housing and urban development, we would save only about six percent of the total discretionary portion of the federal budget. While six percent might sound like a lot, it would account for less than half of the current yearly deficit.

There are many reasons why the US has accumulated public debt over time, including:

■The country spent money fighting abroad or providing new benefits without raising taxes to cover the cost;

■Tax cuts were implemented without cutting expenditures to match;

■Fewer people were working and paying taxes during recessions;

■The government cut taxes or passed “stimulus” programs to prevent a recession from becoming a depression (an approach that worked well in the past);

■Rising health-care costs added to government spending on Medicare, Medicaid, and veterans’ programs.

A Framework for Deliberation

This issue book asks: What should we do to shrink the national debt? In addressing it, we have many things to consider and weigh. This guide lays out three ways of approaching the national debt. Some deal with reducing the debt more directly, while others would increase the debt in the short term with no long-term guarantee that the national debt would be reduced. Each suggests actions that we might take, but every action has trade-offs we should consider.

By working through each option, we can come to our own individual and collective decisions about what we would support and under what conditions.

![]()

Option 1:

Agree to

Limits

ACCORDING TO THIS OPTION, in order to do the responsible thing and avoid passing the burden of a crippling debt on to the next generation, we have to act now in a spirit of compromise and make the vital choices—including both raising taxes and cutting spending—that are our only ways of solving this urgent problem.

According to this option, the national debt has become too large because we are too complacent abou...