![]()

Chapter 1

Introduction to Pricing and Profitability Management

—Katie Paine, founder and CEO of KDPaine & Partners

There is an old joke about a businessman who loses margin every time he sells his products. A customer asks, “How do you make money?” The businessman answers, “I make it up in volume.”

A company that routinely sells products below its margins would hardly seem likely to remain in business for long. Nonetheless, many firms follow this approach today. In some cases, this approach is an unintentional move, which results in the company losing money on every transaction. In other cases, it reflects a carefully considered decision to maximize profitability across a portfolio of product offerings. However, in other instances, this approach is adopted by business leaders who simply misunderstand which of their products and customers are actually generating margin and the factors that truly determine their company's profitability.

The field of pricing management has been growing steadily in recent years. If you mention the subject in a group, many people will assume the ensuing discussion will be limited to price setting. But the discipline involves much more than just prices themselves. Pricing management is a strategic competency that involves people, processes, technology, and information. Its reach extends into virtually every corner of an organization (i.e., marketing, sales, IT, operations, finance, accounting, and executive leadership). Effective pricing management is capable of changing the way a company views and operates its entire business; it helps ensure the overall profitability of an enterprise and it can affect the bottom line profoundly. This book is intended to serve as a comprehensive introduction to the discipline and a reference work for business leaders, managers, and students who want to deepen their understanding of and sharpen their capabilities in this critical function.

Pricing: The Critical Lever for Raising Performance

Why make pricing improvement a focus for an organization? The answer is simple: the benefits are enormous. A study has shown that 90 percent of pricing investment meets or exceeds return on investment (ROI) expectations.1 Put another way, for any dollar invested in performance improvement, the greatest return comes when it is invested in pricing.

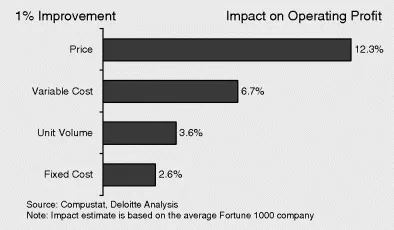

Figure 1.1 reflects one version of an often-replicated analysis.2 All versions lead to the same conclusion: pricing is the most powerful lever available to raise performance. Despite this, the evolution of pricing management has, until recently, been slow. Although it has long been recognized as one of the traditional four Ps of marketing, systemic and structural challenges prevented pricing management from achieving the same level of sophistication or having the same capacity to improve performance as it has now. In its early days, practitioners focused on revenue/yield management and operated almost exclusively in the airline and hospitality industries. But recent developments have led companies to appreciate the breadth and critical importance of the discipline. We discuss three of these developments briefly in the following.

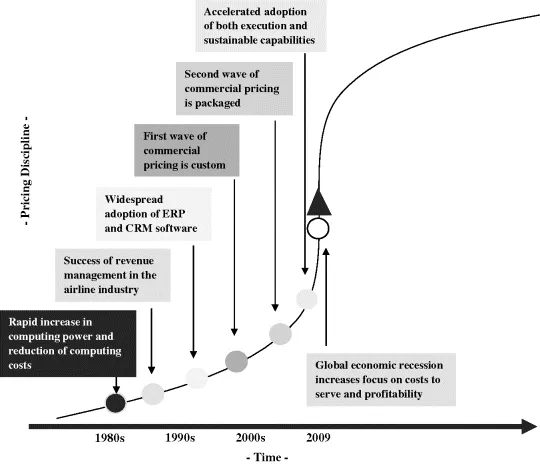

The Search for Improved Data Management Solutions

The widespread adoption of enterprise resource planning (ERP), particularly over the past 10 years, has enabled firms to collect, process, and store more transaction-level data than ever before—a prerequisite for effective pricing management. However, management of this information has lagged behind. Data mining, transaction-level price analyses, demand-elasticity curves, price waterfalls, price-band analysis, customer segmentation, and transaction-level profitability measurement are all tools that require large amounts of clean, available data. Companies have aggressively sought new ways to manage this data, which, in turn, has led to an explosion in price optimization software (see Figure 1.2).

Traditionally, pricing software addressed demand curves, price optimization, and, at the highest level of sophistication, revenue/yield management. In the past five-to-seven years, however, the need for software to address price execution has been recognized and addressed. The software continues to evolve in response to market needs, as various packages leapfrog each other with improved capabilities. Overall, vendors have moved from offering purely custom solutions to providing true “off-the-shelf” functionality that can be implemented in months, not years. In addition, these vendors aggressively pursue the integration of stand-alone pricing software and core ERP systems.

The response to these software developments has been striking. Every single competitor in the ERP space has bought or built software, or partnered with other vendors that have software, to bring advanced pricing capabilities to the market. This is true for both the business-to-business and the business-to-consumer markets.

As this book was going to press in 2011, the pricing software industry was well into a consolidation phase. Some of the small niche players had gone out of business or been absorbed by larger firms that coveted the specific capabilities they could add to their existing application portfolio. A few key players had emerged, but the true winners had not yet achieved dominance.

However, despite its obvious importance, software alone will not provide a competitive price advantage; good data can only serve as a basis for developing an effective strategy. In fact, if software is positioned as the “silver bullet,” it can actually decrease a company's ability to set and manage prices because sales personnel will likely resist using the tool without careful preparation. For example, an advanced software application can help calculate customer-specific pricing, but if sales incentives are not aligned with the new prices, then discounting practices may arise that undermine them and make the new price list suboptimal. For this reason and many others, software must be part of a comprehensive strategy that can meet the demands of an increasingly complex world.

The Growing Challenges of Global Markets

Globalization (and the expansion of cross-border arbitrage and gray market activity) has increased the need for multinational companies to create worldwide pricing strategies. If not addressed effectively, gray markets will cannibalize sales for manufacturers and jeopardize relationships with distributors who own contractual rights within a region. The need to address these issues strategically in international markets will continue to grow as companies realize that other profitability initiatives have ceased to work.

Reaching the Limits of Cost-Cutting

An organization can only undertake so many cost-reduction initiatives without diminishing its ability to serve its customers effectively. For example, a manufacturing company can consolidate plants to slash expenses only so long as its production capacity is still able to meet demand. Similarly, a retailer cannot continue eliminating sales personnel if this strategy interferes with the running of the store, causing revenue to drop. Companies can never “cut” their way to prosperity. Pricing, in contrast, is a constant means to profitable growth.

The emergence of these three trends—improved data management solutions, the challenges of global markets, and the limits of cost-cutting—has helped companies see the tremendous opportunities that pricing management can produce. The benefits are both sizeable and quickly realized. (There is also a first-mover advantage: the earlier a firm addresses pricing, the further along its learning curve and ahead of the competition it will be.) Yet while companies have more and more tools available to help them develop an improved pricing capability, many still have failed to act. Why?

Common Obstacles to Pricing and Profitability Management

In a 2004 study, AMR Research found that fewer than 3 percent of companies effectively managed, communicated, and enforced prices.3 Why? Because pricing, done correctly, is an extremely complex undertaking that requires a group of trained practitioners to view the business through a unique lens.

While executives may understand the benefits of improving their organizations' capabilities, the obstacles they face may seem insurmountable and can create institutional inertia. Many apparent barriers simply reflect the demands of pricing management itself. Other barriers reflect the natural confusion of an organization that lacks the structure and the personnel to handle the new strategic approach. A few of the common impediments follow.

Daunting Complexity

Pricing is an intricate and interdependent competency that affects all levels of an organization and the market it serves (including customers and competitors). At any given time, an organization must ask itself and address a multitude of questions:

- How can price be used as a competitive advantage, and how can we achieve results as quickly as possible?

- How do we position a price with our customers, and how do we differentiate our offering?

- What should our value propositions be for each customer segment?

- How does our product portfolio match the needs of our customers?

- What do we have to do to meet the promises made by our executives and our sales force, while still delivering the required margin?

- Can we use price to influence demand (and can we build that into our production and supply chain thinking)?

- What should our price be?

- Once we have the right price in place, how do we execute it effectively, and what will be the likely customer and competitor responses?

Internal Resistance

Pricing data collection and cleansing can be a challenging and time-consuming task that requires specialized technical skills and a cross-functional and multisystem understanding of the data. Winning cooperation between the different functional groups involved may prove difficult. Initial improvement efforts are often viewed skeptically by organizations simply because they reflect a new approach. In addition, individual units may rely on different data sets to form their assessments of the organization's needs and market position, which can lead to strategic disagreements. Thus, many pricing initiatives fail before they truly begin because managers find various reasons to resist changing the status quo and are unwilling to adopt a fresh, objective view of the business at a transaction level.

Fear of High Stakes

Besides being costly, pricing errors can produce long-term (if not permanent) consequences for an organization. Any organization that has engaged in a price war with a competitor can attest that the brand (and/or the price levels) never fully recovers. Many firms fear the negative consequences of poor decisions, and conclude that maintaining the status quo with acceptable margins is a safer path than trying to achieve better margins and risking a catastrophic mistake.

Unavailable, Inaccessible, or Unclean Data

If data are missing or otherwise unusable, then companies lack the basic information they need to formulate a plan. For example, a company will have trouble performing a profitability analysis by customer segment if it lacks organized transaction-level data and customer-level, cost-to-serve information. This problem will remain if effective modeling or sampling techniques cannot be developed to address the issues.

Human Resource Constraints

Engaging the right people for pricing improvement (i.e., those with the appropriate authority, political connections, and skills) can be challenging as many managers are already too busy executing their day-to-day activities to take on additional responsibilities. Many organizations struggle to dedicate...