eBook - ePub

Financial Market Risk

Cornelis Los

This is a test

Condividi libro

- 496 pagine

- English

- ePUB (disponibile sull'app)

- Disponibile su iOS e Android

eBook - ePub

Financial Market Risk

Cornelis Los

Dettagli del libro

Anteprima del libro

Indice dei contenuti

Citazioni

Informazioni sul libro

This new book uses advanced signal processing technology to measure and analyze risk phenomena of the financial markets. It explains how to scientifically measure, analyze and manage non-stationarity and long-term time dependence (long memory) of financial market returns. It studies, in particular, financial crises in persistent financial markets,

Domande frequenti

Come faccio ad annullare l'abbonamento?

È semplicissimo: basta accedere alla sezione Account nelle Impostazioni e cliccare su "Annulla abbonamento". Dopo la cancellazione, l'abbonamento rimarrà attivo per il periodo rimanente già pagato. Per maggiori informazioni, clicca qui

È possibile scaricare libri? Se sì, come?

Al momento è possibile scaricare tramite l'app tutti i nostri libri ePub mobile-friendly. Anche la maggior parte dei nostri PDF è scaricabile e stiamo lavorando per rendere disponibile quanto prima il download di tutti gli altri file. Per maggiori informazioni, clicca qui

Che differenza c'è tra i piani?

Entrambi i piani ti danno accesso illimitato alla libreria e a tutte le funzionalità di Perlego. Le uniche differenze sono il prezzo e il periodo di abbonamento: con il piano annuale risparmierai circa il 30% rispetto a 12 rate con quello mensile.

Cos'è Perlego?

Perlego è un servizio di abbonamento a testi accademici, che ti permette di accedere a un'intera libreria online a un prezzo inferiore rispetto a quello che pagheresti per acquistare un singolo libro al mese. Con oltre 1 milione di testi suddivisi in più di 1.000 categorie, troverai sicuramente ciò che fa per te! Per maggiori informazioni, clicca qui.

Perlego supporta la sintesi vocale?

Cerca l'icona Sintesi vocale nel prossimo libro che leggerai per verificare se è possibile riprodurre l'audio. Questo strumento permette di leggere il testo a voce alta, evidenziandolo man mano che la lettura procede. Puoi aumentare o diminuire la velocità della sintesi vocale, oppure sospendere la riproduzione. Per maggiori informazioni, clicca qui.

Financial Market Risk è disponibile online in formato PDF/ePub?

Sì, puoi accedere a Financial Market Risk di Cornelis Los in formato PDF e/o ePub, così come ad altri libri molto apprezzati nelle sezioni relative a Negocios y empresa e Negocios en general. Scopri oltre 1 milione di libri disponibili nel nostro catalogo.

Informazioni

Part I

Financial risk processes

1 Risk — asset class, horizon and time

1.1 Introduction

1.1.1 Classical market returns assumptions

Most investors, portfolio managers, corporate financial analysts, investment bankers, commercial bank loan officers, security analysts and bond-rating agencies are concerned about the uncertainty of the returns on their investment assets, caused by the variability in speculative market prices (market risk) and the instability of business performance (credit risk) (Alexander, 1999).1

Derivative instruments have made hedging of such risks possible. Hedging allows the selling of such risks by the hedgers, or suppliers of risk, to the speculators, or buyers of risk, but only when such risks are systematic, i.e., when they show a certain form of inertia or stability. Indeed, the current derivative markets are regular markets where “stable,” i.e., systematic risk is bought and sold.

Unfortunately, all these financial markets suffer from three major deficiencies:

(1) Risk is insufficiently measured by the conventional second-order moments (variances and standard deviations). Often one thinks it to be sufficient to measure risk by only second-order moments, because of the facile, but erroneous, assumption of normality (or Gaussianness) of the price distributions produced by the market processes of shifting demand and supply curves.

(2) Risk is assumed to be stable and all distribution moments are assumed to be invariant, i.e., the distributions are assumed to be stationary.

(3) Pricing observations are assumed to exhibit only serial dependencies, which can be simply removed by appropriate transformations, like the well-known Random Walk, Markov and ARIMA, or (G)ARCH models.

Based on these simplifying assumptions, investment analysis and portfolio theory have conventionally described financial market risk as a function of asset class only (Greer, 1997; Haugen, 2001, pp. 178–184). In a simplifying representation:

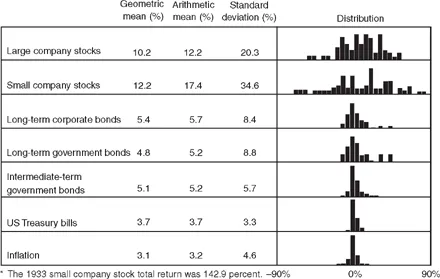

Figure 1.1 shows the familiar presentation of risk as a function of asset class by Ibbotson and Sinquefield, who have collected annual rates of return as far back

Figure 1.1 Historical average annual returns and return volatility, 1926–1995.

Source: Stocks, Bonds, Bills and Inflation 1996 Yearbook,™ Ibbotson Associates, Chicago (annually updates work by Roger G. Ibbotson and Rex A. Sinquefield). Used with permission. All rights reserved.

as 1926 (Ibbotson and Sinquefield, 1999). The dispersion of the return distributions, measured by the respective standard deviations, differs by six different asset classes:

(1) common stocks of large companies;

(2) common stocks of small firms;

(3) long-term corporate bonds;

(4) long-term US government bonds;

(5) intermediate-term US government bonds;

(6) US Treasury bills.

When an investor wants a higher return combined with more risk, he invests in small stocks. When he wants less risk and accepts a lower return, he is advised to invest in cash.

For example, Tobin (1958) made two strong assumptions, which were believed to be true by many followers: first, that the distributions of portfolio returns are all normally distributed and, second, that the relationship between the investors' portfolio wealth and the utility they derive it from is quadratic of form.2 Under these two conditions, Tobin proves that investors were allowed to choose between portfolios solely on the basis of expected return and variance. Moreover, his liquidity preference theory, shows that any investment risk level (as defined by the second moment of asset returns) can be attained by a linear combination of the market portfolio and cash, combined with the ability to hold short (borrow) and to hold long (invest). The market portfolio contains all the non-diversifiable systematic risk, while the cash represents the “risk-free” asset, of which the return compensates for depreciation of value caused by inflation. The linear combination of the market portfolio and cash can create any average return and any risk-premium one wants or needs, under the assumption that the distributions of these investment returns are mutually independent over time.

1.1.2 What's empirically wrong?

Regrettably, there are many things wrong with this oversimplified conceptualization and modeling of the financial markets and one has now become alarmingly obvious. Financial disasters are much more common and occur with much higher frequencies than they should be according to the classical assumptions. An incomplete but rather convincing listing of financial disasters can be found in Kindleberger (1996). Bernstein (1996) and Bassi et al. (1998) mention many additional instances.

The world's financial markets exhibit longer term pricing dependencies, which show, in aggregated and low frequency tra...