![]()

PART I

Recent Changes in the Contemporary Art Marketplace: Things Beyond Each Dealer’s Control

![]()

1

The Growing Globalization of the Contemporary Art Market

WHAT HAS CHANGED?

The increasing globalization of the contemporary art market has often been cited as one of the main reasons it did not completely collapse during the Great Recession.1 Even as most American or European collectors were pulling back on acquisitions in late 2008 and 2009, others from around the world reportedly moved in to take advantage of the deals to be had among the severely shaken galleries and, in the process, kept more of them afloat than had been originally predicted. One conclusion from this perception is that even if your entire collector base is local, it behooves art dealers everywhere to understand the global trends at play in making the overall contemporary art market stronger or weaker and to learn how to strategize in concert with them.

Not everyone is convinced the contemporary art market is actually global in a significant way, though. In April 2014, Olav Velthuis (Associate Professor at the University of Amsterdam, who has been studying the emergence and development of art markets in so-called BRIC countries—Brazil, Russia, India, and China) gave a lecture at London’s Courtauld Institute on what he called the “myth of a global art market.” According to a report on the lecture in The Art Newspaper2, Velthuis told the audience that his research revealed “that the majority of businesses are organized ‘extremely locally,’ despite aspiring to the borderless ideals of international artists who command global demand—which [Velthuis] said has been ‘vastly exaggerated’.” Velthuis did reportedly later acknowledge that there is a “small top segment” of globe-trotting collectors who buy art around the world, but he argued that a disproportionate degree of press coverage about this minority served to perpetuate the myth of a truly global market. As a Courtauld professor in attendance pointed out during the Q&A, however, this small set of top collectors does account for a large percentage of the total art business.

Even if you accept that the contemporary art market has indeed gone global in a meaningful new way, it is not always easy to know how to respond to that information. Depending on which year’s data or which news source you are reading, you may learn that “it’s all about China” or “it’s all about Brazil,” no wait, “it’s now all about Qatar.” In other words, the big picture is a bit murky and also rapidly changing. There is also a perception that things are evolving so rapidly that if you rely on such reports to decide which new market to explore, it will already be too late by the time you get there.

Publicly available sources of information on where collectors are buying contemporary art are either limited to auction results, confusing, controversial, or all of the above. Among the most cited sources for such information are:

• TEFAF Art Market Report. Dr. Clare McAndrew, a cultural economist and founder of the Dublin-based research and consulting firm Arts Economics (www.artseconomics.com), is commissioned annually by The European Fine Art Foundation (TEFAF) to compile data on global art sales, which is then released each March in conjunction with TEFAF’s art fair in Maastricht as the TEFAF Art Market Report. Not limited to contemporary art; combines “Postwar and contemporary art” in one category; based on auction sales and art dealer surveys. (www.tefaf.com)

• Artprice’s Contemporary Art Market Annual Report. Founded by French artist/entrepreneur Thierry Ehrmann, the Lyon-based company Artprice, which aggregates worldwide auction results and publishes overall “Art Market Trends,” also publishes a specific overview of the global contemporary art market each October in English, French, German, Italian, Spanish, and Chinese. This multi-language publishing may be partially responsible for why this report’s name is not entirely consistent within the art press. The most recently available report is called, in English, Contemporary Art Market 2014: The Artprice Annual Report. Limited to contemporary art (defined as work by artists born after 1945); based only on auction sales. (www.artprice.com)

• Skate’s Annual Art Investment Report. Founded by Russian art market analyst Sergey Skaterschikov, Skate’s Annual Art Investment Report focuses on the very top of the contemporary art market, particularly within the auctions, but also looks at special issue trends, such as performance among top galleries and ranking of the top art fairs. More of an analytic approach than in-depth data-mining, but designed to be a summary of their monthly newsletter with additional special issues. (www.skatepress.com)

When you bring up these sources of information among collectors, dealers, or some arts journalists, though, you are often likely to hear complaints about the sample sizes they use, the lack of supplied detail about their methodology, or simply the findings’ true relevance to how they get discussed.3 Especially among professionals who work in industries where such weaknesses are not tolerated in reports (such as finance), these reports have been considered of limited use outside of their auction data, which is seen as very reliable, but obviously of less value when considering the primary market. Despite these concerns, these reports are still frequently cited in the arts press, and therefore do indeed form perceptions and sway decisions in the art market.

Still, I kept running into inconsistencies while trying to reconcile their findings into a meaningful analysis and so ultimately decided to explore how “global” the contemporary art market has become through entirely different methods. It’s not that these reports don’t have value (I will indeed refer to parts of them later in this book), but rather that the way their data about the “global” question is interpreted, because of the way it is framed by their authors, leads readers to overestimate how actionable their findings are. With that in mind, we will look below at three other ways of trying to deduce how more “global” the contemporary art market has become since 2008. The first of these is admittedly highly subjective, but all three have the advantage of being more readily acted upon by individual art dealers focused on the primary market than I was finding for the data from the three reports mentioned above. My chosen metrics here include:

1. Changes in where the top 200 contemporary art collectors primarily reside

2. Changes in the primary location of the contemporary art galleries participating in the world’s top art fairs

3. Locations where new art fairs are being launched

Changes in Where the Top 200 Contemporary Art Collectors Primarily Reside

Although it is assembled via a highly subjective process, the list of the world’s “Top 200 Collectors” published by ARTNews magazine every summer is reported on far and wide and in that way influences the perceptions of where the biggest art collectors live, where they get their money (what industries they work in or where they inherited their fortunes from), and what they collect. (I should note here how thankful I am to ARTNews’s former editor-in-chief Robin Cembalest and her staff for helping me with access to these lists.) The Top 200 Collectors list is not limited to those who collect contemporary art, but in the 2008 edition, 154 of the collectors listed (or a little more than 75 percent) either focused on or collected some contemporary art. Here is where the contemporary art collectors on the 2008 list predominantly resided (please note that percentages in the tables below do not total 100 percent due to rounding for space considerations):

The Primary Residence of the 154 Collectors of Contemporary Art in ARTNews’s List of the 200 Top Collectors in 2008

| PRIMARY RESIDENCE | Number | % of total |

| US and Canada | 93 | 60% |

| UK and Europe | 47 | 30% |

| Mexico and South America | 6 | 4% |

| Asia | 4 | 3% |

| Turkey and the Middle East | 2 | 1% |

| Other | 2 | 1% |

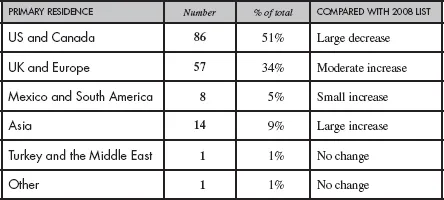

By the 2014 edition of ARTNews’s Top 200 Collectors, the categories for what type of art was being collected had changed somewhat, but of the 200 listed that year, 167 collectors either focused on or collected some contemporary art, which was a drop from the 171 listed in 2013 but still a fair increase over the 2008 list. Here’s the breakdown for 2014 by primary residence:

The Primary Residence of the 167 Collectors of Contemporary Art in ARTNews’s List of the 200 Top Collectors in 2014

While collectors in both Asia and Europe seem to have made noticeable gains in assuming positions among the Top 200 Collectors, and the biggest decrease in percentage is clearly among American collectors, there are a few caveats to using this list as a measure of how much more “global” the contemporary art market has become over the past several years. First, many people on the list often move from home to home within each year, and a number of these collectors primarily live in countries outside their country of origin. Second, the collectors appearing on the list shift from year to year for a wide range of reasons: individuals on the list pass away, get divorced and continue to collect separately, or stop collecting as much or altogether. Third, as noted above, these lists are compiled via a subjective process in which who is “important” may often be determined by who’s getting the most attention for their collection that year. Human interest in what’s “new” being what it is, there may be more attention paid to collectors who have made a splash than to others more quietly still adding to their established collections.

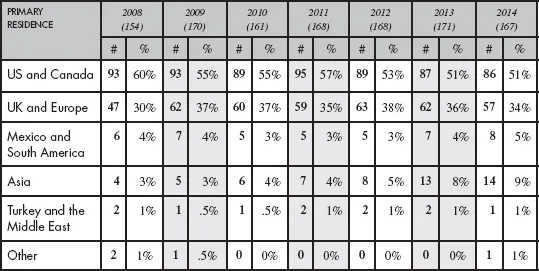

Still, looking at the numbers across all the years from 2008 through 2014 (see below), we see a fairly continuous decrease in the percentage of US-based collectors among the top 200, except for a slight bump back up in 2011 (Canadians on the list remain consistent). This does not necessarily mean fewer Americans are actively collecting contemporary art as much as it suggests collectors from other countries seemed more active. We also see both a big jump in 2009 and then a plateau in the percentage of collectors from Europe and the UK, until it begins to decrease again in 2013–2014. Most consistent is the slow-but-steady increase in the number of top collectors from Asia, with most of the new entries by 2014 residing in China, which corresponds with a number of larger Western galleries opening new spaces there (see Chapter 2), as well as an increase in the efforts to produce high-profile art fairs there (see Chapter 3).

The ARTNews 200 Top Collectors 2008–2014 (Number collecting Contemporary art)

But let’s look a bit more closely at the two regions where the numbers of collectors in the top 200 have increased over the past several years. First, breaking down the numbers in Europe and the UK by country, we see a few interesting trends:

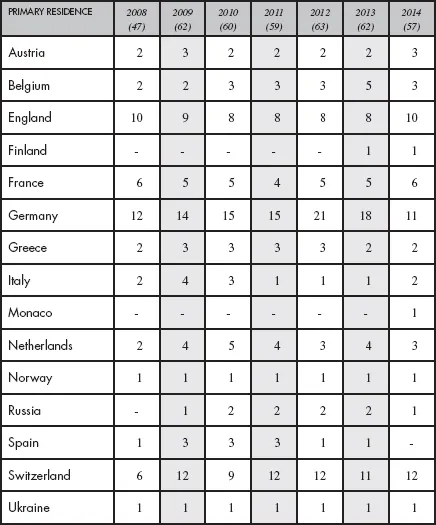

The ARTNews 200 Top Collectors 2008–2014 in Europe and the UK (Number Who Collect Contemporary Art)

Right after the recession, Switzerland and Germany saw the biggest increases in the number of their residents in the top 200, but whereas Switzerland has remained steady, Germany has recently decreased to almost half of its post-recession high. Most other countries’ numbers essentially held steady, including England and France. And a few countries had residents join the elite collectors’ circle for the first time, like Russia, Finland, and Monaco.

It is tempting to try to interpret these numbers as a reflection of real-world events, such as the fact that the economy in Germany (where the number of top collectors grew from twelve to over twenty at one point) is known to have remained fairly strong throughout these years, but then what explains the dip back down to eleven in 2014? The German economy was still among Europe’s strongest then. The aforementioned factors (such as how top collectors may have moved primary residences, divorced, died, or stopped collecting) make any such economic narratives a bit too speculative for much use on their own, so later in this chapter we will compare these numbers with the findings from the other two metrics to see what actionable conclusions can be drawn within the larger picture.

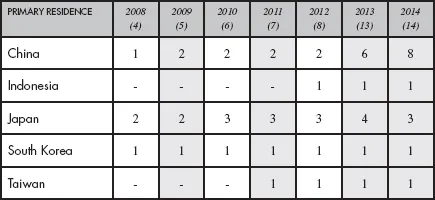

Breaking down the Asian collectors on the list by country, the trend here is a slow, steady increase, but the overall numbers remain low:

The ARTNews 200 Top Collectors 2008-2014 in Asia (Number who Collect Contemporary Art)

Even though the numbers for Asia are small in comparison with the United States and Europe, one conclusion here seems obvious: while Asia as a whole has steadily climbed or remained steady, it is China’s top contemporary art collectors who have gained the most in international stature. Here again, it is tempting to conclude that this reflects how strong the economy in China has been during these years, but even if that partially explains the rise, that information alone is not actionable for most art dealers. Critical questions remain, such as “What exactly are these collectors acquiring?” For several years the perception has persisted that the top Asian collectors focus on Asian artists and big brand-name Western artists like Koons, Hirst, and Warhol, but have not shown much interest in collecting Western artists outside those few art stars. In early 2015, anecdotal reports from the fairs in Hong Kong suggested that may be changing, a little.

Changes in the Primary Location of the Contemporary Art Galleries Participating in the World’s Top Art Fairs

According to Skate’s Annual Art Investment Report4, the top ten international art fairs in 2013 were:

1. Art Basel in Basel

2. The European Fine Art Fair (TEFAF; Maastricht)

3. Foire Internationale d’Art Contemporain (FIAC; Paris)

4. Art Basel in Miami Beach (ABMB; Miami)

5. The Armory Show (New York)

6. Paris Photo (Paris)

7. Feria Internacional de Arte Contemporáneo (ARCOmadrid; Madrid)

8. Frieze (London)

9. Art Cologne (Cologne)

10. Artissima (Turin)

Skate’s notes that this ranking was based on four criteria: period on the market, number of participants, participation figures, and reputation among peers. That last category is, of course, somewhat subjective and depends on whom you ask.

Because the amount of contemporary art shown at TEFAF is considerably lower than at the other fairs listed, however, I have taken it out of my top-ten list here and added the thirteenth fair on Skate’s list, Art Brussels (Brussels), instead, to create a somewhat customized list of the Top Ten International Contemporary Art Fairs for 2014, which we’ll examine below for clues their participating galleries can reveal about shifts in the global contemporary art market. (I should perhaps also explain I did not add the eleventh and twelfth fairs on Skate’s list: Art Basel in Hong Kong and Arte Fiera Bologna, respectively. In 2013 Art Basel in Hong Kong had only just undergone a change in ownership and branding, and so in 2014 it was basically a very different entity from what it had been in 2008, making the comparison in their participating galleries less meaningful. Also, despite Skate’s ranking, Arte Fiera Bologna is overwhelmingly a national fair and not as internationally influential as the Skate’s ra...