eBook - ePub

Problems in Portfolio Theory and the Fundamentals of Financial Decision Making

Leonard C MacLean, William T Ziemba

This is a test

- 212 pagine

- English

- ePUB (disponibile sull'app)

- Disponibile su iOS e Android

eBook - ePub

Problems in Portfolio Theory and the Fundamentals of Financial Decision Making

Leonard C MacLean, William T Ziemba

Dettagli del libro

Anteprima del libro

Indice dei contenuti

Citazioni

Informazioni sul libro

-->

This book consists of invaluable introductions, tutorials and problems which are helpful for teaching purposes and have a very broad appeal and usage. The problems cover many aspects of static and dynamic portfolio theory as well

Domande frequenti

Come faccio ad annullare l'abbonamento?

È semplicissimo: basta accedere alla sezione Account nelle Impostazioni e cliccare su "Annulla abbonamento". Dopo la cancellazione, l'abbonamento rimarrà attivo per il periodo rimanente già pagato. Per maggiori informazioni, clicca qui

È possibile scaricare libri? Se sì, come?

Al momento è possibile scaricare tramite l'app tutti i nostri libri ePub mobile-friendly. Anche la maggior parte dei nostri PDF è scaricabile e stiamo lavorando per rendere disponibile quanto prima il download di tutti gli altri file. Per maggiori informazioni, clicca qui

Che differenza c'è tra i piani?

Entrambi i piani ti danno accesso illimitato alla libreria e a tutte le funzionalità di Perlego. Le uniche differenze sono il prezzo e il periodo di abbonamento: con il piano annuale risparmierai circa il 30% rispetto a 12 rate con quello mensile.

Cos'è Perlego?

Perlego è un servizio di abbonamento a testi accademici, che ti permette di accedere a un'intera libreria online a un prezzo inferiore rispetto a quello che pagheresti per acquistare un singolo libro al mese. Con oltre 1 milione di testi suddivisi in più di 1.000 categorie, troverai sicuramente ciò che fa per te! Per maggiori informazioni, clicca qui.

Perlego supporta la sintesi vocale?

Cerca l'icona Sintesi vocale nel prossimo libro che leggerai per verificare se è possibile riprodurre l'audio. Questo strumento permette di leggere il testo a voce alta, evidenziandolo man mano che la lettura procede. Puoi aumentare o diminuire la velocità della sintesi vocale, oppure sospendere la riproduzione. Per maggiori informazioni, clicca qui.

Problems in Portfolio Theory and the Fundamentals of Financial Decision Making è disponibile online in formato PDF/ePub?

Sì, puoi accedere a Problems in Portfolio Theory and the Fundamentals of Financial Decision Making di Leonard C MacLean, William T Ziemba in formato PDF e/o ePub, così come ad altri libri molto apprezzati nelle sezioni relative a Negocios y empresa e Finanzas. Scopri oltre 1 milione di libri disponibili nel nostro catalogo.

Informazioni

Argomento

Negocios y empresaCategoria

FinanzasSECTION F: DYNAMIC PORTFOLIO THEORY AND ASSET ALLOCATION

The components of financial decision making are financial assets, trading prices, wealth preferences, decision sets, dominance and efficiency. There is a rich literature on financial decision models, where variations on the components are proposed. Some of the models are considered in this final section. Most of the discussion concerns negative power/log utility functions and the associated capital growth. Within the framework of expected utility theory significant qualitative properties of decision behavior can be developed analytically for negative power utility, with log being the most risky power utility function.

An asset class is a group of securities that exhibit similar characteristics, behave similarly in the marketplace, and are subject to the same laws and regulations. The three main asset classes are equities (stocks), fixed income (bonds) and cash equivalents (money market instruments). Additionally, currencies, commodities, real estate and gold are separate asset classes. Asset allocation refers to the specific asset by asset proportional weight in a portfolio.

Strategic asset allocation is passive and describes the practice of creating a portfolio with a mix of assets whose parameters will remain relatively stable over the long term. Because asset prices fluctuate, investors and investment managers may set criteria for rebalancing to the pre-set targets. With a fixed mix, the asset to asset proportions remain constant despite market fluctuation which requires periodic rebalancing.

Tactical asset allocation is active and essentially takes a strategic asset allocation and regularly adjusts it for changing market conditions subject to various forecasts. The premise is that by doing this, one can optimize market exposure to maximize risk-adjusted returns. The primary difference between strategic and tactical asset allocation is active investment management and the belief that it is possible to “beat” the market.

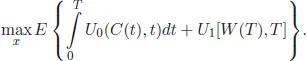

Consider the decision framework, where the investor makes investment decisions constrained by market conditions and capital requirements. The objective is to invest available capital X(t) and consume C(t) in each period, where investment generates wealth, (X(1), . . . ,X(t − 1)) → W(t), through the return on investment, is

The change in wealth from investment in period t is a geometric process governed by a standard diffusion (random walk) and a jump process. The incremental budget condition is

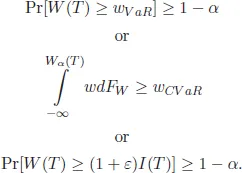

In addition to investment and consumption decisions being constrained by the available capital, the investor may have financial requirements or goals/targets to meet at the horizon such as:

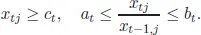

Finally, there also may be limits placed on trading which constrain decisions, e.g., short selling and rebalancing.

The functions defining the decision model are presented in continuous time, but differencing and summation operators could replace the differential and integral. The richest formulations are discrete time stochastic dynamic models which are solved with multi-period stochastic programming (Ziemba, 2003). The continuous time models yield qualitative results which are useful for characterizing decision behavior.

The utility function is overconsumption at each time period and a bequest function of final wealth. Typically these functions are assumed to be concave risk averse. In the models presented in chapters included in this section, either U0 ≡ 0 or U1 ≡ 0.

The budget constraint defines the change in wealth from the returns on investment and the consumption at each time period. The returns have a diffusive process component (x′(α − re)+ r)W dt, and a point process (shock) component θtdNt(λt). The diffusion is geometric Brownian motion (or a geometric random walk) and the point process is a type of Poisson process. An important feature of the point process is the dependence of the shock intensity on market conditions. This generates clusters of up/down shocks (Consigli et al. 2009). Alternatively, the ...

Indice dei contenuti

Stili delle citazioni per Problems in Portfolio Theory and the Fundamentals of Financial Decision Making

APA 6 Citation

MacLean, L., & Ziemba, W. (2016). Problems in Portfolio Theory and the Fundamentals of Financial Decision Making ([edition unavailable]). World Scientific Publishing Company. Retrieved from https://www.perlego.com/book/852551/problems-in-portfolio-theory-and-the-fundamentals-of-financial-decision-making-pdf (Original work published 2016)

Chicago Citation

MacLean, Leonard, and William Ziemba. (2016) 2016. Problems in Portfolio Theory and the Fundamentals of Financial Decision Making. [Edition unavailable]. World Scientific Publishing Company. https://www.perlego.com/book/852551/problems-in-portfolio-theory-and-the-fundamentals-of-financial-decision-making-pdf.

Harvard Citation

MacLean, L. and Ziemba, W. (2016) Problems in Portfolio Theory and the Fundamentals of Financial Decision Making. [edition unavailable]. World Scientific Publishing Company. Available at: https://www.perlego.com/book/852551/problems-in-portfolio-theory-and-the-fundamentals-of-financial-decision-making-pdf (Accessed: 14 October 2022).

MLA 7 Citation

MacLean, Leonard, and William Ziemba. Problems in Portfolio Theory and the Fundamentals of Financial Decision Making. [edition unavailable]. World Scientific Publishing Company, 2016. Web. 14 Oct. 2022.