Random Walks in Fixed Income and Foreign Exchange

Unexpected Discoveries in Issuance, Investment and Hedging of Yield Curve Instruments

- 196 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Random Walks in Fixed Income and Foreign Exchange

Unexpected Discoveries in Issuance, Investment and Hedging of Yield Curve Instruments

About this book

The fixed income and foreign exchange (FX) markets have never been as challenging to operate in as they are today. The post-crash combination of reduced liquidity, higher operating costs, low interest rates, flat yield curves and increased regulation means that market makers and investors alike need to work harder to generate value and remain in full understanding of the markets.

Random Walks in Fixed Income and Foreign Exchange brings together the best of detailed and original practitioner-orientated market research on many specialist areas of the bond and FX markets. Written by the highly regarded FX and bonds research desk at Commerzbank, the book offers varied and in-depth insight into specific topics of vital important to dealers and investors, including the cross-currency basis and hedging, the yield curve, and overseas issuance conversion factors which will give investors a genuine edge in generating value. Written in accessible text, it is a must-read for all those interested in bonds and FX.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

Chapter 1 What Really is the Cross-Currency Basis?

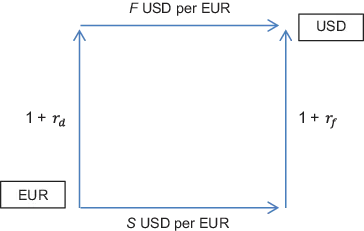

The Calculation Underlying the Cross-Currency Basis Swap

A Quick Note on Terminology

Perhaps the Simplest Formula in Financial Mathematics

- Method 1. Invest now for the period in question, at the domestic interest rate, then exchange at the end of the period.

- Method 2. Exchange now so that you hold the foreign currency, and invest at the foreign currency rate for the period.

How the Calculation Distorts No-Arbitrage Pricing

Table of contents

- Title Page

- Copyright

- Contents

- Advance Praise for Random Walks in Fixed Income and Foreign Exchange

- Chapter 1 What Really is the Cross-Currency Basis?

- Chapter 2 XVA and the Cross-Currency Basis

- Chapter 3 Calculating Novel Cross-Currency Bases and FX Hedged Pickups

- Chapter 4 FX Hedging of Fixed Income – What is the Best Way?

- Chapter 5 Introducing the Conversion Factor

- Chapter 6 An Empirical Method of Calculating the Term Premium

- Chapter 7 An Update of the Term Premium Calculation

- Chapter 8 Forward Curves, Duration and Convexity

- Chapter 9 Implied vs Realised Convexity

- Index

- The Moorad Choudhry Global Banking Series