eBook - ePub

Never Mind the Sizzle...Where's the Sausage?

Branding based on substance not spin

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

Are you looking for a branding book that's a bitdifferent? You've found it. Never Mind the Sizzle... is an irreverent story packed full of practical tips, tricks and tools that reveal how to cut through the bull and buzzwords of branding, get deep insight into your customers, create a big brand idea, get your boss on board, win the consumer's heart and mind and stand out from the crowd. Join the blog at wheresthesausage.com!

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Never Mind the Sizzle...Where's the Sausage? by David Taylor in PDF and/or ePUB format, as well as other popular books in Business & Marketing. We have over one million books available in our catalogue for you to explore.

Information

Quarter Two

FROM INSIGHT TO BRAND VISION

4.

April — Be the consumer (don’t over-rely on research)

DO NOT DISTURB: ARTIST AT WORK (TUESDAY, APRIL 3)

This morning I decided to test out Hugo’s ‘open-door’ policy with a question about the rationale for going after young urban consumers not families. I found his door firmly closed and waited outside for 15 minutes, during which time Hugo was engrossed in a heated phone conversation. Even with the door closed I could hear him screaming McEnroe-like that he simply could not believe it. I wondered if the latest monthly market share results were the subject of his anger, as they didn’t make pretty reading; we’d lost another share point, making it 20 consecutive months of decline.

I knocked on the door and popped my head tentatively around, summoning up my best brand-speak to ask Hugo if I could ‘bounce an idea’ off him. He motioned for me to enter as he marched up and down in disgust. Seeking to show solidarity, I suggested optimistically that our market share had perhaps hit the bottom. Hugo stopped pacing, frowned and looked at me with a confused expression. Seems that share results were the last thing on his mind. His anger was caused by ETC only getting upper circle tickets for the Royal Opera House performance of La Bohème, not the stall seats he was used to. Our conversation continued in the artistic vein when I voiced my concerns about how interested young urban consumers would be in our brand. Hugo replied that Picasso didn’t ask people what they wanted before painting his next masterpiece; he created and the adoring public followed. And the same thing would happen with the Simpton’s ‘brand renaissance’. He suggested that if I wanted to discuss something as mundane as consumers, then I should take it up with Jane.

When I asked Jane about our consumer target, she picked the brand pyramid off the wall and read out what was written with the same enthusiasm as Amy practising her 12 times tables. When I complained that I was having problems understanding who this consumer really was, Jane perked up and said that she did have a solution. She had organized some focus groups later in the week to explore concepts for our new pizza, and I was welcome to come along. On the question about whether our current customers weren’t families, Jane said she’d ask Brian to get some data for us.

THE MAN IN THE MIRROR (THURSDAY, APRIL 5)

Spent this evening sitting through the focus groups, and it was certainly an eventful affair. It also saved me from a night out with the pushy parents from Amy’s class at school. It’s one thing to nod a polite hello to them in the playground, it’s another thing altogether to listen to them droning on and on about how proud they are that their precious little offspring speaks fluent Japanese, rides a pony bare-back and prefers Shakespeare to the Simpson’s.

The venue for the research was conveniently located close to the Royal Opera House, where Hugo and the ETC team headed off just as the first group was starting. This left Jane, Brian and myself sitting behind the one-way mirror that allowed us to see the eight ladies sat in a circle eating soggy sandwiches, without them seeing us. The mirror was so convincing that one of the ladies came right up close to look in it and adjust her hairstyle.

After the focus group participants had helped themselves to an extra large glass of free wine, Susy the ‘moderator’ who was running the session kicked things off. She asked everyone to say what sort of animal they would like to be, in an attempt to break the ice. However, the exercise clearly left the participants bemused, being something of a mental double-somersault with a back-flip when most of them looked barely capable of a lazy forward roll. Susy took the hint and moved the conversation onto sausages.

I know the ladies were all getting paid £30 for their trouble, but boy did they earn it. Susy was asking them to remember in vivid detail their last sausage-cooking experience, which for some of them was a few weeks ago. She reminded me of an irritatingly inquisitive toddler in the way she responded to every answer with ‘why?’. I thought at one point she was going to grab the table lamp and shine it in the eyes of one of the less responsive ladies to cajole her into baring more of her soul. It all seemed rather artificial and forced. I asked Jane what she could remember about her last sausage-cooking experience, at which point she reddened with embarrassment and tried to divert my attention by offering me another cold beer. I accepted the beer, but didn’t let Jane off the hook. She owned up that she never ate sausages. Ever. I had a horrible feeling she wasn’t the only one on the team like this, and I

pointed with my beer bottle towards Brian. Jane shook her head and mouthed the word ‘veggie’. It turns out the one team member who did eat the occasional sausage was Hugo. Jane told me he was rather fond of the bangers and mash served at his favourite upmarket eatery, the Ivy.

Susy had worked her way through the first part of her interrogation, sorry questionnaire, made up of general questions about buying and cooking sausages. She proudly summarized the 20-step process that they had come up with together. Could it really be that complicated, I wondered? Jane enthusiastically noted down all 20 steps in the form of little interconnected bubbles, so she obviously found it useful. But I had the impression that the people there had come up with such a complex process because they had been asked to, and they wanted to please Susy.

It was then time to get onto the main subject of the evening: concepts for the new pizza range. Jane handed me a stapled set of ten A4 pages, each with several dense paragraphs of text. After reading the first three of these I was confused, and I worked on the brand team. They were very dry, complicated and all seemed to be very similar. The ladies in the group seemed to agree with me, and on seeing the second board one of them complained that she didn’t like ‘the advert’. Susy turned slowly to face her, her jaws clenched together so hard that little dimples appeared in her cheeks. She explained through gritted teeth that these were not adverts, they were concepts. I knew what the poor lady was going to reply, and felt like one of those bodyguards who throw themselves in the line of fire when someone tries to shoot the President of the United States. But I was too late. She asked in a whisper the question on the lips of the other seven ladies: ‘What’s a concept?’ Susy threw down the board in disgust and stormed out of the room in a huff, saying that she couldn’t work with this sort of consumer.

SEEING CONSUMERS IN 3-D (TUESDAY, APRIL 10)

Went into London for a meeting with INK to discuss the ramifications of the focus group debacle on the pizza packaging. After the meeting finished I headed over to the City to meet my mate Tom at Fresh Italy, the chain of shops he runs that sell fresh, fast Italian food. Fresh pasta, risotto and the like, all cooked in front of you by chefs. I also got three new ideas about what this consumer insight thing was all about.

By the time I got there at 1pm the place was heaving with the lunchtime rush hour. Tom was busy talking to one of his team, so I joined the queue and looked up at the menu to pick what I would have. As I got to the front a young woman walked straight past me, grabbed a bag that was sitting on the counter and strode off without paying. I was about to run after the woman and demand she pay, when Tom came up to the counter to serve me. When I told him about the lady who had done a runner, he laughed and told me not to worry.

It turns out that the customer in question was using Tom’s new service allowing people to order their lunch from their computer whilst at work (wheresthesausage.com). The kitchen got cooking and told the customer when to come and pick up the food. When you log in, they even tell you what you ate last time and ask you if you want the same again, which it turns out most people do. You save precious time by not having to queue, and don’t have to worry about carrying cash as the food is charged to your credit card.

I quizzed Tom about where the idea for the service came from, and if he had used focus groups. The idea had actually come from a much simpler, cheaper source, which it seems to me is also much more effective: observing customers and chatting to them as they queued up for their food.

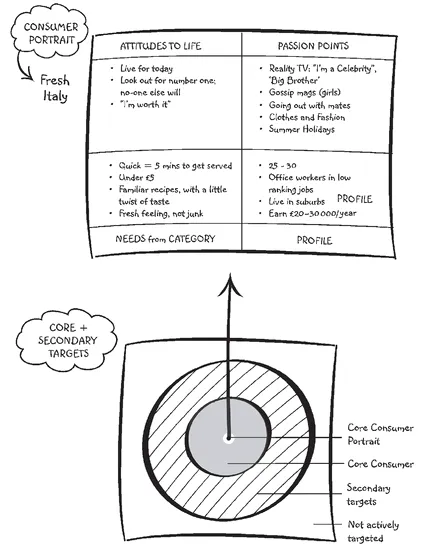

The second thing I learnt about was how to describe your consumer. The Fresh Italy team had painted a colourful ‘portrait’ of their target customer, who they christened ‘Rachel’. Tom took a folded-up photo of Rachel out of his wallet and turned it over. On the back he had drawn four boxes that answered questions about her, such as her hobbies and what she needed from lunchtime food. From reading the profile, I got a good picture of the sort of person Fresh Italy was aiming at. With such a vivid picture of the target customer, the team came up with loads of ideas for new services, including the PC ordering one. Rachel’s lunchtime was precious, and 10 minutes less time in the queue meant 10 more minutes for chatting with her mates or checking out the latest gossip in Heat.

The final thing I learnt about was exploring new ideas. With the PC ordering system, they didn’t write out wordy concepts like the ones for our pizzas. Instead, they got a prototype website mocked up, and then asked some of their loyal customers to try it out for real. It was much easier for them to get the idea by seeing what it would really look like, rather than reading it on a sheet of paper.

My concern with Tom’s approach was that by focusing on people like Rachel, wasn’t he missing out on other potential user groups such as families or tourists. His reply was that you needed to be clear on who was your main target and build the brand mainly for them. There would then be some secondary targets, who have the same needs and attitudes on certain occasions (Figure 4.1). Thinking about it reminded me of the old saying, ‘try and appeal to everyone and you’ll appeal to no-one’. And this is exactly what we were trying to do in the target audience of our brand pyramid.

Figure 4.1: Core consumer portrait

FOLLOW THE MONEY (FRIDAY, APRIL 13)

Brian came to see me with the data on our consumers today. He really was a whizz with numbers, and had done a range of helpful graphs. As I had guessed, it turns out that by far our biggest source of business is families with kids. They’re about 30% of the UK population, but a whopping 65% of our sales. Thinking about my own life so far helped me understand these figures. I ate the odd sausage when I was a student, but most of these came with chips and gravy from the local take-away. When I got my first job, I bought lots of ready meals as I had neither the time nor the inclination to cook. However, when I met Claire and we settled down and had kids, I rediscovered the desire for a Sunday morning fry-up. The other thing the data backed up was a seasonal peak during the summer months, when the barbeque season got into swing. This was a habit that had really caught on in the UK, though it was still not as big as in the USA.

It seemed to me that by chasing after younger, urban and more affluent consumers we were leaving behind our heartland of families with kids. Wouldn’t we be better off ‘following the money’ and trying to get more of these people, or persuade existing customers to buy us more often?

BE THE CONSUMER (MONDAY, APRIL 16)

I got another injection of inspiration about consumer insight on Saturday night, when we had dinner with a friend called Anna who does headhunting for Nike. I was talking to her about what I had learnt about the limits of research, and she told me the most interesting thing. Nike don’t do any conventional research at all. None. They can do this because they only hire people who love sport and are actively involved in at least one (wheresthesausage.com). Anna looked down rather disapprovingly at my ever-expanding waistline as she explained this. I guess drinking a whole six-pack of beer whilst watching the Six Nations rugby tournament doesn’t count. Nike’s recruitment policy meant that their team was full of people who were not trying to understand the consumer. They were the consumer. They had an intuitive sense of what would work or not work for Nike, that they felt in their guts. Their insight was not just rational, it was emotional.

I thought back to the conversation with Jane about our team, and the contrast was stark. Never mind being avid fans of our product, they didn’t use it at all. Their lives were miles away from our core family users. As a result, they used research like a drunk uses a lamp-post: for support, not illumination. I decided a quick and easy way to immerse Brian and Jane in the consumer world was to invite them over for one of my fry-ups next weekend.

BRAND BOND (WEDNESDAY, APRIL 18)

Great night out to see Casino Royale, the new James Bond film. Claire and I talked about the movie over dinner and both agreed that the producers had done a very clever job at updating the Bond ‘brand’, if you can call it that. We played a silly game to see how many features and catchphrases they had managed to stay loyal to over the years, and came up with at least 20. These included:

- The basic idea: ‘Bond vs. the baddie to save the world’.

- The theme tune.

- The gadgets.

- Characters: ‘M’ (James Bond’s boss), Miss Moneypenny.

- Cars.

- Girls, girls, girls.

- ‘Bond, James Bond’.

- ‘Martini, shaken not stirred’.

But whilst a lot of elements stayed the same, the producers also managed to update the brand to keep it relevant for today (wheresthesausage.com). And they really needed to do this when you think how much the world has changed in the last 20 years. Firstly, the world is a lot more dangerous and complex. Gone are the days of the Cold War; welcome to the era of global terrorism. Also, the baddies have got badder. Looking back at Dr No, he seems like a real gent compared with the evil foes Bond now has to face. The competitive environment around James Bond is also a lot tougher now. There are other spy films to compete with, such as the Bourne Supremacy. But there are also competitive entertainment brands in other channels, such as the 24 series on television, and the rise of video games.

I scribbled a drawing on the cinema magazine I picked up so I would remember our discussion and see if it had any relevance to product brands at Simpton’s (Figure 4.2). I thought it would do, as one of my concerns with our brand strategy is the way we seem to be forgetting what ...

Table of contents

- Praise

- Title Page

- Copyright Page

- Dedication

- Acknowledgements

- Introduction

- Quarter One - BRANDING FOR BUSINESS

- Quarter Two - FROM INSIGHT TO BRAND VISION

- Quarter Three - TEST-DRIVING THE VISION

- Quarter Four - THE RUBBER HITS THE ROAD (AS THE PIZZA HITS THE FAN)

- Index