![]()

Part 1

Why the Research and Original Approach Are Valid Today

![]()

Chapter 1

Building a Long-Term Career

You’re in Control

What is it about a sales career in financial services that attracts people? The magnitude and range of skills required to succeed are clearly daunting. Yet, the career continues to attract a steady stream of energetic, entrepreneurial people. What is the appeal? The answer is the unique combination of rewards the career offers, such as:

• Potential of financial rewards

• Independence

• An opportunity to truly help people in a significant way

• Intellectual stimulation

Rewards and Opportunities

Financial Potential

Many believe the financial potential of this career is “unlimited.” Perhaps this is a bit of a stretch, but it is clear that a financial service professional can earn compensation in direct proportion to his or her talent and effort. Think about it. Most career opportunities have clear limits on what someone can earn in a given time period. How many other careers are as free from the restrictions of internal corporate politics? In most financial services companies the territories, markets, and types of accounts are open to every producer. It’s really you and the world – you’re in control! The opportunity to achieve is truly exceptional.

Earnings Commensurate with Your Talent and Effort

Personal Independence

The American essayist Christopher Morley once wrote, “There is only one success…to be able to spend your life in your own way.” It appears that most people who are attracted to the financial services industry have a strong desire to be self-directed and captain of their own ship. Experienced, successful financial service professionals have an unusual amount of independence in the structuring of their professional lives. They control their own calendars and time schedules. They have the luxury of being able to choose their own travel commitments. They can schedule around family events and, to a large extent, control their own destiny.

The initial relationship between you and your company is one of interdependence.

As success is earned, so is increased independence. Perhaps it would be more accurate to describe the initial relationship between new financial service professionals and their companies as one of interdependence. Nonetheless, the combination of earning potential and independence creates an opportunity for personal freedom that few careers can match.

An Opportunity to Be of Service to Others

Another appealing feature of a financial services career is the genuine opportunity to help other people in a significant way. It is difficult to overstate the human benefit that flows from your work. Programs providing an intelligent mix of insurance and investments provide both peace of mind and personal confidence. Knowing that the financial well being of one’s family and business is protected is both satisfying and enormously important. Furthermore, your contribution to your clients’ future doesn’t stop with the immediate family. It flows through generations and has a lasting mark on the course of the lives of children and grandchildren. Communities also benefit through capital accumulation and business longevity. The financial service professional truly makes a substantial and lasting difference in many, many lives.

Your contribution to your Clients’ financial security will flow through generations.

Continual Intellectual Stimulation and Challenge

Finally, the ever-changing nature of the economy, tax laws, and the industry offer continual intellectual stimulation. While this career choice is not without its challenges, it is never boring.

The Client Building Philosophy

The Profit Is in the Relationship, Not in the Sale

The key to achieving this combination of compensation, individual freedom, and service to others centers around the process of obtaining and sustaining a client base. Clients – not just sales – bring both freedom and the opportunity to be of genuine service.

Who, then, is a Client? A Client is a person, household or business that has purchased insurance or other financial products as a result of an in-depth Fact Finding Interview. In other words, a Client is a paying entity in which the decision maker has a relationship with you that is based upon a thorough discussion of his or her situation. A Client is probably best defined not by what he or she has bought, but by the process that was used to determine the appropriate purchase. Simply put, a Client is someone who has shared personal and financial information with you and feels a sense of trust and continuity into the future. A Client is considered to be active when he or she is likely to buy from you again as his or her situation changes over time.

You know you have a true Client when, if asked whether they have a trusted financial professional, they name you!

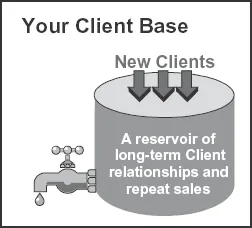

What is a client base? Since Active Clients are people or businesses that will continue to buy from you in the future, a client base is best viewed as a reservoir of long-term relationships and repeat sales. Unfortunately, the reservoir is somewhat leaky. That is, Clients die, move, divorce or are lured away. Some just become satisfied and saturated, so steady but slow attrition is inevitable. The goal is to fill the reservoir with new Clients faster than the reservoir drains.

Client vs. Policyholder or Investment Account Holder

A Client, in One Card System (OCS) terminology, is not the same as a policyholder or investment account owner. A policyholder or account owner is a person who has engaged in a sales transaction with a producer but feels no particular sense of trust or loyalty. This person often buys a product focusing on cost or ...