This book will guide you through the seven key steps to help you determine if early retirement makes sense for you. The first step to answering your $100,000 Question is to learn exactly what your Social Security benefits will be. Next, you will learn about the penalties for early retirement, and the financial risks of making the wrong early retirement decision. In this chapter, you will learn the options and their cost to you.

YOUR SOCIAL SECURITY STATEMENT

In 1999 the SSA began mailing Social Security statements annually to all adults 25 and over about three months prior to their birthdays. In the statement, you receive an estimate of your benefits under the most current laws, and a record of your earnings upon which your benefits are based. If you do not have this statement, you need to get one. Call 800-772-1213 or go to www.ssa.gov and request a statement order form. Because this is sensitive personal information, it is not available online. You have to mail a form to the SSA and wait for a response in four to six weeks.

Your Social Security statement estimates what your benefits will be based on current law and your history of earnings. As you get closer to retirement age the estimate of your benefits are more accurate, as your earning record is more complete and the laws are less apt to change. Check your earnings history to make sure it agrees with your records. The SSA estimates that employers submit incorrect information 4 percent of the time and it tries to correct most of the errors, but it estimates that 1 percent of wages fail to be credited to the correct worker’s record. Nancy actually found an error several years ago. Those mistakes can cost you thousands. The most common mistakes occur because the SSA computer does not recognize your family name. Problems occur with hyphenated names, names with spaces, such as Oscar de la Hoya, and Asian and Spanish names in which the primary family name does not come at the end, such as Ho Zheng Fuhu and José López Portillo Alvarez.

In order to qualify for retirement benefits, you must have paid into the system and earned a minimum forty quarterly “work credits” or approximately ten years of work. You must earn at least $920 in a quarter, or $3,680 for the year [2005], to accumulate four annual credits. This amount is indexed upward each year for inflation. Spouses and dependents who are entitled to receive benefits based on your record of earnings credits do not have an earnings requirement themselves.

How do you calculate your benefits? Follow me through this three-step process. First, we will adjust earnings for inflation, then determine lifetime average earnings, and finally calculate benefits based on your average earnings.

First, let’s find out your lifetime earnings adjusted for inflation. Each year of your earnings is adjusted forward based on real wage growth inflation to the Base Year that you turn 60. The inflation rate of wages is considerably more than what we commonly think as inflation as measured by the Consumer Price Index (CPI) for Urban Wage Earners and Clerical Workers computed by the Bureau of Labor Statistics. The CPI measures inflation as experienced by consumers in their day-to-day living expenses. Fortunately for all of us, using the larger wage inflation factor creates a larger initial benefit the first year and therefore creates a larger stream of benefits thereafter with the larger initial base.

After you begin receiving benefits they are adjusted annually for inflation by using the lower CPI measure. In 2005 there was a 2.7 percent increase in benefits, the highest being 14.3 percent in 1980 a, and the lowest 1.3 percent in 1999. Fewer than 20 percent of private pensions have automatic cost-of-living increases, according to the Employee Benefit Research Institute, making Social Security very valuable in times of inflation.

Second, the SSA chooses the best thirty-five years of your adjusted earnings years to arrive at your benefits. Some people may have a few years of unemployment, child rearing, or education in their work records. Those zeros in your record reduce your benefits if they are part of your highest 35 years.

This total adjusted earnings amount is divided by 420, the number of months in 35 years, to determine your Average Indexed Monthly Earnings (AIME). You may have zeros in some years and that brings down your average. If you choose to retire early, you could be reducing your average by foregoing some of the highest paid years of your career in the calculation.

Once your AIME is calculated, the SSA applies a percentage, called a Replacement Rate, to arrive at your monthly benefits amount. The average Replacement Rate is 40 percent. However, the rate tends to be higher for low-income workers and lower for higher income workers. In this progressive way, lower-paid workers—who in theory would have less opportunity to save—get proportionally more of their incomes replaced by Social Security. A very low-paid worker may have a 90 percent replacement rate, yet receive a much smaller check. An upper income worker may only have a 33 percent replacement rate, but get a check three times as large in absolute terms. It is also not totally a progressive system because the maximum income subject to the Social Security tax is $90,000 [in 2005], which is adjusted upward annually for inflation. This leaves a large proportion of high earners’ incomes untaxed.

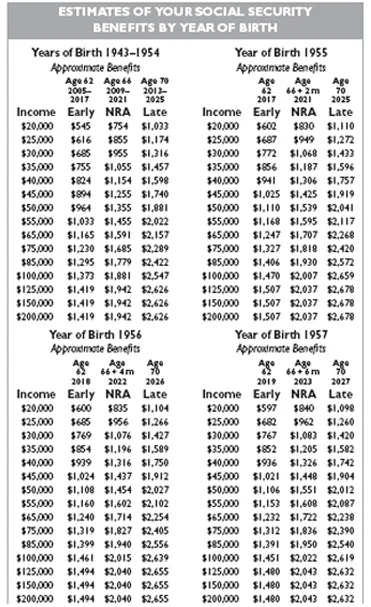

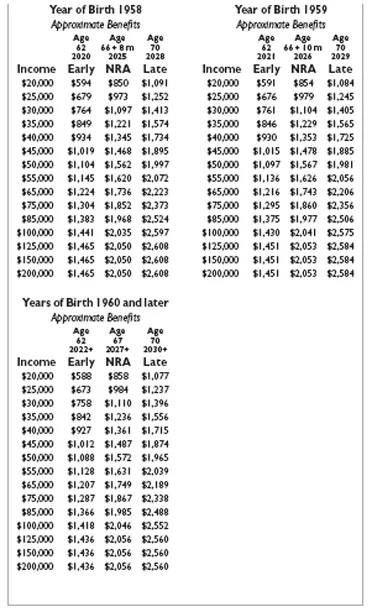

By using the benefit-estimating Quick Calculator provided by the SSA at www.ssa.gov, I’ve developed the following charts showing approximate benefits for people with birthdays beginning in 1943, who can choose to collect an early retirement benefit beginning in 2005. The charts, not available anywhere else, input a range of incomes at the various birth years from 1943 to the present. The Quick Calculator assumes that you continue to work until retirement to estimate your benefits.

Your personal statement will give a more accurate picture because your earnings stream may differ from the average. Your personal statement will state what your early retirement benefit will be at age 62, what your full retirement benefit at your NRA, and what your benefits would be if you postpone benefits until age 70. Because of the changes in the Social Security law in 1983, the NRA is gradually increasing from age 65 currently to age 67 for those born in 1960 and thereafter. Surprisingly, half of us Baby Boomers don’t know that. Legislators spared current and near retirees the pain of the corrective actions to save the system from insolvency. Those long-ago changes to benefits made in 1983 are starting to affect retirees today.

One reason the decisions you make regarding Social Security are so important is that these benefits are a major source of income support for most Americans. Although Social Security benefits were never intended to replace one’s working income, they now keep millions and millions of retirees out of poverty, or contribute a major chunk of their annual incomes. Despite the wealth of the U.S. economy and the relative affluence of the U.S. consumer, Social Security is rapidly becoming the only guaranteed retirement provided to American workers and their families. In fact, Social Security is the sole source of income for 18 percent of American retirees today, and it provides nine tenths of total income for almost a third of today’s retirees. For 64 percent of current retirees, the Social Security check amounts to 50 percent of their income!

Enormous changes in the ways corporations provide retirement benefits to workers, and in the reliability of those benefits over long periods of time, have left each of us with far greater responsibility for planning and managing our finances in retirement than we would have thought possible even twenty years ago. Today, employers provide defined pension benefits plans (guaranteeing a set pension check amount to the retiree) to just 20 percent of current workers. And that number is expected to rapidly dwindle as employers continue to choose defined contribution plans, such as 401(k) plans, which establish retirement stock and savings accounts for employees who are responsible for managing their own assets. What’s more, pension benefit cutbacks are becoming routine for troubled companies and industries. We’re even reading reports in the Wall Street Journal that companies are hiring sheriffs to deliver retirees a summons with the news that their pension benefits are being slashed or eliminated!

The decline in traditional pensions is also due to the dwindling number of union employees who have guaranteed pension plans as part of their contracts. Approximately 80 percent of workers are now offered a defined contribution plan such as a 401(k), and are responsible for their contribution and investment choices, which may or may not provide an adequate retirement nest egg. Even the federal government has switched to a less costly plan. Employees hired after 1984 are part of the Social Security system rather than the more generous Federal Employee Plan.

Nearly Two Thirds of Recipients Rely on Social Security for More Than 50% of Their Support

| % of

Support | % of

Recipients | % Greater

than or Equal |

| 100 | 18 | |

| 90 | 12 | 30 |

| 50 | 34 | 64 |

EARLY RETIREMENT

Retiring early: it’s a huge topic of conversation, a staple of financial news stories, and a dream for many hard working mid-lifers paying that mortgage and saving for college tuition who hope to buy that log-hewn mountain house for their golden years. But few have realized just how big the price tag can be.

The typical working Baby Boome...