eBook - ePub

The Corporate Executive's Guide to General Investing

Paul Mladjenovic

This is a test

Partager le livre

- 150 pages

- English

- ePUB (adapté aux mobiles)

- Disponible sur iOS et Android

eBook - ePub

The Corporate Executive's Guide to General Investing

Paul Mladjenovic

Détails du livre

Aperçu du livre

Table des matières

Citations

Foire aux questions

Comment puis-je résilier mon abonnement ?

Il vous suffit de vous rendre dans la section compte dans paramètres et de cliquer sur « Résilier l’abonnement ». C’est aussi simple que cela ! Une fois que vous aurez résilié votre abonnement, il restera actif pour le reste de la période pour laquelle vous avez payé. Découvrez-en plus ici.

Puis-je / comment puis-je télécharger des livres ?

Pour le moment, tous nos livres en format ePub adaptés aux mobiles peuvent être téléchargés via l’application. La plupart de nos PDF sont également disponibles en téléchargement et les autres seront téléchargeables très prochainement. Découvrez-en plus ici.

Quelle est la différence entre les formules tarifaires ?

Les deux abonnements vous donnent un accès complet à la bibliothèque et à toutes les fonctionnalités de Perlego. Les seules différences sont les tarifs ainsi que la période d’abonnement : avec l’abonnement annuel, vous économiserez environ 30 % par rapport à 12 mois d’abonnement mensuel.

Qu’est-ce que Perlego ?

Nous sommes un service d’abonnement à des ouvrages universitaires en ligne, où vous pouvez accéder à toute une bibliothèque pour un prix inférieur à celui d’un seul livre par mois. Avec plus d’un million de livres sur plus de 1 000 sujets, nous avons ce qu’il vous faut ! Découvrez-en plus ici.

Prenez-vous en charge la synthèse vocale ?

Recherchez le symbole Écouter sur votre prochain livre pour voir si vous pouvez l’écouter. L’outil Écouter lit le texte à haute voix pour vous, en surlignant le passage qui est en cours de lecture. Vous pouvez le mettre sur pause, l’accélérer ou le ralentir. Découvrez-en plus ici.

Est-ce que The Corporate Executive's Guide to General Investing est un PDF/ePUB en ligne ?

Oui, vous pouvez accéder à The Corporate Executive's Guide to General Investing par Paul Mladjenovic en format PDF et/ou ePUB ainsi qu’à d’autres livres populaires dans Commerce et Trading. Nous disposons de plus d’un million d’ouvrages à découvrir dans notre catalogue.

Informations

CHAPTER 1

Your Starting Point … Plus Assumptions

Whether you are starting in your corporate executive position today as a junior, middle-level executive in a mid-sized firm or you are a C-level executive in a large, public firm, you can reach your financial objectives by maximizing the wealth you can accumulate through both your salary and your investment-related fringe benefits (such as stock options and 401k plan).

Your Action Plan Blueprint

The essence of building wealth during your career is a simple premise that has been tweaked and modified a thousand times by all sorts of advisers and financial consultants … and here it is:

1. Inflow: Earn your money … find ways to increase it.

2. Outflow: Spend less than you make … find ways to decrease it.

3. Invest the difference. Repeat regularly until you reach your target amount for financial independence.

4. Maximize all your financial resources (greater income, 401k, etc.) to accelerate your journey to your target amount.

Yes … the approach is simple … but it’s not easy. However, over a span of 20 to 40 years, very doable! Do this approach year in and year out and by the end of your working career it could be a seven-figure nest egg for a middle-class earner … or an eight-figure sum for the industrious upper-income corporate executive.

You have heard it all before: “If you fail to plan … then you plan to fail.” The corporate job you have may give you some great perks now and some great income but to what extent will it be maximizing your career resources? Because the corporate executive is in a position to make an income that is significantly higher than the average worker, I think it’s an important task for you to do the most simplest goal of all: coming up with the one number that if your assets grow to that point you will be financially self-sufficient or independent or at the point where you don’t need to work that hard anymore.

From Focusing on Growth to Focusing on Income

Consider this an addendum to the overall action blueprint. It was about the “how” in terms of your overall approach, but this section accentuates the “what” involved in the approach. During your working years, the investments inside your various accounts should generally be focused on growth. Growth-oriented investments include

• Stocks (covered in Chapter 3)

• Exchange-traded funds (Chapter 4)

• Mutual funds (Chapter 5)

• Real estate (Chapter 6)

• Alternative assets (Chapter 7)

Later on and especially in your retirement years, the focus switches to income. Income-oriented investments include

• Bonds (covered in Chapter 8)

• Dividend stocks and other income strategies (Chapter 9)

• Real-estate income strategies (Chapter 6)

The Executive’s Starting Point (Homework!)

Before you begin your journey to your financial independence target amount, like any journey, you need to know your starting point and the optimal path to your destination. Here is where your corporate skills will benefit you personally. It’s time to create two important documents:

1. Personal balance sheet. What are your total assets, your total liabilities, and your net worth? The investable net worth is your starting point. This is what should be on the growth path to hit your retirement target.

2. Personal cash flow statement. From your total inflow (e.g., wages or net business income) less your outflow (expenses, debt payments, etc.) to figure out what you can comfortably invest as part of your accumulation and growth toward your personal target amount. Update this document regularly to know how much you can comfortably set aside for investing.

In terms of the amount(s) to invest, this includes what you can sock away not only in pretax, tax-advantaged accounts (401k, traditional IRAs, etc.) but also in after-tax vehicles (regular accounts, etc.). How much should you seek to invest? As much as possible. The real question is: How quickly do you want to reach a target amount that symbolizes your financial freedom?

The whole point of long-term investing is to build your wealth to the point where your wealth’s potential cash flow (dividends, interest, etc.) makes work an option and not a necessity. Work is great … but it should be something you enjoy and something that eventually becomes optional. The ultimate question when discussing your financial independence (such as a secure retirement) is that you woke up that morning and said to yourself: “What do I feel like doing today?” That is the essence of financial freedom in a single question. This is the essence of what I communicate in my retirement planning seminars and webinars. (For the reader’s benefit, I include a link to a free retirement planning webinar in the resources listed at the end of this chapter.)

The Maximized 401k and Roth IRA Approach

Say you don’t have a specific target amount for retirement, but you were specific in how much you plan to commit to your goal of financial freedom, how would that work out? Keep in mind that for higher-income folks, there may be limits to how much you can sock away so check with your tax adviser with your personal contribution limits. Regardless, I will assume relatively modest contributions for typical corporate compensation scenarios. Contributing a total of $20,000 in pretax accounts such as through some combination of a 401k plan and a Roth IRA, for example, is easily doable. If you did $20,000 per year for at least 30 years (averaging 10 percent total reinvested annual growth), how would you fare? If you were to plug in those numbers at financial websites that offer investment calculators (such as Bankrate.com and smartassets.com), that approach would accumulate over $3.6 million before factoring other variables such as tax rates and inflation, which can be hard to forecast decades in advance. The bottom line for you is that, in this example, $3.6 million, if invested in a portfolio of income securities yielding at least 3 percent, would earn you over $100,000 per year without touching the principal. But let’s say that you will need $140,000 per year, how long would that $3.6 million last … again, presuming it is only yielding 3 percent?

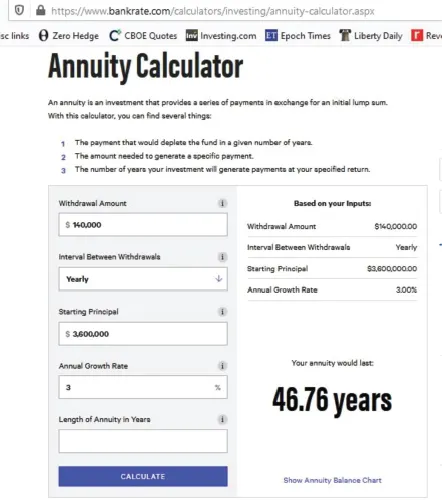

In this case you would use an annuity calculator. Figure 1.1 is Bankrate’s annuity calculator (found at www.bankrate.com/calculators/investing/annuity-calculator.aspx).

Plugging in your available numbers for our example and clicking on “Length of Annuity in years” gave the answer “46.76 years,” which sounds comforting to me. Say you changed the yield from 3 percent to 3.5 percent … how long would your money last? In this case, that relatively modest increase of a half (0.5) percent extended the shelf life of that investment total to 59.21 years … nice!

Of course, you have the power to change the above for a more favorable result. What if, instead of socking away $20,000 annually for 30 years, it was 35 or 40 years? What if instead of $20,000 per year … you did $25,000 … or $30,000 … or more?

On the income side, what if you did better than 3 or 3.5 percent? How about 4 or 5 percent or better? What if you augmented your income strategy by writing call and put options which have the potential to increase the yield from your portfolio by an additional 3 or 5 or even 8 to 10 percent per year? What if you decreased your outflow (expenses and debt payments) by moving from a high-tax, high-cost state to a low-tax, low-cost state? Some of the best action ideas can start with “what if” questions.

Figure 1.1 Bankrate calculator

I know one corporate executive that decided to maximize her 401k. She aggressively apportioned her salary so that the full 401k contribution allowable by law was immediately invested in the early part of the year to the point that her net pay (after all deductions including the 401k allotment) was less than $100! She wanted to reach the full 401k amount as early in the year as possible to take full advantage of time for the benefit of compounded growth. She could’ve spaced out the contribution more evenly throughout the year but she took very seriously the idea of time in her wealth-building approach. And yes … she hit her target sooner than planned. So how badly do you want to hit your financial target(s)?

Crash Course Retirement Plan—The 5 to 10 Percent Assumption

Because we are planning for a future scenario, you can’t avoid the fact that you must make assumptions. For my crash course on retirement planning, I do two assumptions: I assume 5 percent income potential (or yield) and I assume 10 percent growth. Why?

First off, both numbers are easy “back of the napkin” calculations for anyone and these ballpark assumptions are close enough, given market experiences going back decades. There have been stocks and ETFs I (or my students and clients) acquired years ago that had a dividend yield of 3 or 3.5 percent that today are yielding much higher than 5 percent. And the 10 percent growth? If you talk to a group of market analysts, you will hear that the market averaged annual growth of 8 to 11 percent in spite of what seems like a roller-coaster ride spanning decades. Additionally, successful long-term growth of 10 percent or better can be achieved not only based on what you invest in, but how. Dividend-paying stocks with dividend reinvestment plans (see Chapter 3 for details) and the investor’s approach of “total reinvestment” can achieve the desired annual growth. In addition, most mutual funds (both growth oriented and income oriented) give you the ability to totally reinvest all dividends, interest, and capital gain distributions, which greatly enhance your annual growth above the nominal appreciation of merely own stocks and funds. And the “total reinvestment” approach is what anyone would do if they were serious about long-term wealth building.

The Four Retirement Scenarios and Your Response

Scenario A

Say, for example, that you expect to need $100,000 per year in retirement to have a comfortable retirement and, second, let’s say that at the time of your retirement you’re able to have a yield of 5 percent or greater from your ass...