eBook - ePub

International Trade Theory

Murray Kemp

This is a test

Partager le livre

- 240 pages

- English

- ePUB (adapté aux mobiles)

- Disponible sur iOS et Android

eBook - ePub

International Trade Theory

Murray Kemp

Détails du livre

Aperçu du livre

Table des matières

Citations

À propos de ce livre

Murray C. Kemp is one of Australia's foremost economists. He has held positions across the world including London School of Economics, U.C. Berkeley, Columbia University, McGill University, MIT, and latterly Macquarie University. Kemp was a Member of Council for the Econometric Society and was a Distinguished Fellow of the Economics

Foire aux questions

Comment puis-je résilier mon abonnement ?

Il vous suffit de vous rendre dans la section compte dans paramètres et de cliquer sur « Résilier l’abonnement ». C’est aussi simple que cela ! Une fois que vous aurez résilié votre abonnement, il restera actif pour le reste de la période pour laquelle vous avez payé. Découvrez-en plus ici.

Puis-je / comment puis-je télécharger des livres ?

Pour le moment, tous nos livres en format ePub adaptés aux mobiles peuvent être téléchargés via l’application. La plupart de nos PDF sont également disponibles en téléchargement et les autres seront téléchargeables très prochainement. Découvrez-en plus ici.

Quelle est la différence entre les formules tarifaires ?

Les deux abonnements vous donnent un accès complet à la bibliothèque et à toutes les fonctionnalités de Perlego. Les seules différences sont les tarifs ainsi que la période d’abonnement : avec l’abonnement annuel, vous économiserez environ 30 % par rapport à 12 mois d’abonnement mensuel.

Qu’est-ce que Perlego ?

Nous sommes un service d’abonnement à des ouvrages universitaires en ligne, où vous pouvez accéder à toute une bibliothèque pour un prix inférieur à celui d’un seul livre par mois. Avec plus d’un million de livres sur plus de 1 000 sujets, nous avons ce qu’il vous faut ! Découvrez-en plus ici.

Prenez-vous en charge la synthèse vocale ?

Recherchez le symbole Écouter sur votre prochain livre pour voir si vous pouvez l’écouter. L’outil Écouter lit le texte à haute voix pour vous, en surlignant le passage qui est en cours de lecture. Vous pouvez le mettre sur pause, l’accélérer ou le ralentir. Découvrez-en plus ici.

Est-ce que International Trade Theory est un PDF/ePUB en ligne ?

Oui, vous pouvez accéder à International Trade Theory par Murray Kemp en format PDF et/ou ePUB ainsi qu’à d’autres livres populaires dans Business et Business generale. Nous disposons de plus d’un million d’ouvrages à découvrir dans notre catalogue.

Informations

Part I

The classical theory of international trade

1

The Torrens-Ricardo Principle of Comparative Advantage

An extension

1.1 Introduction

Nearly two hundred years on, the Torrens-Ricardo Principle of Comparative Advantage is still widely admired within the profession, and appears prominently in many elementary textbooks and in most treatises on international trade. However, careful inspection of the Principle, either in the mildly disparate formulations of Torrens (1815:264–5) and Ricardo (1817:135) or in any later formulation, reveals that it relies on restrictive assumptions about preferences and technology in each trading country, assumptions that are always implicit, never explicit. Specifically, the Principle rests on the assumption that in autarkic equilibrium each country consumes all commodities, at least incipiently. Our purpose is to make good this claim and to reformulate the Principle in sufficient generality to accommodate alternative assumptions about preferences and technology. In our reformulation the emphasis is on marginal rates of substitution in consumption, not on the traditional ratios of marginal labour costs in production. Thus our restatement concerns not merely the proper display of the Torrens-Ricardo Principle but rather its essential content. It is shown in effect that, in existing formulations, the supply side is assigned a role that it cannot always sustain. That two classical economists overlooked this point can be understood, but the same indulgence cannot be extended to the authors of neo-classical textbooks.1

1.2 The standard formulation

In the usual textbook formulation, two countries, England and Portugal, produce, consume and trade two commodities, cloth and wine; there are no non-tradable commodities. Each commodity is produced by means of a single primary factor, homogeneous labour, under constant returns to scale. Within each country, but not necessarily across countries, all households are identical in all respects: size, age distribution, preferences, quality of labour and access to technical information.2

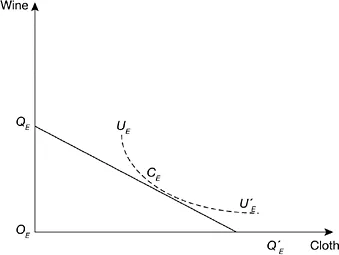

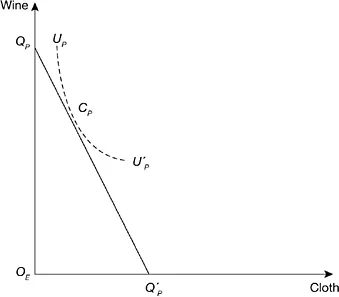

For England, the household and (by revision of quantity units) the economy-wide production possibility locus is represented in Figure 1.1(a) by the straight segment QEQ′E, the slope of which is (minus) the ratio of the two marginal labour costs of production. In the absence of market distortions, a unique autarkic equilibrium is represented by point CE, where a community indifference curve forms a tangent to the production possibility locus and where, for each commodity, (positive) consumption is equal to production. The equilibrium commodity price ratio is equal to the ratio of marginal labour costs. Similarly, the unique autarkic equilibrium of Portugal is represented in Figure 1.1(b) by point CP.

Figure 1.1a England’s autarkic equilibrium, with incomplete specialization

Figure 1.1b Portugal’s autarkic equilibrium, with incomplete specialization

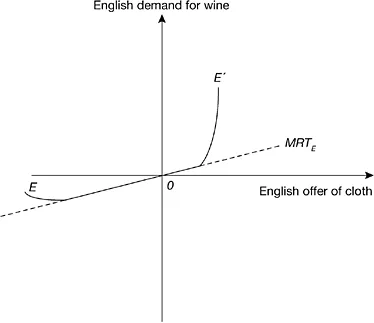

Figure 1.2a England’s offer curve, with incomplete autarkic specialization

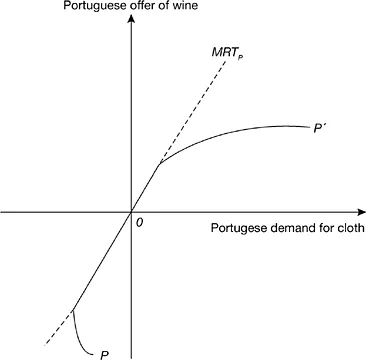

Figure 1.2b Portugal’s offer curve, with incomplete autarkic specialization

Abandoning the assumption of autarky, let us pass in review all conceivable world price ratios. Given any particular price ratio, we can determine the profit-maximizing pair of English outputs, uniquely except when the hypothetical price ratio is equal to the equilibrium autarkic price ratio, and we can determine uniquely the utility-maximizing English consumption pair. Transferring that information to Figure 1.2(a), we obtain the offer curve EOE′ for England, where the straight segm...