The Handbook of Technical Analysis + Test Bank

The Practitioner's Comprehensive Guide to Technical Analysis

Mark Andrew Lim

- English

- ePUB (disponibile sull'app)

- Disponibile su iOS e Android

The Handbook of Technical Analysis + Test Bank

The Practitioner's Comprehensive Guide to Technical Analysis

Mark Andrew Lim

Informazioni sul libro

A self study exam preparatory guide for financial technical analysis certifications

Written by the course director and owner of www.tradermasterclass.com, a leading source of live and online courses in trading, technical analysis, and money management, A Handbook of Technical Analysis: The Practitioner's Comprehensive Guide to Technical Analysis is the first financial technical analysis examination preparatory book in the market. It is appropriate for students taking IFTA CFTe Level I and II (US), STA Diploma (UK), Dip TA (Aus), and MTA CMT Level I, II, and III exams in financial technical analysis, as well as for students in undergraduate, graduate, or MBA courses.

The book is also an excellent resource for serious traders and technical analysts, and includes a chapter dedicated to advanced money management techniques. This chapter helps complete a student's education and also provides indispensable knowledge for FOREX, bond, stock, futures, CFD, and option traders.

- Learn the definitions, concepts, application, integration, and execution of technical-based trading tools and approaches

- Integrate innovative techniques for pinpointing and handling market reversals

- Understand trading mechanisms and advanced money management techniques

- Examine the weaknesses of popular technical approaches and find more effective solutions

The book allows readers to test their current knowledge and then check their learning with end-of-chapter test questions that span essays, multiple choice, and chart-based annotation exercises. This handbook is an essential resource for students, instructors, and practitioners in the field. Alongside the handbook, the author will also publish two full exam preparatory workbooks and a bonus online Q&A Test bank built around the most popular professional examinations in financial technical analysis.

Domande frequenti

CHAPTER 1

Introduction to the Art and Science of Technical Analysis

LEARNING OBJECTIVES

- Understand the key concepts underlying technical analysis

- Identify the different forms of chart analysis

- Describe the objectives of technical analysis

- Understand what subjectivity means in technical analysis

- Recognize the strengths and weaknesses of technical analysis

- Categorize market participants according to style and time in markets

- Identify the various styles and approaches in technical analysis

1.1 MAIN OBJECTIVE OF TECHNICAL ANALYSIS

- The instinct to survive

- The instinct for comfort

- The instinct to propagate

- The instinct to stay alive

- The instinct to satisfy hunger

- The instinct to seek safety, that is, being in a group/herd

- The instinct to avoid danger (by having natural fears like the fear of fire, loud sounds, heights, etc.)

1.2 DUAL FUNCTION OF TECHNICAL ANALYSIS

- For Identification: It identifies and describes past and present price action. It serves as a historical record of what has transpired in the markets. It provides a descriptive representation of market action. This allows the market practitioner to observe how the market has performed in the past, which includes its average volatility over a specified period; its highest and lowest historical price extremes; the common areas of consolidation, average duration, and price excursion of trends; the amount of liquidity and participation in the markets; the average degree and frequency of price gapping; the impact of various monetary economic announcements on price, and so on. This information is especially critical prior to any investment or trading decision.

- For Forecasting: Once a particular price or market action is identified, the practitioner may now use this information to interpret what the data actually means before inferring future price action. This inference about potential price action is wholly based on the assumption that price patterns are repetitive to some reasonable degree and therefore may be used as a basis for price predictions.

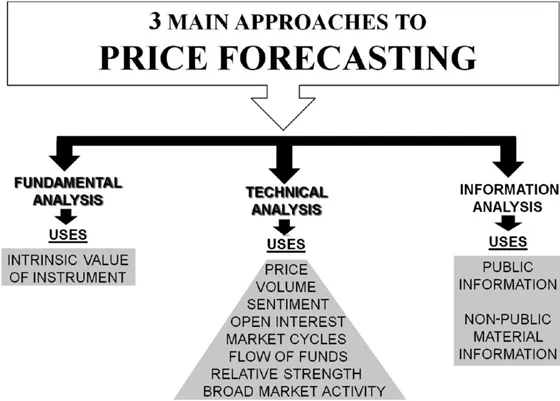

1.3 FORECASTING PRICE AND MARKET ACTION

- Fundamental Analysis

- Technical Analysis

- Information Analysis