Wiley Revenue Recognition

Understanding and Implementing the New Standard

Joanne M. Flood

- English

- ePUB (disponibile sull'app)

- Disponibile su iOS e Android

Wiley Revenue Recognition

Understanding and Implementing the New Standard

Joanne M. Flood

Informazioni sul libro

Everything you need to understand and implement the new converged FASB-IASB revenue recognition standard

Wiley Revenue Recognition provides an overview of the new revenue recognition standard and instructs financial statement preparers step-by-step through the new model, providing numerous, helpful application examples along the way. Readers will grasp the many new disclosures that will be required through the use of detailed explanations and useful samples, while electronic tools will be available to aid the preparer in implementing the standards and making the proper disclosures.

The Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) are in the final stages of a decade-long project to clarify and converge revenue recognition standards. This new principles-based standard—which will affect the business practices of virtually every company worldwide—is designed to serve as one model applied consistently across most industries. This book guides professionals through the new standard.

- Offers a full explanation of over forty topics superseded by the new standard

- Includes digital ancillaries featuring measurement tools and GAAP and IFRS Disclosure Checklists

- Provides all the tools needed to implement the new revenue recognition standard

- Covers how the structure of contracts will be affected

Wiley Revenue Recognition is a trusted, authoritative guide to the new FASB-IASB revenue recognition standard for CPAs and financial professionals worldwide.

Domande frequenti

Informazioni

1

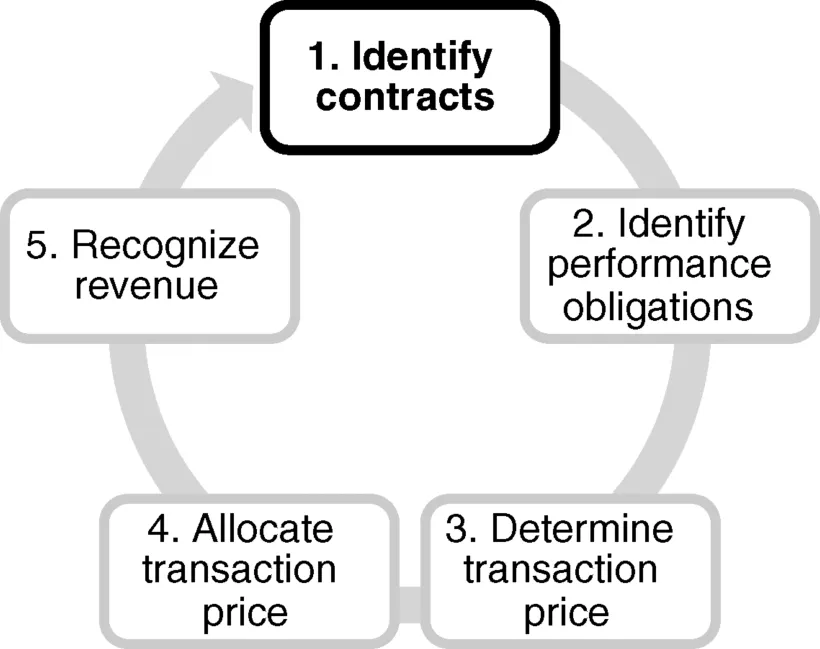

Step 1—Identify the Contract with the Customer1

- Overview

- Assessing Whether Contracts are Within the Scope of the Standard

- Enforceable Rights and Obligations

- The Five Contract Criteria

- The Contract has Approval and Commitment of the Parties

- Example 1.1: Oral Contract

- Example 1.2: Product Delivered, but No Written Contract Exists

- Example 1.3: Contract Extension

- Example 1.4: Meeting the Termination Criteria

- Rights of the Parties are Identifiable

- Payment Terms are Identifiable

- The Contract has Commercial Substance

- Collectibility of Consideration is Probable

- Collectibility Threshold

- Comparison with Legacy Guidance

- Differences between IFRS and U.S. GAAP

- Assessing Collectibility

- Judgment

- Timing of Assessment

- Collectibility = Intent and Ability to Pay

- Consider Only Transaction Price

- Basis of Assessment May Be Less than Total Consideration

- Example 1.5: Assessing Collectibility—Implied Price Concession

- Example 1.6: Assessing Collectibility—Meeting the Collectibility Threshold

- Contract Recognition

- Arrangements where Contract Criteria are not Met

- Example 1.7: No Contract Exists—Accounting for Consideration Received

- Reassessment

- The Portfolio Approach and Combining Contracts

- A Practical Expedient

- Combination of Contracts Required

- Assessing Collectibility of a Portfolio of Contracts

- Identifying the Customer

- Collaborative Arrangements

- Example 1.8: Collaborative Arrangement

- Arrangements with Multiple Parties

Overview

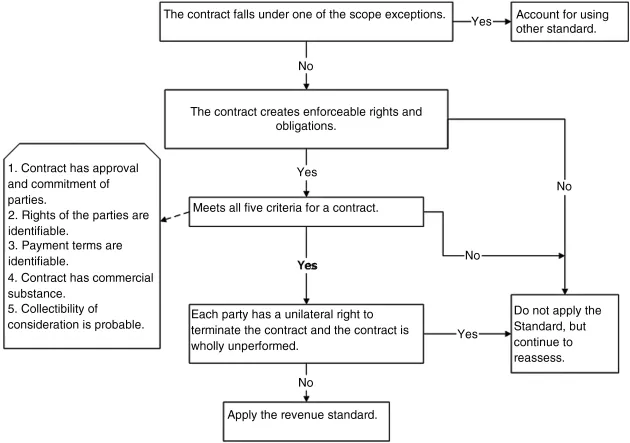

Assessing Whether Contracts are Within the Scope of the Standard

- create enforceable rights and obligations, and

- meet the five criteria listed in the Standard.

Enforceable Rights and Obligations

- is a matter of law

- varies across legal jurisdictions, industries, and entities

- may vary within an entity

- may depend on the class of customer or nature of goods or services.

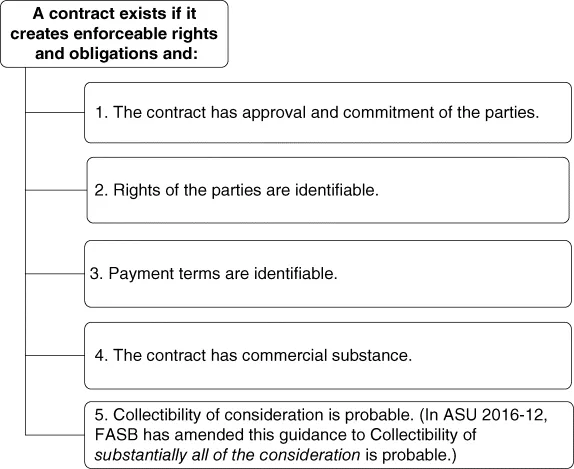

The Five Contract Criteria

The Contract has Approval and Commitment of the Parties

- written,

- oral, or

- implied by the entity's customary business practice.