- 344 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

International Money and Finance

About this book

International Money and Finance, Ninth Edition presents an institutional and historical overview of international finance and international money, illustrating how key economic concepts can illuminate real world problems.

With three substantially revised chapters, and all chapters updated, it functions as a finance book that includes an international macroeconomics perspective in its final section. It emphasizes the newest trends in research, neatly defining the intersection of macro and finance.

Successfully used worldwide in both finance and economics departments at both undergraduate and graduate levels, the book features current data, revised test banks, and sharp insights about the practical implications of decision-making.

- Includes current events, such as the LIBOR and Greek crises

- increases emphasis on countries other than the US

- Minimizes prerequisites to encourage use by students from varied backgrounds

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access International Money and Finance by Michael Melvin,Stefan C. Norrbin,Stefan Norrbin in PDF and/or ePUB format, as well as other popular books in Economics & Banks & Banking. We have over one million books available in our catalogue for you to explore.

Information

Part I

The International Monetary Environment

Outline

Chapter 1

The Foreign Exchange Market

Abstract

Foreign exchange trading refers to trading one country’s money for that of another country. The kind of money specifically traded takes the form of bank deposits or bank transfers of deposits denominated in foreign currency. The foreign exchange market typically refers to large commercial banks in financial centers, such as New York or London, that trade foreign-currency-denominated deposits with each other. This chapter provides a big picture of foreign exchange trading and particularly covers the details of the “spot market,” which is the buying and selling of foreign exchange to be delivered on the spot as opposed to paying at some future date. Major issues discussed are trading volume, geographic trading patterns, spot exchange rates, currency arbitrage, and short- and long-term foreign exchange rate movements. Specific examples illustrate the discussions of broad concepts. Two appendices further elaborate on exchange rate indexes and the top foreign exchange dealers.

Keywords

Arbitrage; asymmetric information; bid/offer spread; currency arbitrage; currency cross rate; exchange rate movement; foreign exchange market; inventory control; rogue trader; spot exchange rate; spot market; trade flow model; triangular arbitrage; two-point arbitrage

Foreign exchange trading refers to trading one country’s money for that of another country. The need for such trade arises because of tourism, the buying and selling of goods internationally, or investment occurring across international boundaries. The kind of money specifically traded takes the form of bank deposits or bank transfers of deposits denominated in foreign currency. The foreign exchange market, as we usually think of it, refers to large commercial banks in financial centers, such as New York or London, that trade foreign-currency-denominated deposits with each other. Actual bank notes like dollar bills are relatively unimportant insofar as they rarely physically cross international borders. In general, only tourism or illegal activities would lead to the international movement of bank notes.

Foreign Exchange Trading Volume

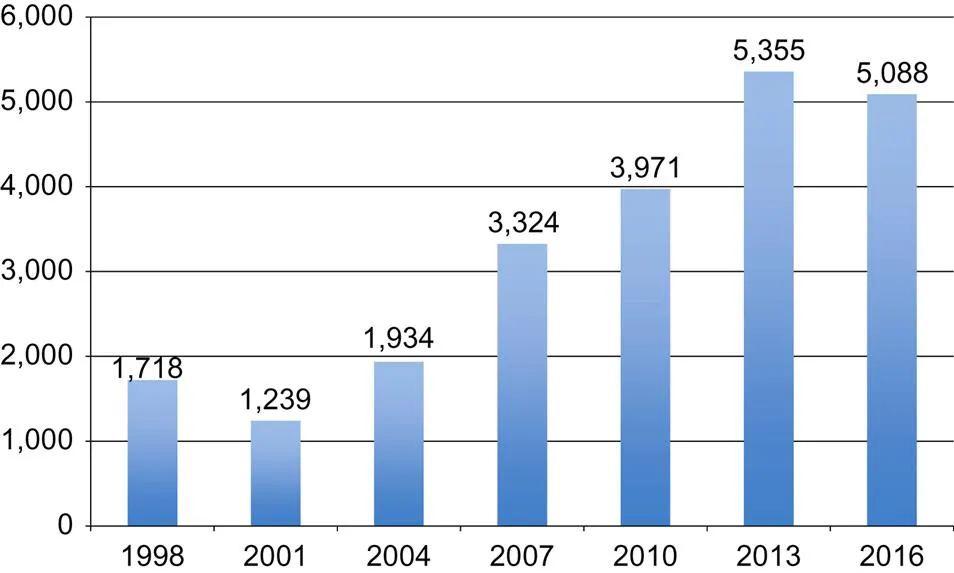

The foreign exchange market is the largest financial market in the world. Every 3 years the Bank for International Settlements conducts a survey of trading volume around the world and in the 2016 survey the average amount of currency traded each business day was $5,088 billion. Thus the foreign exchange market is an enormous market. Fig. 1.1 shows that the foreign exchange market has been growing rapidly in the last decade. In 2001 the trading volume of foreign exchange was $1,239 billion. In 2007 the foreign exchange market had almost tripled in volume, and by 2013 the foreign exchange market had grown another $2 trillion.

The US dollar is by far the most important currency, and has remained so even with the introduction of the euro. The dollar is involved in 87% of all trades. Since foreign exchange trading involves pairs of currencies, it is useful to know which currency pairs dominate the market. Table 1.1 reports the share of market activity taken by different currencies. The largest volume occurs in dollar/euro trading, accounting for 23% of the total. The next closest currency pair, the dollar/yen, accounts for slightly less than 18%. After these two currency pairs, the volume drops off dramatically. For example, the dollar/UK pound is roughly half as much foreign currency trading as the dollar/yen. The US dollar is represented in nine of the top ten currency pairs. Thus, the currency markets are dominated by dollar trading.

Table 1.1

Top ten currency pairs by share of foreign exchange trading volume

| Currency pair | Percent of total |

| US dollar/euro | 23.0 |

| US dollar/Japanese yen | 17.7 |

| US dollar/UK pound | 9.2 |

| US dollar/Australian dollar | 5.2 |

| US dollar/Canadian dollar | 4.3 |

| US dollar/China yuan renminbi | 3.8 |

| US dollar/Swiss franc | 3.5 |

| US dollar/Mexico peso | 2.1 |

| Euro/UK pound | 2.0 |

| US dollar/Singapore dollar | 1.9 |

Source: Bank for International Settlements, Triennial Central Bank Sur...

Table of contents

- Cover image

- Title page

- Table of Contents

- Copyright

- Preface

- Acknowledgments

- To the Student

- Part I: The International Monetary Environment

- Part II: International Parity Conditions

- Part III: Risk and International Capital Flows

- Part IV: Modeling the Exchange Rate and Balance of Payments

- Glossary

- Index