Learn Algorithmic Trading

Build and deploy algorithmic trading systems and strategies using Python and advanced data analysis

- 394 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Learn Algorithmic Trading

Build and deploy algorithmic trading systems and strategies using Python and advanced data analysis

About this book

Understand the fundamentals of algorithmic trading to apply algorithms to real market data and analyze the results of real-world trading strategies

Key Features

- Understand the power of algorithmic trading in financial markets with real-world examples

- Get up and running with the algorithms used to carry out algorithmic trading

- Learn to build your own algorithmic trading robots which require no human intervention

Book Description

It's now harder than ever to get a significant edge over competitors in terms of speed and efficiency when it comes to algorithmic trading. Relying on sophisticated trading signals, predictive models and strategies can make all the difference. This book will guide you through these aspects, giving you insights into how modern electronic trading markets and participants operate.

You'll start with an introduction to algorithmic trading, along with setting up the environment required to perform the tasks in the book. You'll explore the key components of an algorithmic trading business and aspects you'll need to take into account before starting an automated trading project. Next, you'll focus on designing, building and operating the components required for developing a practical and profitable algorithmic trading business. Later, you'll learn how quantitative trading signals and strategies are developed, and also implement and analyze sophisticated trading strategies such as volatility strategies, economic release strategies, and statistical arbitrage. Finally, you'll create a trading bot from scratch using the algorithms built in the previous sections.

By the end of this book, you'll be well-versed with electronic trading markets and have learned to implement, evaluate and safely operate algorithmic trading strategies in live markets.

What you will learn

- Understand the components of modern algorithmic trading systems and strategies

- Apply machine learning in algorithmic trading signals and strategies using Python

- Build, visualize and analyze trading strategies based on mean reversion, trend, economic releases and more

- Quantify and build a risk management system for Python trading strategies

- Build a backtester to run simulated trading strategies for improving the performance of your trading bot

- Deploy and incorporate trading strategies in the live market to maintain and improve profitability

Who this book is for

This book is for software engineers, financial traders, data analysts, and entrepreneurs. Anyone who wants to get started with algorithmic trading and understand how it works; and learn the components of a trading system, protocols and algorithms required for black box and gray box trading, and techniques for building a completely automated and profitable trading business will also find this book useful.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Section 1: Introduction and Environment Setup

- Chapter 1, Algorithmic Trading Fundamentals

Algorithmic Trading Fundamentals

- Why are we trading?

- Introducing algorithm trading and automation

- What the main trading components are

- Setting up your first programming environment

- Implementing your first native strategy

Why are we trading?

Basic concepts regarding the modern trading setup

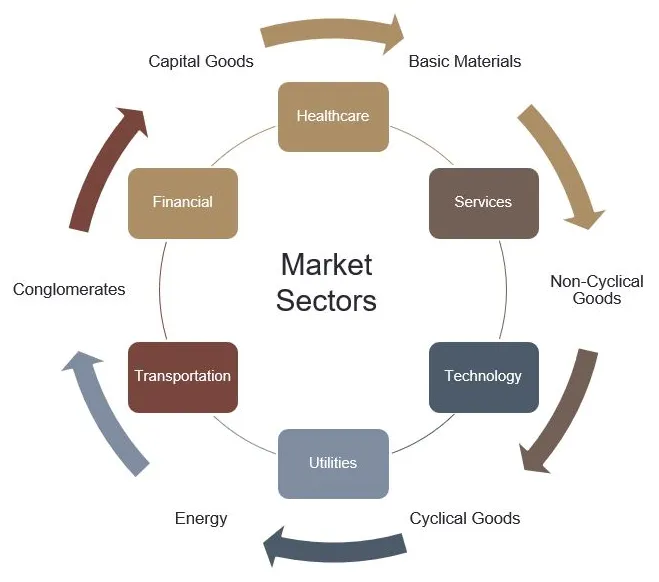

Market sectors

Asset classes

Basics of what a modern trading exchange looks like

Table of contents

- Title Page

- Copyright and Credits

- About Packt

- Contributors

- Preface

- Section 1: Introduction and Environment Setup

- Algorithmic Trading Fundamentals

- Section 2: Trading Signal Generation and Strategies

- Deciphering the Markets with Technical Analysis

- Predicting the Markets with Basic Machine Learning

- Section 3: Algorithmic Trading Strategies

- Classical Trading Strategies Driven by Human Intuition

- Sophisticated Algorithmic Strategies

- Managing the Risk of Algorithmic Strategies

- Section 4: Building a Trading System

- Building a Trading System in Python

- Connecting to Trading Exchanges

- Creating a Backtester in Python

- Section 5: Challenges in Algorithmic Trading

- Adapting to Market Participants and Conditions

- Other Books You May Enjoy

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app