Summary: Rich Dad's Guide to Investing

Review and Analysis of Kiyosaki and Lechter's Book

BusinessNews Publishing

- English

- ePUB (adapté aux mobiles)

- Disponible sur iOS et Android

Summary: Rich Dad's Guide to Investing

Review and Analysis of Kiyosaki and Lechter's Book

BusinessNews Publishing

À propos de ce livre

The must-read summary of Robert Kiyosaki and Sharon Lechter's book `Rich Dad's Guide to Investing: What the Rich Invest in That the Poor Middle Class Do Not`

This complete summary of the ideas from Robert Kiyosaki and Sharon Lechter's book `Rich Dad's Guide to Investing` explains that the rich position themselves as one of three general types of investors (sophisticated, inside, and ultimate investor) and invest in three different areas 'Education, Experience, and Excessive Cash'. This summary will allow you to identify these types and areas, thus changing your view on investing and allowing you to use your newly acquired knowledge to improve your own circumstances.

Added-value of this summary:

• Save time

• Understand the key principles

• Expand your business knowledge

To learn more, read `Rich Dad's Guide to Investing` and discover the investment habits of the rich.

Foire aux questions

Informations

Summary of Rich Dad’S Guide to Investing (Robert Kiyosaki and Sharon Lechter)

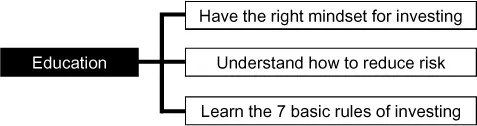

Section 1: Education

Have the right mindset for investing

- Personal priorities Most people have three fundamental priorities:1st – To be secure.2nd – To be comfortable.3rd – To be rich.In other words, most people would rather feel secure and comfortable than be rich.For rich investors, the way forward starts when becoming rich moves from being their #3 priority in life to being #1.

- The rich see abundance, not scarcity. Most people know only financial scarcity. To them, there’s never enough money to go round – therefore, they look at everything from a scarcity perspective.Rich investors, by contrast, realize there’s plenty of money in the world which will always flow to viable projects. Therefore, they work from an abundance perspective. They have a financial plan for what to do during the times cash flow is tight and another for what to do when the cash is flowing strongly.

- Investing means different things to different people. Rich investors know that everyone who is active in the world of investing has a bias towards investments they like and a lack of knowledge about different investment products. Therefore, by asking someone for advice, all they can give are their opinions about what they personally like.In its purest form, investing is a plan. It’s a journey to go from one point on the financial spectrum to another. There are a number of investment products which can be utilized to make that journey, but what’s appropriate in one situation isn’t necessarily correct for a completely different journey.It’s the plan that dictates which investment products would be most applicable. Until a person has a plan to get from where they are to where they want to be financially, choosing which investment products to use is a pointless exercise.

- Rich investors have the right vocabulary. The difference between a rich person and a poor person lies in their vocabulary. To become richer, all a person needs to do is increase their financial vocabulary.Rich investors understand and use freely the vocabulary of investing, finance, money, accounting, corporate law and taxation. They define terms appropriately, and understand their true meaning. And they use that vocabulary in developing a long-term financial plan for themselves.

- Investing is a methodical process, not a risky endeavor. Rich investors never base their financial futures on an ability to find hot tips or quick cash. Instead they develop a steady, methodical plan, made up of formulas and strategies. And they keep their financial affairs as simple as possible.

- Rich investors always have an evolving plan. A plan for financial security looks entirely different from a plan for financial comfort and distinctively different again from a plan for getting rich. Rich investors know and understand they live in a world of unlimited abundance, and their greatest asset isn’t money but time. Therefore, they keep developing new financial plans throughout their lives taking into account what they learn along the way. And rich investors also understand the difference between a financial plan to be rich and a plan to be secure or comfortable isn’t money – it’s time.Thus, before rich investors try and develop a plan for getting rich, they put in place financial plans to be secure and comfortable. Usually, these plans are plain and conservative, and involve turning money over to a professional manager who will increase it over time using conventional investment vehicles.Once the financial plans to become secure and comfortable are in place and running on autopilot, investors can then spend the time that’s required to develop and run a financial plan to become rich.

- Rich investors take responsibility for their own futures. In the old days, people worked for large companies in the belief that as they got older, the company would take care of them. That’s no longer the case – ...