- 352 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Fashion Marketing

About this book

A collection of international contributions from renowned academics and practitioners from the US, UK, China, the second edition of Fashion Marketing has been completely updated, revised and expanded to reflect the major changes in the fashion industry since 2001 and covers all of the key themes and issues of the area.

Key themes and areas covered include globalization, fast fashion, luxury fashion, offshoring, business-to-business, forecasting, sourcing, supply chain management, new product development, design management, logistics, range planning, color prediction, market testing, e-commerce, and strategy.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Fashion Marketing by Tony Hines,Margaret Bruce in PDF and/or ePUB format, as well as other popular books in Business & Marketing. We have over one million books available in our catalogue for you to explore.

1

Globalization: global markets and global supplies

Tony Hines

Introduction

This chapter provides an overview of the impact of globalizing markets and globalizing production centres throughout the world. In this context, it is essential to understanding the competitive landscape for this important international industry before examining some of the key themes and contemporary issues that consume time and effort of policy-makers, managers, consultants and researchers. The chapter begins by examining meanings of fashion markets and fashion marketing in the context of this text before examining in detail the changing business environment. Globalization is then explored through two key industries that underpin fashion markets: textiles and clothing. Structures and conditions that have caused the phenomenon of globalization are examined and it is defined before moving on to identify consequences for fashion markets. The interconnectedness of these markets and supply networks at both the local and global level is demonstrated through discussion of UK retail markets.

Fashion markets and fashion marketing

The textile, apparel (clothing)1 and footwear industries are what many consider to be elements of a fashion industry. Textiles in the shape of home furnishings, fabrics, curtains, various upholstery, wall and floor coverings are considered by many to be fashionable items, as indeed are clothing and foot-wear. However, the term fashion can be used more broadly and cover a much greater range of goods. A glance at any contemporary style magazine would lead one to conclude that fashion could equally apply to food, housing, music, automobiles, perfumery and beauty products. Indeed, modern lifestyles and consumerism rely heavily on and are influenced by these wider fashion trends. Nevertheless, much of the focus for this book in terms of products and markets will remain with two important industries that underpin fashion markets: textiles and clothing.

World trade in textiles and clothing is around US $350 billion. Textile and clothing industries worldwide represented 7 per cent of total world exports in 2004. Between 1997 and 2004 clothing exports grew at 5.9 per cent and textiles at 3 per cent. This hides the disparities between different economies and the reliance placed on these industries. For example, in Bangladesh clothing represents 76 per cent of total exports, in Sri Lanka 51.6 per cent, Cambodia 80 per cent whereas in China it is only 11.9 per cent. Textile exports represents 47.7 per cent of Pakistan’s total exports, China 6.3 per cent and Sri Lanka 4 per cent (ILO, 2005).

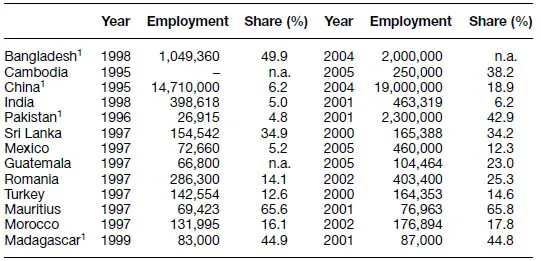

Employment figures range from an estimated 19 million people employed in Chinese Textile and Clothing Manufacture in 2004 up from 14 million in 1995 to 76,963 in Mauritius. Worldwide there are estimated to be 40 million people employed in these industries. The majority of people employed in the clothing sector are women. Although figures vary from country to country, it is estimated that over 70 per cent of all employment is in this industry is female.

There has been a declining trend in global employment in the clothing sector – from 14.5 million workers in 1990 to 13.0 million in 2000, partly as a result of a consolidation process of this production group and a more intensive use of capital. Likewise, employment in textiles declined from 19.7 million workers in 1990 to 13.5 million in 2000 (ILO, 2006). Nevertheless, both textiles and clothing manufacturing employment remain significant and in many developing economies it is the most important sector. In addition to the reported numbers employed directly there are significant numbers of indirect workers who rely on these industries. Table 1.1 indicates employment in clothing manufacture in selected countries between 1995 and 2005 and their relative importance to the particular country’s economy as a percentage of manufacturing industry.

Table 1.1 Trends in employment and share of clothing as a percentage of manufacturing employment, selected countries; 1995–2005 Source: ILO (2005).

n.a. = Not available. – = Insignificant.

1 Recent data from Bangladesh, China, Pakistan and Madagascar are for clothing and textiles. China’s textiles and clothing share based on 2003 data. Manufacturing employment in 2003 based on estimation.

Sources: UNIDO: Industrial Statistics Database (INDSTAT) 2003 and 2005, Rev. 2 and 3; Cambodia: Better Factories Cambodia Project,China: China Textile Industry Development Report 2005 for textiles and clothing and China Statistical Yearbook 2004 for manufacturing employment; Pakistan: Textiles and clothing employment for 2001 from Institut Français de la Mode (IFM) et al.: Study on the implications of the 2005 trade liberalization in the textile and clothing sector (Paris, Feb. 2004). manufacturing employment from the Federal Bureau of Statistics; Bangladesh: Bangladesh Garment Manufacturers’ and Exporters’ Association (BMGEA) for 2004 data; Guatemala; Association Gremial de Exportadores de Productos no Tradicionales; Madagascar Ministry of Labour and Social Law.

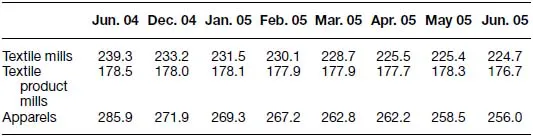

Table 1.2 Employment in the USA (textile and clothing sector), seasonally adjusted (thousands) Source: ILO (2005).

Source: Bureau of Labour Statistics.

China, Pakistan and India have the largest number of people employed in the textile sector.

Employment in the US textiles and clothing sector (Table 1.2) fell by about 7.7 per cent from June 2004 to June 2005. Since quotas were lifted on 1 January 2005, about 25,000 jobs have been lost in the sector as a whole, most of them in apparel manufacturing.

World textile and clothing markets are truly international networks of supply and demand. If one considers human basic needs, food and clothing come near the top of the list. Food and clothing provide for our biological and physiological needs. They are amongst the oldest markets in the world. Europe has been a leading exporter of clothing in recent times. In 1980 the EU (15) had a world market share of exports equivalent to 42 percent of the total market for clothing but by 2003 this stood at around 26 per cent (WTO, 2004). During this same period China increased its market share from 4 per cent in 1980 to 23 per cent in 2003.

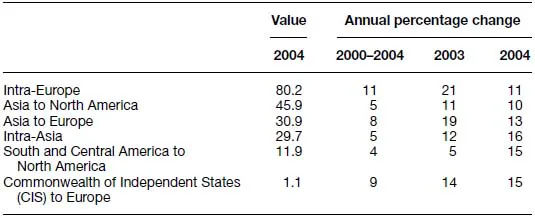

Table 1.3 illustrates the major regional flows of trade in clothing. The annual percentage change shows the shift in value by percentage year on year in the final two columns or over the period from 2000 to 2004 in the first column for annual percentage changes. Intra-European trade is by far the largest share at US $80.2 billion.

Table 1.3 Major regional flows in world exports of clothing, 2004 (Billion dollars and percentage)

Source: WTO (2005).

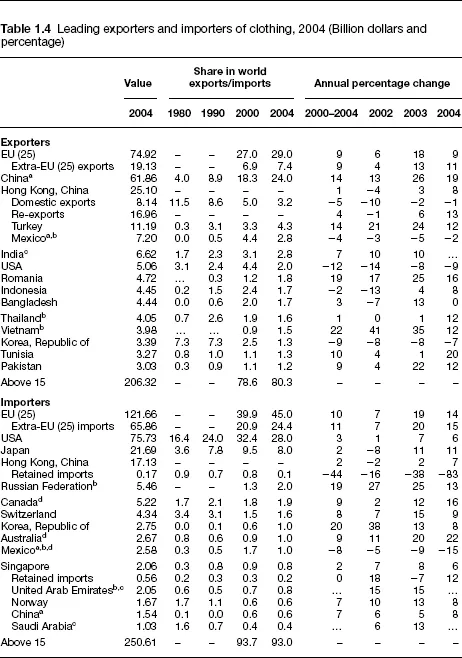

Table 1.4 shows the leading clothing exporting and importing regions and countries and their share of world markets in 2004. The EU 25, China and Hong Kong China are the leading exporters significantly higher than the others in the table. China together with Hong Kong China is the largest exporter. The EU 25 and the US are the largest importers of clothing products. China and Hong Kong China being relatively small as importers. This illustrates the large trade balance surplus for China. Earnings are significantly higher than expenditure.

Exports of textiles and clothing in the world in 2004 represented $195 billion and $258 billion respectively (WTO 2005).

Table 1.4 Leading exporters and importers of clothing, 2004 (Billion dollars and percentage)

a Includes significant shipments through processing zones.

b Includes Secretariat estimates.

c 2003 instead of 2004.

d Imports are valued free on board (f.o.b.)

Source: WTO (2005).

The growing impact of China on world textile and clothing markets

China has an estimated 40,000 textile and garment manufacturing firms and 24,000 textile mills with 19 million people employed in textile and clothing manufacture and a forecast growth rate of 17 per cent per annum to increase its capacity further (WTO 2004, 2005 and World Bank Report, 2005). China’s clothing imports into the UK stood at £1.7 billion in 2002 and they are expected to increase to £2.8 billion by 2005 when 20 per cent of all clothing purchases by UK consumers will have been made in China. China produced 20 billion garments in 2002 enough for each person on the planet to have four garments from China in their wardrobe. China had a positive textile and clothing trade balance with the rest of the world at $54.6 billion (US) with $50.4 being clothing and $4.2 being textiles. Perhaps it should be no surprise that the country with the most people is so dominant in a labour intensive industry such as clothing. Pure labour economics on the basis of supply and demand might lead us to conclude thus.

China’s clothing exports to the USA stood at just around $9 billion in 1990, $25 billion in 1995 and they are forecast to rise to $70 billion by the end of 2005. This acceleration in growth is fuelled by the demise of the multi-fibre arrangement (MFA) quota system. Trade liberalization will also have the effect of lowering the price of goods by 46 per cent in the US market and by 42 per cent across the EU increasing further retail price cuts. The Chinese economy has grown fast over the past 20 years but average income is still only one twenty-fifth that of France and there are over 100 million people living in absolute poverty according to Oxfam (2005).

According to ILO (2005) China’s clothing exports reached US $61.62 billion in value in 2004, while its import of fabrics, raw materials and textile machinery from other countries reached US $24.02 billion. China is the world’s third largest textile importer, just behind the EU and the USA. The Chinese textile industry is the world’s largest importer of raw cotton. China is also among the top importers of wool in the world (220,000 tons in 2004) and the world’s largest importer of textiles machinery and parts (importing US $4.48 billion in 2004, of which 43.1 per cent, or US $1.95 billion, came from the EU).

India’s expected growing share of the world market

India is also a beneficiary of the removal of the MFA and is expected to increase its share of the global textile business from 3 per cent to 15 per cent by 2010 according to the World Trade Organization (WTO). The textile industry in India employs 35 million people and accounts for nearly one-quarter of India’s exports. The impact that trade liberalization will have may be illustrated by one company’s (Matrix) reported expected growth from US $17 million turnover to around US $60 million by 2010 slightly lower than that expected for the Indian sector as a whole but nevertheless a significant increase. Indian cotton exports are predicted to grow from US $12 billion in 2005 to about US $40 billion by 2010. I...

Table of contents

- Front Cover

- Half Title

- Title Page

- Copyright

- Contents

- Foreword

- List of Contributors

- Acknowledgements

- Introduction

- 1 Globalization: global markets and global supplies

- 2 Supply chain strategies, structures and relationships

- 3 Challenges of fashion buying and merchandising

- 4 Segmenting fashion consumers: reconstructing the challenge of consumer complexity

- 5 Developing a research agenda for the internationalization of fashion retailing

- 6 Retail brand marketing in the fashion industry

- 7 Competitive marketing strategies of luxury fashion companies

- 8 Store environment of fashion retailers: a Hong Kong perspective

- 9 The process of trend development leading to a fashion season

- 10 Innovation management in creating new fashions

- 11 Consumers and their negative selves, and the implications for fashion marketing

- 12 Fashion retailer desired and perceived identity

- 13 Fashion e-tailing

- 14 The international flagship stores of luxury fashion retailers

- 15 The making and marketing of a trend

- 16 Approaches to doing research

- Index