- English

- ePUB (mobile friendly)

- Available on iOS & Android

Industrial Organic Chemicals

About this book

An essential introduction to the organic chemicals industry—in the context of globalization, advances in technology, and environmental concerns

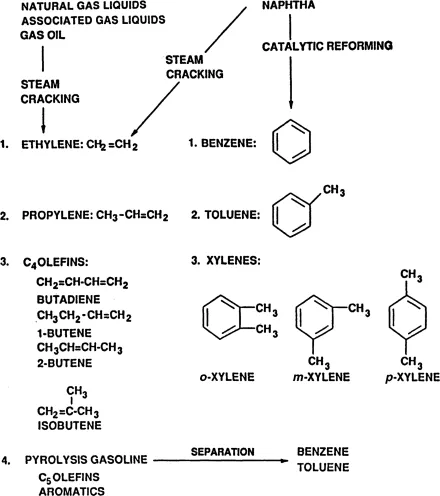

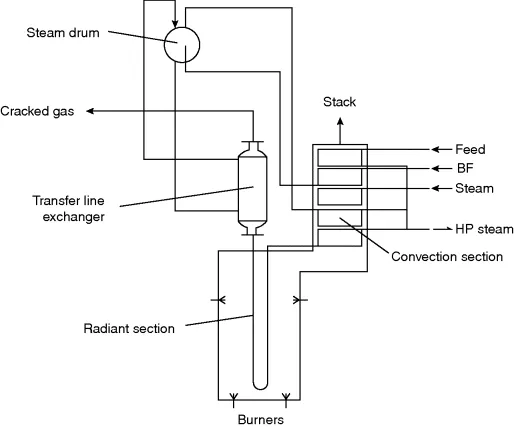

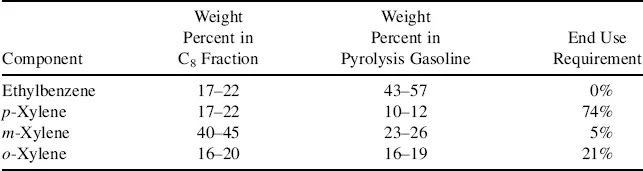

Providing 95 percent of the 500 billion pounds of organic chemicals produced in the world, the petroleum and natural gas industries are responsible for products that ensure our present quality of life. Products as diverse as gasoline, plastics, detergents, fibers, pesticides, tires, lipstick, shampoo, and sunscreens are based on seven raw materials derived from petroleum and natural gas. In an updated and expanded Third Edition, Industrial Organic Chemicals examines why each of these chemical building blocks—ethylene, propylene, C4 olefins (butenes and butadiene), benzene toluene, the xylenes, and methane—is preferred over another in the context of an environmental issue or manufacturing process, as well as their individual chemistry, derivatives, method of manufacture, uses, and economic significance.

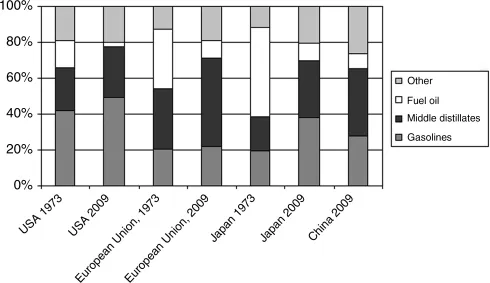

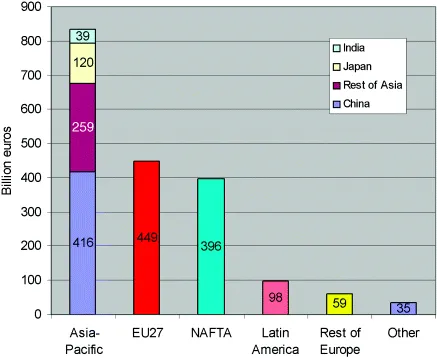

The new edition details the seismic shifts in the world's chemistry industry away from the United States, Western Europe and Japan, transforming the Middle East and Asia-Pacific region, especially China, into major players. The book also details:

- The impact of globalization on the patterns of worldwide transportation of chemicals, including methods of shipping chemicals

- The technological advances in the area of polymerization and catalysis, including catalyst design and single-site catalysts

- Chemicals for electronics, with much new material on conducting polymers, photovoltaic cells, and related materials

- The discovery of vast reserves of shale gas and shale oil, altering long-term predictions of resource depletion in the United States and other countries

- Commercial and market aspects of the chemical industry, with coverage of emerging new companies such as INEOS, Formosa Plastics, LyondellBasell, and SABIC

With expanded coverage on the vital role of green chemistry, renewables, chemicals and fuels on issues of sustainability and climate change, Industrial Organic Chemicals offers an unparalleled examination of what is at the heart of this multi-billion dollar industry, how globalization has transformed it, and its ever growing role in preserving the Earth and its resources.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

1.1 The National Economy

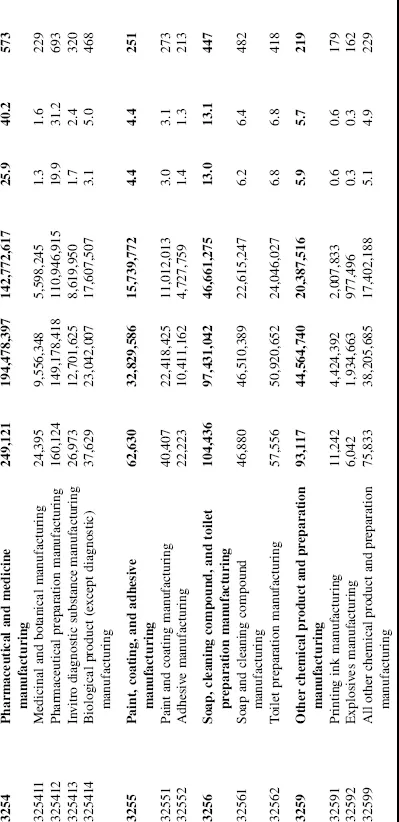

1.2 Size of the Chemical Industry

Table of contents

- Cover

- Other Books by the Authors

- Title Page

- Copyright

- Dedication

- Preface

- Preface to the First Edition

- Preface to the Second Edition

- Acknowledgments

- Bryan Godel Reuben 1934–2012

- List of Acronyms and Abbreviations

- Introduction: How to Use Industrial Organic Chemicals, Third Edition

- Chapter 1: The Evolution of the Organic Chemicals Industry

- Chapter 2: Globalization of the Chemical Industry

- Chapter 3: Transporting Chemicals

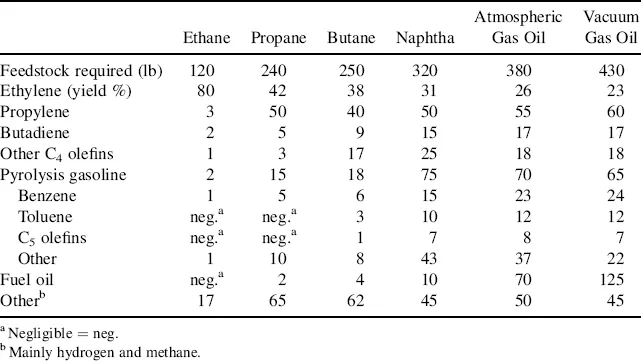

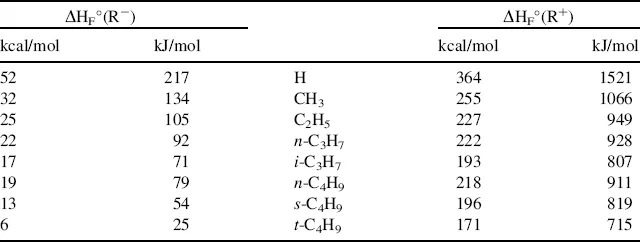

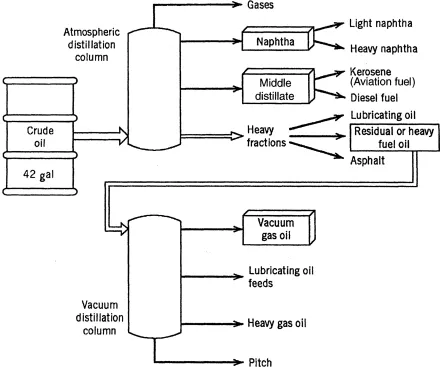

- Chapter 4: Chemicals from Natural Gas and Petroleum

- Chapter 5: Chemicals and Polymers from Ethylene

- Chapter 6: Chemicals and Polymers from Propylene

- Chapter 7: Chemicals from the C4 Stream

- Chapter 8: Chemicals from the C5 Stream

- Chapter 9: Chemicals from Benzene

- Chapter 10: Chemicals from Toluene

- Chapter 11: Chemicals from Xylenes

- Chapter 12: Chemicals from Methane

- Chapter 13: Chemicals from Alkanes

- Chapter 14: Chemicals from Coal

- Chapter 15: Fats and Oils

- Chapter 16: Carbohydrates

- Chapter 17: How Polymers Are Made

- Chapter 18: Industrial Catalysis

- Chapter 19: Green Chemistry

- Chapter 20: Sustainability

- Appendix A: A Note on Cost Calculations

- Appendix B: Units and Conversion Factors

- Appendix C: Special Units in the Chemical Industry

- Appendix D: The Importance of Shale Gas and Shale Oil

- Index

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app