The Banking Sector Under Financial Stability

Indranarain Ramlall

- 259 pages

- English

- ePUB (adapté aux mobiles)

- Disponible sur iOS et Android

The Banking Sector Under Financial Stability

Indranarain Ramlall

À propos de ce livre

Many economies in the world are characterised by a bank-based financial system, that is, the financial intermediation process is mostly performed by banks. It is therefore critically important to undertake a fully-fledged analysis of the banking sector with respect to financial stability risks.

The Banking Sector Under Financial Stability considers the unique position of banks which by nature assume higher risks, but with a low equity to total assets ratio. It recognises that balance sheet analysis of banks becomes a key element in financial stability risk assessment and that the sources of banks' funding also pose risks to financial stability. The book also gives due consideration to the interactive forces which prevail among banks, macroeconomic states, asset prices, the household sector, and monetary policy. The differences between the US and the European Union are also covered at length, as are the various credit risk models pertinent for banks.

This book will prove valuable to central bankers, economists, and policy-makers who are involved in the field of financial stability, as well as researchers studying the field.

Foire aux questions

Informations

Chapter 1

Banks, Risks and Risk Management

1.1. Introduction

1.2. Difference Between a Bank and A Non-Financial Firm

- Bank’s funds are of a short-term nature.

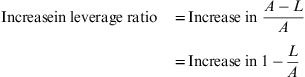

- Banks constitute highly leveraged institutions which are endowed with low levels of equity. High leverage generates higher profits in the case that earnings are positive. Thus, since banks are inherently imbued with high financial leverage, then, in countries which have high-interest rate spreads, banks should be reaping larger levels of profits as to boost up their capital base, making them less vulnerability to financial stability shocks. Leverage emanates not only from the on-balance sheet but also from off-balance sheet items. Deregulation and innovation made the financial sector not only highly leveraged but also highly competitive. As per the Basel Committee on Banking Supervision (2015) under its Basel III Monitoring Report 2015, the aggregate leverage of big banks fell from 29 times Tier 1 capital in the first half of 2011 to 22 times in the first half of 2014.

- Banks have a low proportion of fixed assets which thereby lead to low operating leverage. Operating leverage can be defined as the proportion of fixed costs to total costs.

- Banks have a large chunk of their assets invested in loans and advances and investments, all carrying high-interest rate risk.

- A large part of the revenues of a bank often emanates from interests on advances and investments.

- In the case of profits, net interest income of a bank is akin to gross profit for a non-financial firm.

- Banks tend to have volatile asset values on the back of changes in interest rates and defaults of borrowers.

1.3. Banking Business Inherently Risky: Low-Profit Margin but High Leverage

$Trillion | % of Assets | |

|---|---|---|

Assets | 15.927 | 100.0 |

Liabilities | ||

Deposits | 7.502 | 47.1 |

Short-term wholesale funding | ||

Repurchase agreements and federal funds purchased | 1.658 | 10.4 |

Other short-term wholesale funding | 0.880 | 5.5 |

Trading liabilities | 0.736 | 4.6 |

Total | 3.274 | 20.6 |

Long-term funding | ||

Long-term wholesale funding | 1.718 | 10.8 |

Subordinated debt and trust preferred | 0.416 | 2.6 |

Total | 2.134 | 13.4 |

Other liabilities | 1.570 | 9.9 |

Total liabilities | 14.480 | 90.9 |

Equity | ||

Common stock | 1.309 | 8.2 |

Preferred stock | 0.137 | 0.9 |

Total equity | 1.446 | 9.1 |