Corporate Fraud Handbook

Prevention and Detection

Joseph T. Wells

- English

- ePUB (disponibile sull'app)

- Disponibile su iOS e Android

Corporate Fraud Handbook

Prevention and Detection

Joseph T. Wells

Informazioni sul libro

Delve into the mind of a fraudster to beat them at their own game

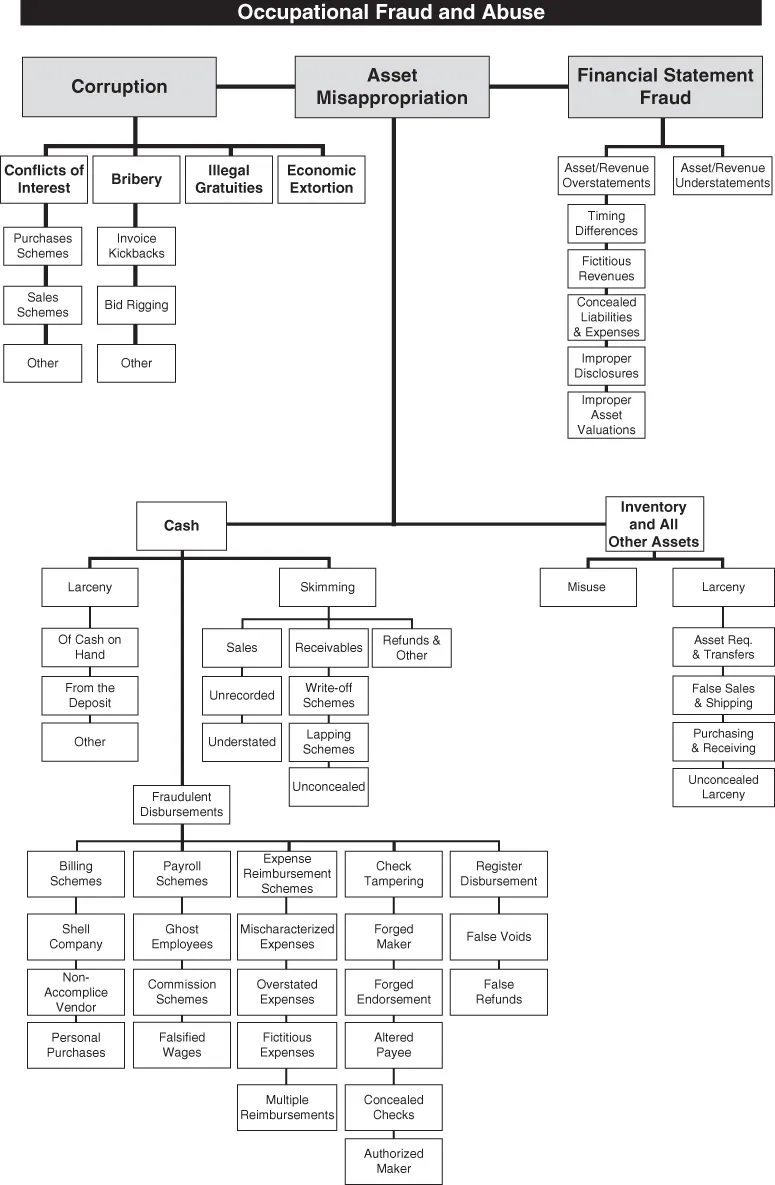

Corporate Fraud Handbook details the many forms of fraud to help you identify red flags and prevent fraud before it occurs. Written by the founder and chairman of the Association of Certified Fraud Examiners (ACFE), this book provides indispensable guidance for auditors, examiners, managers, and criminal investigators: from asset misappropriation, to corruption, to financial statement fraud, the most common schemes are dissected to show you where to look and what to look for. This new fifth edition includes the all-new statistics from the ACFE 2016 Report to the Nations on Occupational Fraud and Abuse, providing a current look at the impact of and trends in fraud. Real-world case studies submitted to the ACFE by actual fraud examiners show how different scenarios play out in practice, to help you build an effective anti-fraud program within your own organization. This systematic examination into the mind of a fraudster is backed by practical guidance for before, during, and after fraud has been committed; you'll learn how to stop various schemes in their tracks, where to find evidence, and how to quantify financial losses after the fact.

Fraud continues to be a serious problem for businesses and government agencies, and can manifest in myriad ways. This book walks you through detection, prevention, and aftermath to help you shore up your defenses and effectively manage fraud risk.

- Understand the most common fraud schemes and identify red flags

- Learn from illustrative case studies submitted by anti-fraud professionals

- Ensure compliance with Sarbanes-Oxley and other regulations

- Develop and implement effective anti-fraud measures at multiple levels

Fraud can be committed by anyone at any level—employees, managers, owners, and executives—and no organization is immune. Anti-fraud regulations are continually evolving, but the magnitude of fraud's impact has yet to be fully realized. Corporate Fraud Handbook provides exceptional coverage of schemes and effective defense to help you keep your organization secure.

Domande frequenti

Informazioni

CHAPTER 1

Introduction

DEFINING OCCUPATIONAL FRAUD AND ABUSE

Defining Fraud

- A material false statement

- Knowledge that the statement was false when it was uttered

- Reliance of the victim on the false statement

- Damages resulting from the victim's reliance on the false statement

One who owes to another the duties of good faith, trust, confidence, and candor.

A relationship in which one person is under a duty to act for the benefit of the other on matters within the scope of the relationship. Fiduciary relationships—such as trustee‐beneficiary, guardian‐ward, agent‐principal, and attorney‐client—require the highest duty of care.3