![]()

Part I Introduction

![]()

ONE Nature and Characteristics of Market Research

The activities that can be described as “market research” cover a vast territory, and it would require a hefty volume to offer a comprehensive overview of all the activities that might be labeled by this term. This book has a much tighter focus. Here, market research means techniques for gathering information from and about customers to support a business decision. The starting point, then, is that you are a businessperson who faces a challenging, important, and probably risky decision. The question is whether collecting information from or about customers could lead to a better decision. If your answer to this question is a tentative “yes,” then you are considering whether to do market research. You hope to address an information gap that prevents you from making the best decision possible. And that’s the purpose of market research.

The answer will not always be yes, let’s do market research. Managers are faced with countless decisions. Not all of these decisions can be improved by collecting data from or about customers. One reason is that many business decisions aren’t marketing decisions (for instance, What metrics should I apply to determine this year’s annual raise for my employees?). But not even all marketing decisions benefit from market research. First of all, the decision has to be big and important enough to justify the cost—as we’ll see, market research can be quite expensive. Second, the decision has to have a long enough time frame to allow for data collection. And finally, the decision has to be such as to benefit from collecting data from or about customers. Suppose instead that your product development path depends on the decision of an international standards body that is currently riven by dissension. It’s unlikely that time or money spent on getting information from customers can give you insight into how that standards body will rule.

Conversely, the answer will almost certainly be yes, do consider doing market research, if there is enough money at stake and any of the information gaps listed below stand between you and a good decision.

If you don’t know . . .

- enough about what customers actually need;

- what’s on their minds or how their situation is changing;

- how many customers of Type X versus Type Y are out there;

- what they are (un)happy about, or what’s driving this (un)happiness;

- how customers select a vendor, search for information, decide where to shop, and so forth;

- what drives the choice of one product configuration over another;

- how much they’d be willing to pay; and

- how many would buy at this price.

In summary, you should consider doing market research whenever you feel unable to decide because you lack information from or about customers. If you’re not faced with a decision, you can’t really justify doing market research. (You may and should collect marketing intelligence on an ongoing basis, but that’s not covered in this book.) If it isn’t a marketing decision, or information from customers can’t really help, then too you should not be doing market research.

The point here is that market research is not like controlling costs, making processes more efficient, eating right, getting exercise, or any of the many activities that have to be done day in, day out. The need for market research only arises at specific points in time. No decision looming, or no ability to identify the decision, and/or no information gap indicates no opportunity or need for market research. As a businessperson, you don’t do market research because it’s virtuous; you do it when and if it promises a payoff.

How Many Kinds of Market Research?

The two fundamental modes of doing market research are exploratory and confirmatory. You either have a discovery orientation—a goal of generating possibilities and new ideas—or you want to narrow things down and eliminate possibilities so as to select the one best option—the right answer. Most exploratory research uses qualitative techniques: You want a better grasp of the different qualities of customer response. Most confirmatory research uses quantitative techniques: You want to count the frequency of or measure the strength of the various qualities of response identified during the exploratory phases. The distinction between qualitative and quantitative techniques provides an organizing framework for the book.

Different techniques apply when you are exploring or confirming. For instance, a focus group can’t confirm much of anything, but it can generate lots of new possibilities. A survey can give exact estimates, but only about the things you already know. If you can keep the distinction between qualitative and quantitative modes straight in your mind, you will avoid the worst mistakes. Most of the horror stories in market research involve trying to make a qualitative technique do confirmatory work or rushing ahead to perform a highly precise quantitative technique before doing the necessary exploration.

So one answer to “How many kinds of market research?” is: There are just two. There are two basic approaches to collecting data from or about customers, corresponding to two different purposes: exploratory investigations of the specific qualities that customer response can take on versus confirmatory investigations designed to count or quantify the qualities discovered earlier.

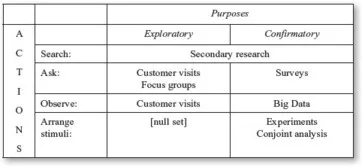

From a slightly different angle, if we focus on what the market researcher actually does in collecting customer data, we can also distinguish four fundamental activities:

- Search an archive.

- Ask customers questions.

- Observe what customers do.

- Arrange for customers to respond to structured stimuli.

Combining the two purposes and four actions produces a roadmap to the named market research techniques to which the bulk of the book is devoted, as laid out next.

Note that there’s no such thing as an exploratory experiment. Experimentation is the epitome of confirmatory research; so is conjoint analysis, which is a kind of experiment, as described later. The table sketches out a point that will be crucial throughout: Some market research techniques, such as exploratory techniques, typically come into play early in the decision process, when discovery is a priority, and others not until much later. Experiments are necessarily a tool used late in the decision cycle; they are the confirmatory tools par excellence. Finally, secondary research can be pursued in either an exploratory or confirmatory mode, depending on what kind of information is being sought for what purpose.

Research Techniques

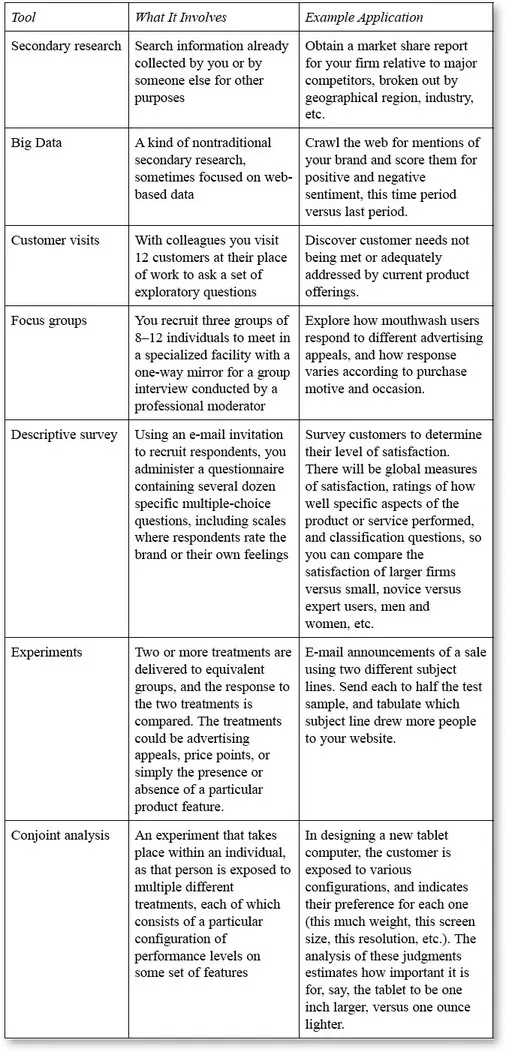

With these preliminaries out of the way, let me introduce to you the specific techniques to which this book provides a concise guide. The metaphor that guides the book is that a manager trying to build an understanding of customers has available a toolbox. Like a carpenter’s toolbox, it contains the equivalent of a hammer, a screwdriver, a wrench, a saw, and so forth. Now think for a moment about how a carpenter uses that toolbox. Does he pick up a screwdriver when he has a nail to drive? Of course not; the screwdriver is the wrong tool for that purpose. Does he throw the screwdriver away because it’s a failure in doing such a poor job of driving nails? Not at all; he knows it will come in handy later, when he has to set a screw (try setting a screw with a hammer). The carpenter seeks the right tool for the job. Since a lot of different jobs have to be done in the course of building a house, he lugs the whole toolbox to the job site. Imagine how strange it would be if instead he brought only a 9-inch socket wrench and proclaimed: “I am going to construct this entire house using only this one tool.”

This book presumes that as a beginner in market research, you need to see the contents of the toolbox laid out one by one. You don’t want to be like the little boy handed a hammer to whom the whole world looked like a nail—you want to use the right tool for the job. You don’t reach for the hammer every time. You don’t throw away the screwdriver because it bruised your thumb the first time you tried to drive a nail with it. In the next chapter, we’ll distinguish specific “jobs” and match tools to jobs, as hammer to nails, wrench to bolts, and so on. Here, using Table 1.1, I want only to name the tools to be addressed and give you a taste of what each involves in concrete terms.

With the tools laid out, let me clarify how the content coverage in this not-a-market-research-textbook differs from that of a more conventional treatment.

First, Big Data is actually just a particular form of secondary research. However, enough people think of Big Data as something new and different to make it worthwhile to give it a chapter of its own. Note also that Big Data is a really huge topic in its own right, and consistent with the limited purposes of this book, I’ll only be treating a small piece of it. My focus will be more particularly on Big Data concerning customer behaviors.

Second, the term “customer visit” rarely appears in a conventional market research textbook, and its absence reveals more than anything else the business-to-consumer (B2C) focus of most such books. In such textbook treatments this chapter would instead be labeled “interviews,” “one-on-one interviews,” or in older treatments “depth interviews.” More commonly, individual interviews would be lumped together with focus groups, under headings like exploratory research, qualitative, or just “interviewing customers.” Whether individual or group, the interviews would take place in a specialized facility and be conducted by a trained professional, and this context is assumed in most textbook discussions.

I learned decades ago that actual practice in B2B and technology firms is quite different. Interviews do play an important role in B2B research, but they almost never take place off site in specialized facilities, and they rarely involve an outside moderator. Rather, teams from the vendor visit customers at their place of work and interview them there. The reason is two-fold: (1) in B2B categories, there are often multiple individuals to be visited at each firm; and (2) because of the complexity of many B2B products, it is important to be able to observe the product in use.

Given my target audience, I only devote chapters to the customer visit and focus group techniques, as both of these are regularly used by B2B firms. The overview to Part II situates these two tools in the larger context of qualitative research techniques, including techniques more commonly seen in B2C contexts, like ethnography.

In the next chapter, each of the tools named in the table will be described in somewhat more detail, and with particular attention to where they fit in the overall decision cycle. The goal is to get across the distinctive competency of each tool, which is simultaneously to reveal the failing, shortcomings, and limits of each tool. The specifics of executing research using each technique are then covered in the following chapters.

Discussion Questions

- The chapter suggested that secondary versus primary research, and within primary research, qualitative versus quantitative, provided an exhaustive compartmentalization of the market research techniques now available. Can you think of any market research procedure ...