eBook - ePub

Business Relationships with East Asia

Jim Slater, Roger Strange, Jim Slater, Roger Strange

This is a test

Condividi libro

- 288 pagine

- English

- ePUB (disponibile sull'app)

- Disponibile su iOS e Android

eBook - ePub

Business Relationships with East Asia

Jim Slater, Roger Strange, Jim Slater, Roger Strange

Dettagli del libro

Anteprima del libro

Indice dei contenuti

Citazioni

Informazioni sul libro

This volume analyses the business environment in East Asia with reference to trade and investment flows within the region and between East Asia and Europe. Focusing on the two-way flow of management ideas, investment and technology, this study highlights the way in which both sides can benefit.

Domande frequenti

Come faccio ad annullare l'abbonamento?

È semplicissimo: basta accedere alla sezione Account nelle Impostazioni e cliccare su "Annulla abbonamento". Dopo la cancellazione, l'abbonamento rimarrà attivo per il periodo rimanente già pagato. Per maggiori informazioni, clicca qui

È possibile scaricare libri? Se sì, come?

Al momento è possibile scaricare tramite l'app tutti i nostri libri ePub mobile-friendly. Anche la maggior parte dei nostri PDF è scaricabile e stiamo lavorando per rendere disponibile quanto prima il download di tutti gli altri file. Per maggiori informazioni, clicca qui

Che differenza c'è tra i piani?

Entrambi i piani ti danno accesso illimitato alla libreria e a tutte le funzionalità di Perlego. Le uniche differenze sono il prezzo e il periodo di abbonamento: con il piano annuale risparmierai circa il 30% rispetto a 12 rate con quello mensile.

Cos'è Perlego?

Perlego è un servizio di abbonamento a testi accademici, che ti permette di accedere a un'intera libreria online a un prezzo inferiore rispetto a quello che pagheresti per acquistare un singolo libro al mese. Con oltre 1 milione di testi suddivisi in più di 1.000 categorie, troverai sicuramente ciò che fa per te! Per maggiori informazioni, clicca qui.

Perlego supporta la sintesi vocale?

Cerca l'icona Sintesi vocale nel prossimo libro che leggerai per verificare se è possibile riprodurre l'audio. Questo strumento permette di leggere il testo a voce alta, evidenziandolo man mano che la lettura procede. Puoi aumentare o diminuire la velocità della sintesi vocale, oppure sospendere la riproduzione. Per maggiori informazioni, clicca qui.

Business Relationships with East Asia è disponibile online in formato PDF/ePub?

Sì, puoi accedere a Business Relationships with East Asia di Jim Slater, Roger Strange, Jim Slater, Roger Strange in formato PDF e/o ePub, così come ad altri libri molto apprezzati nelle sezioni relative a Social Sciences e Ethnic Studies. Scopri oltre 1 milione di libri disponibili nel nostro catalogo.

Informazioni

1 Introduction

Jim Slater

A widespread implicit belief in both Europe and East Asia is that the ‘other’ region is homogeneous. Visitors are often dismayed to discover that both are equally diverse linguistically, culturally and economically. This diversity complicates business decision-making and increases the need for accurate intelligence. The authors’ hope is that this book will assist in the requisite environmental scanning. The emphasis here is on conditions in East Asia, rather than on Europe. None of the studies is specifically concerned with Japan. Even though roughly one-third of the papers presented at the conference in Birmingham, which forms the basis of this collection, were concerned with Japan, it was felt that Japan is already heavily researched, but that there is relatively little easily available information on other, faster-growing East Asian economies. The scale and pace of change in these countries is unprecedented as technology transfer, globalization and liberalization have undammed their commercial energies. However, though the ‘Region’ exists as a geographical entity it is no more homogenous in national or business/organizational culture than is Europe. There are, for example, clear differences in industrial organization: the Chaebol of Korea and the Japanese sogoshosha differ in concept and management style and contrast with the networking of relatively small Taiwanese firms. The physical distance between Singapore and Tokyo is similar to that between Europe and the USA, but the cultural distance is probably considerably greater. Economic development also varies considerably among Asian countries: what these countries have in common is the ability to generate and cope with change at a rate outside contemporary experience elsewhere. A summary of the development status of the relevant countries is shown in Table 1.1 below.

Within Europe there are, of course, also wide differences between countries though within narrower geographic limits. The southern countries of the EU are less developed than the north, whilst the difference in development between the EU and the former Soviet Eastern European countries is even more marked. Because of these differences and because of liberalization, there are, within and between both these regions, considerable opportunities for trade and, particularly, investment. Whilst regionalism may have lessened internal trade barriers, it has also raised external ones. Trade barriers and frictions are likely to stimulate

Table 1.1 Economic development status among Asian countries

| Country | Development status | |

| NIE ‘Dragons’ | Singapore South Korea Taiwan Hong Kong | Developed* Mature NIE/Developed Mature NIE/Developed Mature NIE |

| ASEAN ‘Tigers’ | Thailand Indonesia Malaysia Philippines | Young/Mature NIE Developing Developing/Young NIE Young NIE |

| China | Young NIE | |

| Vietnam | Low income Developing | |

| Cambodia | Low income Developing | |

| Laos | Low income Developing | |

| Myanmar | Low income Developing |

*Singapore's official status as ‘developed’ is subject to some ambiguity. The Organisation for Economic Cooperation and Development (OECD) puts Singapore in the category of advanced developing nations no longer eligible for aid. However, its living standards are ahead of Britain.

Source: Adapted from Nomura Research Institute. Classification is based on current trade structure.

Foreign Direct Investment (FDI), an alternative to exporting, as a means of circumvention. Globalization and liberalization of firms and national economies, tied to emerging regionalism, have, in fact, provided the foundations for an enormous growth in FDI. Statistically, FDI figures are subject to varying degrees of over- or under-reporting, as well as to unpredictable innaccura-cies due to problems of reporting and data collection. However, the main trends and rough magnitudes seem incontestable. Between Asia and Europe, in both directions, and within Asia, this type of commercial activity is growing rapidly and at a much faster rate than conventional trade. Most of this book, therefore, is concerned with investment and direct linkages rather than with trade per se.

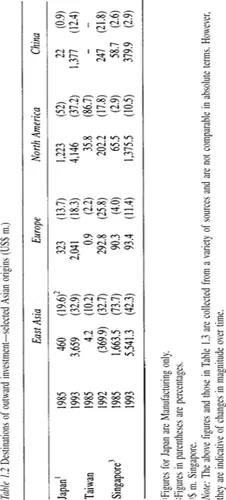

Much of the growth in Asian FDI has been driven by China's liberalization and opening-up to the outside world, particularly as a result of policies aimed at investment-led growth. Table 1.2 shows outward FDI figures for some of the main Asian investors. Between the mid-1980s and 1990s the total volume of outward investment increased by orders of magnitude. Absolute values of investment to the major destinations increased but the share of the US as a recipient declined in favour of the Asian countries, including China, and Europe. Only Singapore's pattern is different, arising from a very large decline in Malaysia's share of Singaporean FDI (from over 50% to less than 25% between 1985 and 1993). It is fairly clear that massive shifts in FDI can occur over relatively short periods of time. The boom in FDI into Europe in the early 1990s may have

Table 1.2 Destinations of outward investment-selected Asian origins (US$ m.)

Note: The above figures and those in Table 1.3 are collected from a variety of sources and are not comparable in absolute terms. However, they are indicative of changes in magnitude over time.

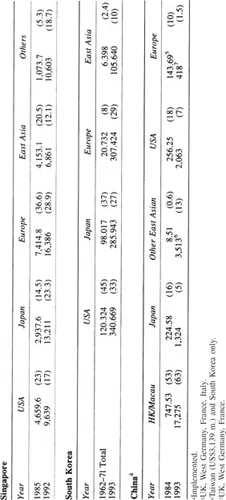

Table 1.3 Inward FDI in selected Asian destinations (US$ m.) (% share in brackets) (% share in brackets)

been induced by implementation of the Single Market and anticipatory fears of a Regional fortress. In the last two or three years there are indications of increasingly large switches into China despite Tiananmen.

Table 1.3 shows the magnitude and origins of FDI into Singapore, Korea and China. It shows clearly the massive increase in intra-regional FDI in less than a decade and, again, a decline in the US share. Both Table 1.2 and 1.3 confirm that there has been a significant increase in FDI, especially within the East Asia region, that Europe-East Asia investment is highly active in both directions and that this is growing.

Investment patterns are neither simple nor unidirectional. For example, between Hong Kong and China, capital is moving in both directions. Investment from Hong Kong to China is primarily in the traditional mature manufacturing sectors to take advantage of lower labour and land costs. Most of the manufacturing companies who have moved have closed their plants in Hong Kong. Increasingly, service firms are moving not only for cost advantage but also as support services following their mainly manufacturing clients. Investment from China to Hong Kong is primarily in the trade and financial services sectors: either to help emerging Chinese multinationals to engage with the world economy or to provide a backdoor for domestic capital to realize packages of benefits designed for foreign investors (sometimes known as round-trip investment). By far the greatest proportion of inward investment to China is from ‘overseas’ Chinese in Hong Kong, Macau and Taiwan, primarily a consequence of geographical and cultural proximity.

The complexity of FDI patterns reflects the different circumstances and objectives of firms. Analysts have identified a range of motivators, or determinants of FDI, none of which stands unique as a touchstone for understanding investment behaviour. Rather, the importance and relative ranking of these factors will vary from firm to firm, from time to time and from place to place. Most simply, in Porter's (1990) strategies in order to gain:

- Cost advantage. In this case firms seek to locate where production costs are low. Output may be exported, or re-exported in the case of semi-manufactures. Gaining cost advantage through relocation reinforces the product lifecycle view of FDI whereby firms transfer production to take advantage of growing demand in developing country markets for products which have matured in domestic and other developed markets. The process is seen on an accelerated scale within East Asia as firms move capital within the region and climb up the ‘development ladder': e.g. from Japan to the NIEs, from the NIEs to ASEAN countries, and from ASEAN to China, Vietnam, etc. This is known as flying geese investment.

- Differentiation advantage. Here companies seek access to specialist production factors, skill and expertise. Typically, this may be undertaken to facilitate technology transfer and is particularly likely to be accompanied by partnership or takeover arrangements with local firms. Examples include South Korean firms in Europe and even US firms in Taiwan (see Jocelyn Chen, chapter 4). In Singapore, government policy is active in encouraging centres of excellence, for example in silicon wafer technology, to attract incomers as well as to benefit domestic firms.

The actual decision to undertake FDI along the lines of the two generic strategies above may be precipitated by changes in socio-economic, political or legal conditions which can in turn be differentiated as ‘push’ or ‘pull’ factors. ‘Push’ factors typically describe increasingly adverse domestic conditions, such as tight labour markets (skill shortages, job-hopping and high wage costs), disadvantageous exchange rates, regulation and political instability. Economic ‘push’ factors are, especially in Asia, in business eyes often the unanticipated consequence of collective success. ‘Pull’ factors, conversely, result from increased attractiveness elsewhere. Examples are favourable changes in market proximity and growth, fiscal incentives, political risk, access to marketing channels, technology and information. Significant pull factors have emerged as a consequence of regionalization: firms try to realize the benefits of locating facilities within trading blocs rather than attempt to surmount ris...