- 118 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Emotional Appeals in Advertising Banking Services

About this book

Advertisements are considered as stimuli which consumers will respond to. Banks can develop emotionally appealing advertisements, but they are not guaranteed a positive emotional reaction. The unprecedented turbulence and uncertainty experienced in the banking industry has increased the need to appear more appealing to consumers.

Taking into consideration the global financial crisis, the current challenges of competition and open banking, and the looming threat of Brexit, this book explores how UK banks are pulling at consumers' heart strings with appeals that are often filtered through personal ideologies, life experiences and previous exposure to brands. It investigates consumers' perception of this strategy, as well as the wider implications of using emotional appeals in financial services advertising.

Based on empirical data and research, this books will prove invaluable to students, researchers and managers alike.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Emotional Appeals in Advertising Banking Services by Emmanuel Mogaji in PDF and/or ePUB format, as well as other popular books in Business & Advertising. We have over one million books available in our catalogue for you to explore.

Information

CHAPTER 1

INTRODUCTION

Though an advertisement is often viewed as a means for selling – you might have a particular advertisement you like, e.g. the iconic Coca-Cola Christmas Red Truck advertisement, the Cadbury’s Gorilla advertisement or Gio Compario in the Gocompare.com insurance advertisements on television in the UK – these advertisements are often considered unique either because of the product being advertised, the theme songs used in them, the colours applied or even the characters in the advertisements.

As individuals we have many personal reasons why we may feel attached to an advertisement – perhaps your favourite celebrity is endorsing a product or it reminds you of an endearing childhood memory. The advertisement makes you feel happy and excited, and you often smile and sing along when you hear the background music. Some advertisements can also make you angry because of what is being depicted in them, either by eliciting negative memories or through the specific wording they employ.

These advertisements appeal to our emotions; they are stimuli we react to, either positively or negatively. These reactions are unique to individuals, which is often why, as individuals, we may enjoy a specific advertisement that a friend dislikes, with some even going a step further to report it to the Advertising Standards Authority (ASA).

The book considers emotional appeals as a creative and conscious decision made by advertising professionals to develop their advertising campaigns in a manner that appeals to consumers. Many different thought processes are engaged with before its production. One example is the image of the Andrex puppy, the Labrador Retriever, used for advertising Andrex tissue paper. The choice of image, music and actors used in advertisements are creative decisions that anticipate arousing specific feelings. The viewer will either like it and experience a willingness to try the product, or it might make them experience guilt, and encourage them to change their behaviour.

These emotional appeals are channelled through various media – TV, radio, billboards – and creative elements such as images, background music and text. Emotional appeals on radio will be different from those on TV, as images cannot be used on radio, but background music can be used in both.

Often, the discussion around emotional appeals in advertisements focuses on positive (humour, empathy) or negative (shame, guilt) emotions. This book focuses on how UK banking services are being advertised through the use of emotional appeals.

The unprecedented turbulence and uncertainty experienced in global economic and financial markets because of the credit crisis has had a damaging impact on consumer confidence. Trust and credibility have been eroded, as many customers feel let down by banks. It has been observed that banks are using emotionally appealing advertisements to reach out to customers, which presents some justification for researching this topic, in a bid to provide theoretical and managerial knowledge to understand this concept better.

This book provides in-depth insight into how the UK financial services sector employs emotional appeals to advertise banking services and how consumers engage with these advertisements. The book is research-based, with empirical data gathered through qualitative interviews with a range of individuals as a means for better understanding attitudes towards advertising.

The book contributes to a better understanding of the congruency between emotional appeals and financial services, thereby illuminating how advertising shapes our buying decisions. Additionally, more critical issues which relate to how consumers decide where to bank are addressed, and it is found that these are not necessarily based on emotional responses. For students and researchers, the text contributes to an on-going trend in research for understanding consumer attitudes towards banking brands and the advertising strategies they employ to rebuild trust and reputation.

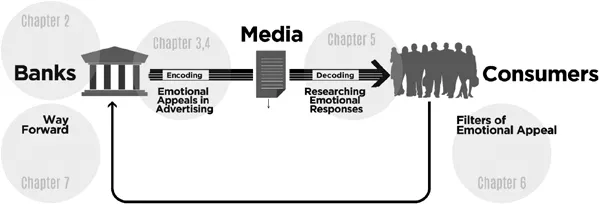

A general overview of the book is illustrated in Figure 1.1, using the communication model. Chapter 2 identifies UK banks as senders of marketing messages; the chapter further sheds light on why they may consider sending marketing communications messages, as well as the type of messages they send.

Figure 1.1. Chapter Overview of the Book Incorporated with the Communications Theory.

This is followed by presenting the creative decisions that are embedded in advertisements using emotional appeals, in anticipation that it will attract consumers. Chapter 3 provides an overview of advertising appeals, both rational and emotional, and further explores the different types of emotional appeals. The unique nature of the conduits (images, music, colour) used to transfer these emotional appeals through a range of various media (traditional, e.g. TV, radio, newspaper; new, e.g. social media) is discussed in this chapter.

It is essential to understand that there is a difference between ‘conduit’ and ‘media channel’, despite being closely related. The image is a conduit (of emotional appeal) that can be transferred through both TV and newspapers as a type of media but not via radio; likewise, background music is a conduit that can transfer emotional appeal via radio and TV but not through a newspaper.

As Chapter 3 explores advertising appeals, Chapter 4 provides an in-depth exploration of emotional appeals in financial services advertisement, differentiating between how emotional appeals are presented across different groups of banks and various banking products and services.

Following on, Chapter 5 presents the research carried out to understand better how consumers are decoding these UK banks’ emotionally appealing advertisements, after which they can engage with the advertisements and review whether they closely match their expectations and desires from banks.

Chapter 6 presents the filtration process – how UK consumers filter the decoded meanings of advertisements to decide if they need an advertisement before making a financial decision. It is expected that consumers provide a degree of feedback following the filtration process to decide what to do about the message they received and decoded.

While emotional appeals embedded in advertisements are acknowledged, Chapter 7 considers a way forward, asking for justification for why banks need to advertise and further questions the congruence between emotional appeals and financial services advertising, at least within the UK context. This chapter completes the entire cycle of the communication model, provides closing remarks on emotional appeals in advertising financial services, and offers recommendations for how best to work with emotional appeals in financial services advertising.

A summary of the book is presented in Chapter 8, graphically illustrated in Figure 8.1, thereby achieving three outcomes that are relevant to numerous stakeholders, including financial service brands, advertising industries and academic researchers and students. First, it provides a significant theoretical contribution to the study of financial service advertisements, mainly by exploring emotions in advertisements qualitatively and also by drawing on the communication model (Kotler, 1967), Second, the filtration process of emotional appeal is introduced, which enhances an understanding of how consumers understand meanings embedded in appeals that are presented in banks’ advertisements. Finally, managers will be able to appropriately consider the implications of advertisements for enhancing their brand, for building relationships with consumers and highlighting the added value of their service.

CHAPTER 2

UK FINANCIAL SERVICES ADVERTISEMENTS

2.1. INTRODUCTION

The unparalleled turbulence and doubt experienced in global economic and financial markets due to the ‘credit crunch’ has had a damaging impact on consumer confidence (McKechinie, 2011). The global financial crisis of 2007–2008 has eroded the trust and credibility attached to UK banks as safe places to keep money (Marketline, 2014). UK banks were profoundly affected by the crisis, resulting in major banks needing government bailouts. Heinonen (2014) noted that in the wake of the crisis, the banking sectors have been transformed, with new regulations and competitions for customers and profits. The unprecedented turmoil witnessed in the European banking market has been noted as it experienced a period of enormous uncertainty and transformation during the financial crisis (Jarvinen, 2014; Saiz & Pilorge, 2010).

Banks’ engagement in various activities has also put their customers at risk. Denning (2013) noted that ‘bad profits were achieved through practices by the banks that were shady, but not strictly illegal’. These practices included price fixing of the London Interbank Offered Rates (LIBOR), money laundering, assisting tax evasion and providing their clients with worthless investment opportunities; all of which have further eroded consumers’ trust in the banks. Barber (2014, p. 243) noted: ‘These days, bankers are widely viewed as greedy, self-serving, amoral or dangerous. Estate agents, even journalists, are held in higher regard.’

With this understanding, the chapter gives an overview of the UK banking industry, their challenges and regulations put in place with regard to advertising strategies; as noted by Gritten (2011), many of the bank customers felt betrayed by the institution which has promised to protect them and their assets. The chapter ends by highlighting the need for banks to re-establish a long-term business relationship with their customers, to rebuild their trust and confidence in their services, suggesting the need for emotionally appealing marketing communications.

2.2. BANKING IN THE UK

As of December 2017, data from the European Central Bank (ECB) and the Central Bank of England showed that there are over 370 credit institutions in the country (European Central Bank, 2017), although this number varies every month. Also, not many of these banks are on the high street, providing retail and commercial banking services. This sector of the financial industry in the UK is dominated by the top four banks, most of which operate under many other brand names. HSBC (founded 1836); Lloyds Banking Group (Lloyds Bank, Halifax, Bank of Scotland) (founded 1765); Royal Bank of Scotland Group (National Westminster Bank, Royal Bank of Scotland and Ulster Bank) (founded 1727) and Barclays (founded 1690) are the four largest providers in the sector and have around 75 per cent of the market share, which has made the market highly concentrated since 2008 (OFT, 2013).

In this book, two classifications in banks and banking services are provided to have a better understanding of how emotional appeals are being presented. First, banks are classified based on their market age and the length of time they have been established as a financial institution in the country: established brands and new entrant banks, while services are classified according to the level of involvement in deciding: high involving and low involving.

2.2.1. Bank Classification

Even though the major banks enjoy the most significant share of the market, new entrants aim at providing services to targeted customers. For instance, when Metro Bank opened in 2010, it was described as the first new bank in 100 years. M&S Bank was formed in 2012. However, Office of Fair Trading (OFT, 2013) noted that none of the banks has grown strong enough to challenge the most established brands. Virgin Money, through the purchase of Northern Rock, has also created a compelling challenger bank in the UK. The Lloyds Banking Group divestments, recreating the TSB Brand has also changed the landscape of the retail banking market in the country.

Santander is also considered a significant player in the UK retail banking market, since its entry in 2004, through the acquisition of Abbey National PLC, Bradford & Bingley and Alliance & Leicester, and with more than 14 million active customers (Santander, 2017), supermarket brands like Tesco and Sainsbury also provide banking services. Sainsbury Bank was the first major British supermarket-owned bank, a combined 50/50 venture between J Sainsbury PLC and Lloyds Banking Group PLC. Harrods also has its banking businesses, catering for high-net-worth individuals.

The established banks are predominantly situated on the high streets of town centres in the UK; they are Barclays, Halifax, HSBC, Lloyds, TSB, Nationwide, NatWest and Santander (GfK, 2014). They are also sometimes called high-street banks because of their location and number of branches across the country; this is synonymous with the American term ‘Main Street’ (Investopedia, 2018).

The new entrant banks are newer financial brands in the UK, they include those not included in the high-street banks category, even though they sometimes have branches on the high street (Metro, Virgin Money, Post Office), online banks (First Direct, Smile) and those owned by supermarkets (Tesco, M&S and Cooperative).

The digital banks are new generation of new entrant banks; they are start-up companies which are seen as a result of the development and advancement in financial technologies (FinTechs); they are sometimes referred to as app-only banks or neobanks as often these banks don’t have physical branches as most banking transactions are performed online and via mobile applications on smartphones. They are seen as disruptors who want to put your financial life in customers’ pocket, acquiring thousands of customers, especially among younger people (Green, 2017). Some of these digital banks are Atom Bank, the UK’s first bank built exclusively for smartphone users, some others are Mondo and Tandem; however, not all of these digital banks have the full UK banking licence from the Financial Conduct Authority (FCA) (formerly the Financial Services Authority, until April 2013) and the Prudential Regulation Authority (PRA).

2.2.2. Banking Services Classification

Providing a general review of the UK retail banking sector, the OFT (2010) disclosed that the industry comprises different connected products and services with a variety of business strategies. Here the services have been classified into high-involving banking services and low-involving banking services; this takes into consideration the amount of information required and level of customers’ involvement in processing the information and making financial decisions.

High-involving banking services are what the FCA categorises as secondary banking services such as unsecured and secured loans to personal and small and medium-sized enterprises (SME) customers and peripheral banking services such as insurance, pensions, wealth management or hedging. These services are not just offered by what are commonly referred to as ‘banks’. Some of these services require a consumer credit licence from the OFT or authorisation from Financial Services Authority (FSA).

Low-involving banking services are described as core banking services which require less information processing; you can walk into a bank and request for such services without much documentation, and even with the advancement in technology, such as FinTech companies and Apps, only banks can provide these services. Low-involving banking services are current account, overdrafts and savings products, traditionally associated with banks even though a provider will typically need authorisation from the FSA to accept deposits and affect how they can advertise these products and services.

2.3. BANKING REGULATIONS IN THE UK

As an industry that involves risk, the financial sector is governed and regulated around the world to safeguard consumers. Procedures were provided to ensure that financial products’ marketing communications materials are fair, truthful and not misleading. The Treating Customers Fairly (TCF) law plays an important role, as does the OFT with its task of ensuring that the markets work efficiently for the consuming public.

The FCA, backed up by legislative acts, makes sure that advertisements are approved before they are distributed in the media. The ASA also has to be sure that the advertisements are not in breach of any advertising code. Although the banks would like to present an emotional appeal in their advertisements, they must make sure that the advertisements are approved and are in all manners truthful and easy to understand.

2.3.1. The Financial Conduct Authority

The high-involving nature and perils associated with buying a financial product or service are so essential that the industry is governed and regulated by financial regulatory bodies to make sure that the organisations follow set rules and guidelines, offering consumers products that they need and treating them fairly. In the USA, there is the Financial Industry Regulatory Authority, Inc. (FINRA). The Federal Financial Supervisory Authority is responsible for financial regulatory activities in Germany. The Australian Prudential Regulation Authority (APRA) regulates bank...

Table of contents

- Cover

- Title Page

- Chapter 1 Introduction

- Chapter 2 UK Financial Services Advertisements

- Chapter 3 Emotional Appeals in Advertising

- Chapter 4 Emotional Appeals Presented by Financial Services

- Chapter 5 Researching Emotional Responses

- Chapter 6 Filters of Emotional Appeal

- Chapter 7 The Way Forward

- Chapter 8 Conclusion

- References

- Index