eBook - ePub

Financial Market Risk

Cornelis Los

This is a test

Buch teilen

- 496 Seiten

- English

- ePUB (handyfreundlich)

- Über iOS und Android verfügbar

eBook - ePub

Financial Market Risk

Cornelis Los

Angaben zum Buch

Buchvorschau

Inhaltsverzeichnis

Quellenangaben

Über dieses Buch

This new book uses advanced signal processing technology to measure and analyze risk phenomena of the financial markets. It explains how to scientifically measure, analyze and manage non-stationarity and long-term time dependence (long memory) of financial market returns. It studies, in particular, financial crises in persistent financial markets,

Häufig gestellte Fragen

Wie kann ich mein Abo kündigen?

Gehe einfach zum Kontobereich in den Einstellungen und klicke auf „Abo kündigen“ – ganz einfach. Nachdem du gekündigt hast, bleibt deine Mitgliedschaft für den verbleibenden Abozeitraum, den du bereits bezahlt hast, aktiv. Mehr Informationen hier.

(Wie) Kann ich Bücher herunterladen?

Derzeit stehen all unsere auf Mobilgeräte reagierenden ePub-Bücher zum Download über die App zur Verfügung. Die meisten unserer PDFs stehen ebenfalls zum Download bereit; wir arbeiten daran, auch die übrigen PDFs zum Download anzubieten, bei denen dies aktuell noch nicht möglich ist. Weitere Informationen hier.

Welcher Unterschied besteht bei den Preisen zwischen den Aboplänen?

Mit beiden Aboplänen erhältst du vollen Zugang zur Bibliothek und allen Funktionen von Perlego. Die einzigen Unterschiede bestehen im Preis und dem Abozeitraum: Mit dem Jahresabo sparst du auf 12 Monate gerechnet im Vergleich zum Monatsabo rund 30 %.

Was ist Perlego?

Wir sind ein Online-Abodienst für Lehrbücher, bei dem du für weniger als den Preis eines einzelnen Buches pro Monat Zugang zu einer ganzen Online-Bibliothek erhältst. Mit über 1 Million Büchern zu über 1.000 verschiedenen Themen haben wir bestimmt alles, was du brauchst! Weitere Informationen hier.

Unterstützt Perlego Text-zu-Sprache?

Achte auf das Symbol zum Vorlesen in deinem nächsten Buch, um zu sehen, ob du es dir auch anhören kannst. Bei diesem Tool wird dir Text laut vorgelesen, wobei der Text beim Vorlesen auch grafisch hervorgehoben wird. Du kannst das Vorlesen jederzeit anhalten, beschleunigen und verlangsamen. Weitere Informationen hier.

Ist Financial Market Risk als Online-PDF/ePub verfügbar?

Ja, du hast Zugang zu Financial Market Risk von Cornelis Los im PDF- und/oder ePub-Format sowie zu anderen beliebten Büchern aus Negocios y empresa & Negocios en general. Aus unserem Katalog stehen dir über 1 Million Bücher zur Verfügung.

Information

Part I

Financial risk processes

1 Risk — asset class, horizon and time

1.1 Introduction

1.1.1 Classical market returns assumptions

Most investors, portfolio managers, corporate financial analysts, investment bankers, commercial bank loan officers, security analysts and bond-rating agencies are concerned about the uncertainty of the returns on their investment assets, caused by the variability in speculative market prices (market risk) and the instability of business performance (credit risk) (Alexander, 1999).1

Derivative instruments have made hedging of such risks possible. Hedging allows the selling of such risks by the hedgers, or suppliers of risk, to the speculators, or buyers of risk, but only when such risks are systematic, i.e., when they show a certain form of inertia or stability. Indeed, the current derivative markets are regular markets where “stable,” i.e., systematic risk is bought and sold.

Unfortunately, all these financial markets suffer from three major deficiencies:

(1) Risk is insufficiently measured by the conventional second-order moments (variances and standard deviations). Often one thinks it to be sufficient to measure risk by only second-order moments, because of the facile, but erroneous, assumption of normality (or Gaussianness) of the price distributions produced by the market processes of shifting demand and supply curves.

(2) Risk is assumed to be stable and all distribution moments are assumed to be invariant, i.e., the distributions are assumed to be stationary.

(3) Pricing observations are assumed to exhibit only serial dependencies, which can be simply removed by appropriate transformations, like the well-known Random Walk, Markov and ARIMA, or (G)ARCH models.

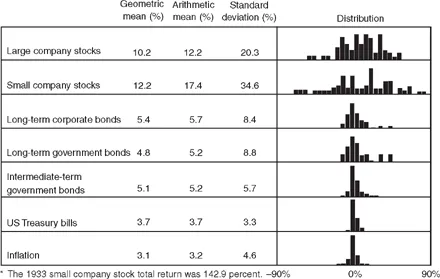

Based on these simplifying assumptions, investment analysis and portfolio theory have conventionally described financial market risk as a function of asset class only (Greer, 1997; Haugen, 2001, pp. 178–184). In a simplifying representation:

Figure 1.1 shows the familiar presentation of risk as a function of asset class by Ibbotson and Sinquefield, who have collected annual rates of return as far back

Figure 1.1 Historical average annual returns and return volatility, 1926–1995.

Source: Stocks, Bonds, Bills and Inflation 1996 Yearbook,™ Ibbotson Associates, Chicago (annually updates work by Roger G. Ibbotson and Rex A. Sinquefield). Used with permission. All rights reserved.

as 1926 (Ibbotson and Sinquefield, 1999). The dispersion of the return distributions, measured by the respective standard deviations, differs by six different asset classes:

(1) common stocks of large companies;

(2) common stocks of small firms;

(3) long-term corporate bonds;

(4) long-term US government bonds;

(5) intermediate-term US government bonds;

(6) US Treasury bills.

When an investor wants a higher return combined with more risk, he invests in small stocks. When he wants less risk and accepts a lower return, he is advised to invest in cash.

For example, Tobin (1958) made two strong assumptions, which were believed to be true by many followers: first, that the distributions of portfolio returns are all normally distributed and, second, that the relationship between the investors' portfolio wealth and the utility they derive it from is quadratic of form.2 Under these two conditions, Tobin proves that investors were allowed to choose between portfolios solely on the basis of expected return and variance. Moreover, his liquidity preference theory, shows that any investment risk level (as defined by the second moment of asset returns) can be attained by a linear combination of the market portfolio and cash, combined with the ability to hold short (borrow) and to hold long (invest). The market portfolio contains all the non-diversifiable systematic risk, while the cash represents the “risk-free” asset, of which the return compensates for depreciation of value caused by inflation. The linear combination of the market portfolio and cash can create any average return and any risk-premium one wants or needs, under the assumption that the distributions of these investment returns are mutually independent over time.

1.1.2 What's empirically wrong?

Regrettably, there are many things wrong with this oversimplified conceptualization and modeling of the financial markets and one has now become alarmingly obvious. Financial disasters are much more common and occur with much higher frequencies than they should be according to the classical assumptions. An incomplete but rather convincing listing of financial disasters can be found in Kindleberger (1996). Bernstein (1996) and Bassi et al. (1998) mention many additional instances.

The world's financial markets exhibit longer term pricing dependencies, which show, in aggregated and low frequency tra...