![]()

| 1 | The framework of accounting |

The objectives of this chapter are to:

- explain the accounting and decision-making process;

- identify the main entities involved in the supply of accounting information;

- distinguish between financial accounting and management accounting;

- identify the external users of accounting information; and

- outline the nature and content of the principal accounting statements.

THE ACCOUNTING PROCESS

Accounting is a data-processing system that has been vividly described as the ‘language of business’. It may be defined as a system for recording and reporting business transactions, in financial terms, to interested parties who use this information as the basis for performance assessment, decision-making and control.

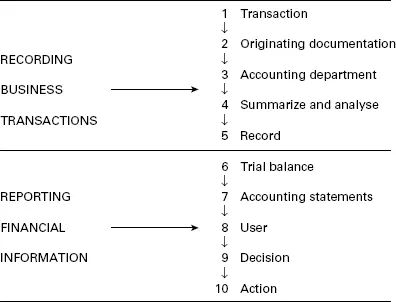

The various stages in the accounting and decision-making process are presented diagrammatically in Figure 1.1. It can be seen that the accounting process contains two basic elements, namely recording business transactions (stages 1–5) and reporting financial information to enable decisions to be taken (stages 6–10). These are interrelated since accounting records form the basis for accounting reports.

The accounting process begins with an economic event, such as the receipt of goods from a supplier. An originating document or voucher is then made out to record the movement of goods, services or cash into, within or out of a business. It is important that the document is made out immediately, since any delay increases the risk of an error that can undermine the entire accounting process. The term ‘garbage in, garbage out’ has been coined to describe the effect, on the information system, of starting with incorrect data.

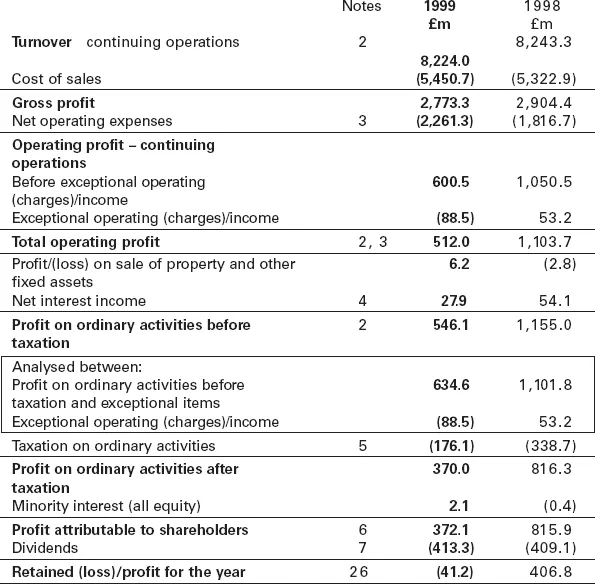

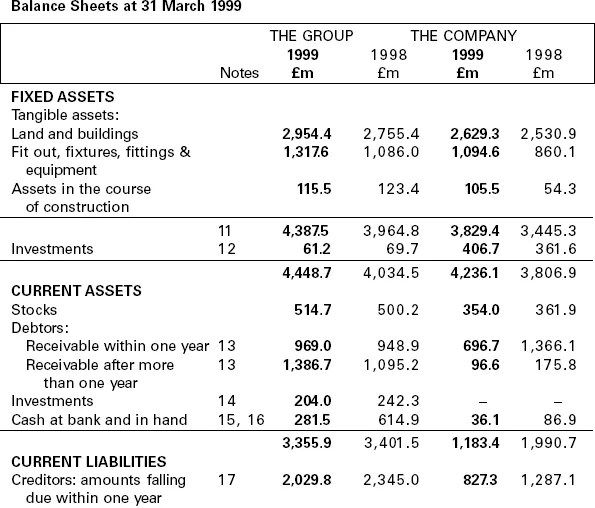

Documents and vouchers quite naturally originate in many different departments of a company, but copies of all of them are sent to the accounts department where they are summarized, analysed and then entered in the books of account. Periodically, at least once a year but probably more often, the balances are extracted from the ledger accounts and assembled in a ‘trial balance’. This is used as the basis for preparing the final accounts, which consists of a profit and loss account and a balance sheet. These accounting statements are then made available to both management and a variety of ‘external’ users (see later in this chapter) to help them reach better-informed decisions than would otherwise have been possible. For example, the financial statements prepared for a well-known company, such as Marks and Spencer plc, may indicate that good (or bad) progress has been made over the last year. On this basis, an individual might decide to purchase some of the company’s shares. That individual will use financial statements subsequently published by Marks and Spencer to judge whether the performance has come up to expectations and whether to retain the shareholding, add to it or sell the shares. The profit and loss account and balance sheet of Marks and Spencer plc for 1999 are given in Figure 1.2.

FIGURE 1.1 Accounting and the decision-making process

SUPPLIERS OF ACCOUNTING INFORMATION

Suppliers of accounting information include the following business units operating in the private sector of the economy. They are listed in no particular order of priority:

| |

| 1 | Sole traders. These are businesses that have a single owner who also takes all the major managerial decisions. Operations are usually on a small scale, and typical examples are an electrician, the local newsagent and hairdresser. The main reason why accounts are prepared for the sole trader is to help establish the amount of income tax due to the Inland Revenue. He or she makes little use of accounting statements for business decisions. Instead these decisions are based on knowledge obtained as a result of direct contact with all aspects of business activity. |

| |

| 2 | Partnerships. These exist where two or more individuals join together to undertake some form of business activity. The partners share between them ownership of the business and the obligation to manage its operations. Professional people, such as accountants, solicitors and doctors, commonly organize their business activities in the form of partnerships. Accounting statements are required as a basis for allocating profits between the partners and, again, for agreeing tax liabilities with the Inland Revenue. |

| |

| 3 | Clubs and societies. There are, in Britain, many thousands of clubs and societies organized for recreational, educational, religious, charitable and other purposes. Members invariably pay an annual subscription and management powers are delegated to a committee elected by the members. The final accounts prepared for (usually large) societies, formed by registering with the Registrar of Friendly Societies, are often controlled by statute. For the local club or society, the form of the accounts is either laid down in the internal rules and regulations or decided at the whim of the treasurer. Conventional accounting procedures are sometimes ignored in a small organization. Reasons for this are lack of expertise, the meagre quantity of assets belonging to the organization and the fact that the accounts are of interest only to the members. |

| |

| 4 | Limited companies. A limited company is formed by registering, under the Companies Act, with the Registrar of Companies and complying with certain formalities. The company may be private, indicated by the letters Ltd at the end of its name, or public, in which case the designatory letters are plc. The main significance of the distinction is that only the latter can make an issue of shares to the general public. In the case of public companies there is the further distinction between quoted companies, whose shares are traded on the stock exchange, and unquoted companies. In general, public companies are larger than private companies and quoted companies larger than unquoted. The directors of all limited companies are under a legal obligation to prepare and publish accounts, at least once in every year, which comply with the requirements of the Companies Act. (It should be noted that there are also in existence a small number of unlimited companies – for example, this method of incorporation is sometimes used by professional firms who are not allowed to have limited liability but want the tax advantages of being a company.) A limited company may, alternatively, be formed by means of either a private Act of Parliament or a royal charter. These are called statutory and chartered companies, respectively. The form of their accounts may be regulated by the charter or statute. In addition, it is normal practice to comply with the general requirements of the Companies Act. |

Consolidated Profit and Loss Account for the year ended 31 March 1999

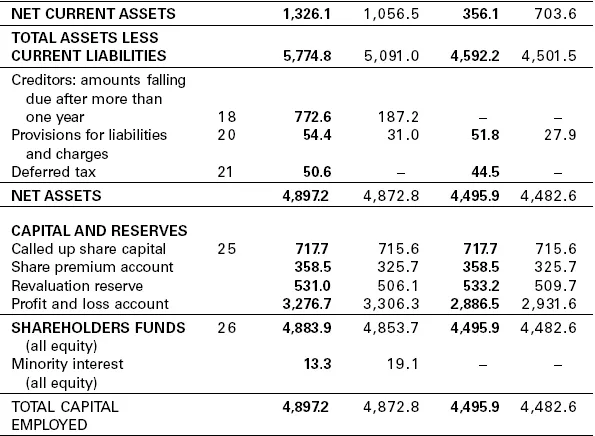

FIGURE 1.2 Profit and loss account and balance sheet of Marks and Spencer plc

Reporting units in the public sector include local authorities, state colleges and the health service. These are outside the scope of this book, although many of the accounting techniques they employ are exactly the same as those used by organizations in the private sector.

FINANCIAL ACCOUNTING AND MANAGEMENT ACCOUNTING COMPARED

Accounting is conventionally divided into financial accounting and management accounting. The former is concerned with the provision of accounting information for external user groups, while the latter concentrates on the provision of information for management. The principal accounting statements – the balance sheet and the profit and loss account – are of interest to internal and external users but, when presented to the latter, they will normally be in a condensed form. It will be noticed that the final accounts of Marks and Spencer plc (Figure 1.2) summarize on two sheets the financial effect of millions of individual transactions. For example, the balance sheet reports total assets of £7,804.6 million (fixed assets £4,448.7 million + current assets £3,355.9 million) divided into just six categories: tangible assets £4,387.5 million; investments £61.2 million; stocks £514.7 million; debtors £2,355.7 million; current asset investments £204 million; and cash £281.5 million.

The main factor affecting the amount of detail contained in the accounts is the requirements of the user group. In general, external users wish to assess the overall performance of the entity and an enormous amount of detail is inappropriate both because it is of little interest and because it is likely to obscure the important trends. It is mainly for this reason that information is presented in a highly summarized form in published accounts. A further reason is that the disclosure of too much detail might be used by competitors to analyse the company’s strengths and weaknesses.

Financial statements prepared for management contain much more detail. The explanation for this difference may be found in the types of decision to be taken. Shareholders base their decision to sell shares, retain their investment or buy more shares mainly on the level of reported profit and dividends declared. Management, in contrast, is keenly interested in the costs and revenues that make up the profit figure. This is because managers are responsible for taking the following kinds of decisions which influence individual items of revenue and expenditure: whether to expand or contract production; whether to substitute one material for another, or one type of worker for another; whether to replace labour-intensive production methods by machinery; whether to acquire property instead of renting it; and which type of power supply to use. In many instances reports must be specially prepared to help reach these decisions, and appraisal techniques have been developed to help the management process. After the decisions have been made, the outcome is monitored to see the extent to which expectations have been fulfilled.

This book introduces accounting techniques that form the basis for both branches of accounting – financial and management – although individual chapters or sections of chapters focus on specialist aspects of each. Chapters 2–8 deal, in detail, with the calculation of profit, the valuation of assets and the preparation of the profit and loss account and balance sheet. As has already been explained, these documents are widely used by both internal and external consumers of accounting information. Chapters 9 and 10 identify the distinctive features of final accounts prepared for partnerships and limited companies. Chapters 11 and 12 explain how the information contained in the accounts may be analysed and interpreted to help both internal and external users decide how to commit resources...