- 288 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Understand Tax for Small Businesses: Teach Yourself

About this book

The recession and the change of government have seen many changes in the British tax system which affect small businesses. Fully updated for the 2013 tax year and beyond, this trusted and bestselling guide will help you steer your small business through the bureucratic hoops. Tax matters for small businesses, because they must pay it correctly in order to stay legal, and they must pay it efficiently in order to stay competitive. This book, written by a chartered accountant who has helped small businesses for twenty years, helps you to do both.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Understand Tax for Small Businesses: Teach Yourself by Sarah Deeks,Sarah Deeks in PDF and/or ePUB format, as well as other popular books in Business & Taxation. We have over one million books available in our catalogue for you to explore.

Information

1

Which taxes do businesses pay?

In this chapter:

• a checklist summarizing which taxes businesses have to pay

• your essential questions answered: Who has to pay income tax, corporation tax, capital gains tax, inheritance tax and National Insurance? What is each tax charged on and at what rate? Are there any exemptions or pitfalls? How is the tax paid?

• sample tax calculations

Before moving on to more complicated subjects it is first of all necessary to understand the range of taxes that businesses have to pay so that you are aware of the full extent of your potential tax obligations. This chapter also introduces you to some simple tax calculations.

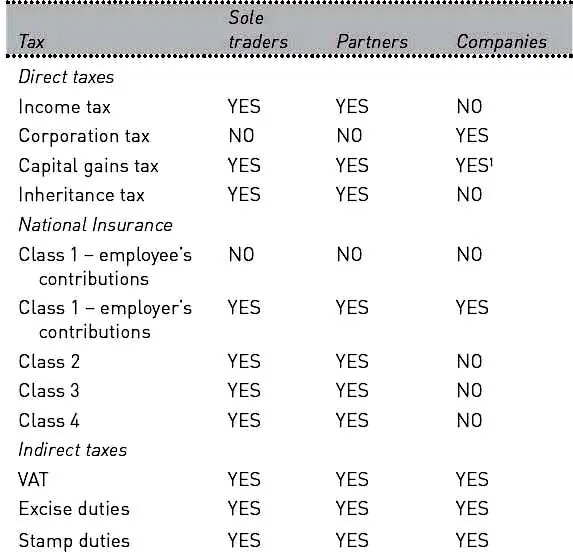

Taxes and duties checklist

There are two main types of taxes levied in the UK – direct taxes and indirect taxes. Direct taxes tax income, profits and gains. There are four direct taxes – income tax and inheritance tax paid by individuals, corporation tax paid by companies, and capital gains tax paid by both individuals and companies. There are also four types of National Insurance. All employers irrespective of whether they are sole traders, partners or companies pay Class 1 employer’s contributions on the wages and salaries paid to their directors and employees. Indirect taxes are charged on expenditure and include VAT, Excise duties and Stamp duties.

In addition to the taxes listed above there are a number of taxes, levies and duties that apply to specific industries such as aggregate extraction, waste management, power generation, oil, shipping, air transport, haulage, banks and insurance.

Direct and indirect taxes and National Insurance are administered by HM Revenue and Customs (HMRC; see Chapter 2). You may also have to pay rates or council tax. These are administered by your local authority.

This chapter examines all the direct taxes and National Insurance. VAT is dealt with in Chapter 9. Rates and council tax are covered in Chapter 8.

The following checklist summarizes all the main UK taxes and indicates whether they apply to sole traders, partners or companies:

1Included in the corporation tax calculation.

Income tax

WHO PAYS IT AND WHAT IS IT CHARGED ON?

Income tax is principally paid by individuals. It is charged on:

Most sources of income are taxed but there are some that are exempt from income tax, including:

The majority of people living in the UK are liable to pay tax on all their income, including their business, profits regardless of whether the money is earned here or overseas. If you live abroad (are non-resident), you still have to pay UK tax on your UK income. If you have been living overseas for some years (are not ordinarily resident in the UK), or come from overseas (are non-domiciled), different rules may apply and you will need to seek professional advice to ensure that you complete your tax return correctly.

PAYMENT

Income tax is paid in the following ways:

CALCULATION

Calculating income tax can be complicated depending on the number of different sources of income that you have. Persevering with the numbers is worthwhile, however, because it may help you to successfully manage your income tax liabilities (see Chapters 3 and 4).

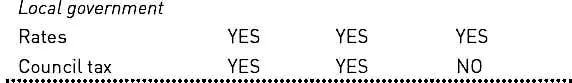

Before you start your income tax calculation you need to add together all your sources of income to arrive at your total income for the tax year. You should refer to Appendix 1 for the tax rates and personal allowances for the appropriate tax year. To calculate the tax on your business profits you must then work through the following steps:

1 A personal allowance is deducted from your income before you calculate your tax bill. It increases slightly each tax year and is £8,105 in 2012/13. Some older people receive a higher allowance. If your income exceeds £100,000 in 2012/13, your personal allowance is restricted. If it is more than £116,210 you will not be entitled to a personal allowance at all.

2 After you have deducted the personal allowance, the first part of your income is taxed at 20%. This is known as the basic rate of income tax. The amount of income charged to basic rate tax changes slightly each year and is £34,370 in 2012/13.

3 Any further income you receive is taxed at 40% – the higher rate. If your taxable income reaches £150,000 in 2012/13, you are taxed at the additional rate which is 50%. This rate falls to 45% in 2013/14.

Example

Ben is a self-employed electrician. His annual profits are £46,500. He calculates his income tax liability as follows:

1Total taxable income £38,395 minus...

Table of contents

- Cover

- Title

- Contents

- Meet the Author

- Only Got a Minute?

- Only Got Five Minutes?

- Introduction

- 1 Which Taxes do Businesses Pay?

- 2 How the Tax System Works

- 3 Starting a Business

- 4 Profits

- 5 Losses

- 6 Equipment

- 7 Employees

- 8 Premises

- 9 VAT

- 10 Pensions and Insurance

- 11 Incorporating a Business

- 12 Closing a Business

- 13 Selling a Business

- 14 Passing on a Business

- 15 Putting it all Together

- Appendix 1: Rates and Allowances

- Appendix 2: Key Dates

- Appendix 3: Glossary

- Appendix 4: Further Information

- Copyright