![]()

APPENDIX: A FORMAL MODEL

A.1 THE BASIC MODEL

I first exposit a simple model to illustrate the role of costly shorting and differences in beliefs in generating bubbles and the association between bubbles and trading. Consider four periods t = 1, 2, 3, 4; a single good; and a single risky asset in finite supply S. In addition to the risky asset, there also exists a risk-free technology. An investment of δ ≤ 1 units of the good in the risk-free technology at t yields one unit in period t + 1. Assume there are a large number of risk-neutral investors that only value consumption in the final period t = 4. Each investor is endowed with an amount W0 of the good.

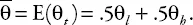

The risky asset produces dividends at times t = 2, 3, 4. At each t = 2, 3, 4 each unit of the risky asset pays a dividend θt Є {θl, θh} with θh > θl. In what follows, I will refer to θh (θl) as the high (resp. low) dividend. Dividends at any t are independent of past and future dividends.1 The probability that θt = θl is .5, and we write

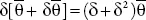

Assets are traded at t = 1, 2, 3, 4. If a dividend is paid in period t, trading occurs after the dividend is distributed—that is, the asset trades ex-dividend and the buyer of the asset in period t has the rights to all dividends from time t + 1 on. Thus in the final period t = 4, the price of the asset p4 = 0, since there are no dividends paid after period 4. The price at time t = 1, 2, 3 depends on the expectations of investors regarding the dividends to be paid in the future. We first calculate the willingness to pay of a “rational” risk-neutral investor that is not allowed to resell the asset after she buys it. Since the investor is risk-neutral, at time t = 3 she is willing to pay for a unit of the asset. In the absence of resale opportunities, at t = 2, the rational investor is willing to pay . Finally, at t = 1 that same rational investor with no resale opportunities would be willing to pay In addition, we suppose that at each t = 1, 2, 3, a signal st is observed after the dividend at t (if t > 1) is observed but before trading occurs at t. Each signal st assumes one of three values {0, 1, 2}, is independent of past realizations of the signal and of the dividends, and has no predictive power for future dividends. Thus the signal st is pure noise. There are, however, two sets of investors, A and B. Each set has many investors. Agents in group A are rational and understand that the distribution of future dividends is independent of st. Agents in B actually believe that st predicts θt+1 and that the probability that θt+1 = θh given st is:

Thus agents in group B believe that the probability of a high dividend at t +1 increases with the observed st and that when st = 0(st = 2), θt+1 = θl(resp. θt+1 = θh) is more probable. All agents agree that st does not help predict θt+j for j≥2, and thus the only disagreement among investors is whether st can predict θt+1. To make agents in set B correct on average, and thus assure that ex-ante there are no optimistic or pessimistic investors, assume that the probability that st = 0 equals the probability that st = 2. Write q.<5 for this common probability, and observe that the probability that st = 1 is 1 − 2q>0.

In the case of binary random variables, forecasts have minimal precision2 when the probability of each realization is 1/2. This is exactly the forecast of rational agents here. Agents in group B, after observing st = 1, also have the same minimal forecast precision. However, if they observe st = 0 or st = 2 they employ forecasts that have higher precision, since they (mistakenly) believe that one of the two possible events has a probability of 3/4. In this sense agents in group B have an exaggerated view of the precision of their beliefs.

At time t = 3, rational agents in group A are wil...